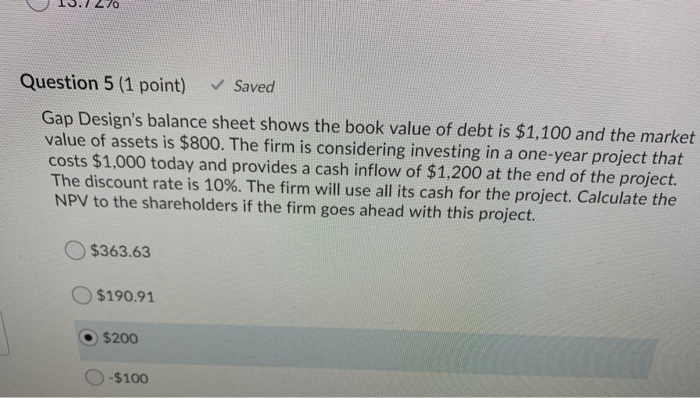

Question: 10.7270 Question 5 (1 point) Saved Gap Design's balance sheet shows the book value of debt is $1,100 and the market value of assets is

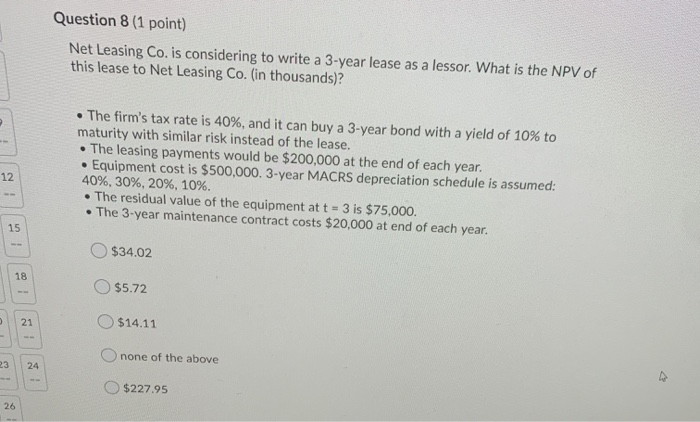

10.7270 Question 5 (1 point) Saved Gap Design's balance sheet shows the book value of debt is $1,100 and the market value of assets is $800. The firm is considering investing in a one-year project that costs $1,000 today and provides a cash inflow of $1,200 at the end of the project. The discount rate is 10%. The firm will use all its cash for the project. Calculate the NPV to the shareholders if the firm goes ahead with this project. $363.63 $190.91 $200 -$100 Question 8 (1 point) Net Leasing Co. is considering to write a 3-year lease as a lessor. What is the NPV of this lease to Net Leasing Co. (in thousands)? The firm's tax rate is 40%, and it can buy a 3-year bond with a yield of 10% to maturity with similar risk instead of the lease. The leasing payments would be $200,000 at the end of each year. Equipment cost is $500,000. 3-year MACRS depreciation schedule is assumed: 40%, 30%, 20%, 10%. The residual value of the equipment at t = 3 is $75,000. The 3-year maintenance contract costs $20,000 at end of each year. $34.02 $5.72 $14.11 none of the above $227.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts