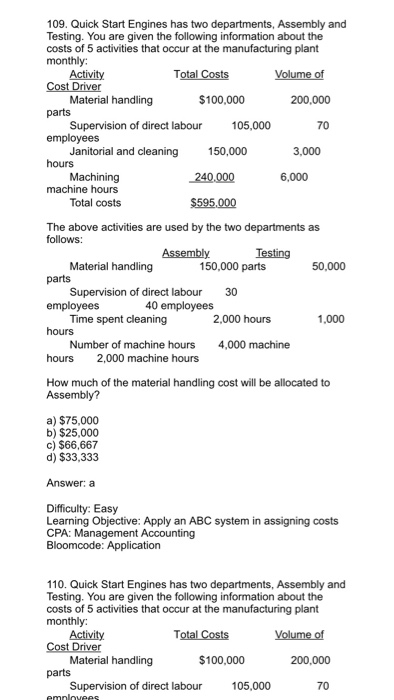

Question: 109. Quick Start Engines has two departments, Assembly and Testing. You are given the following information about the costs of 5 activities that occur at

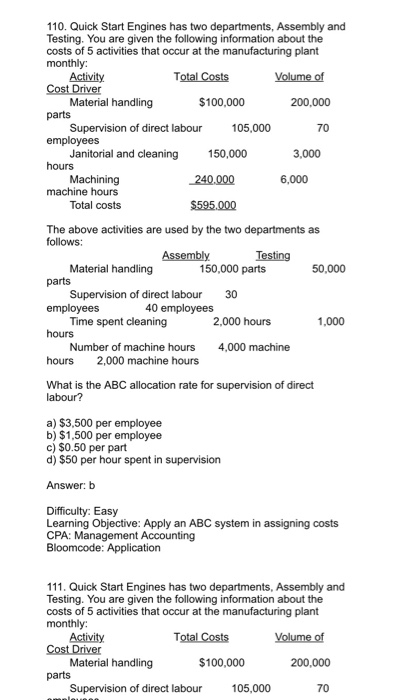

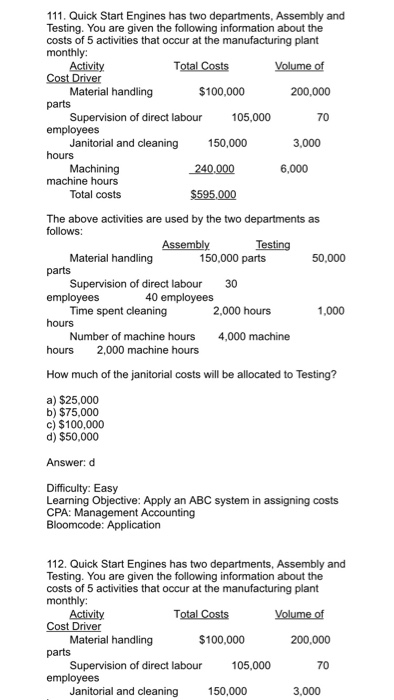

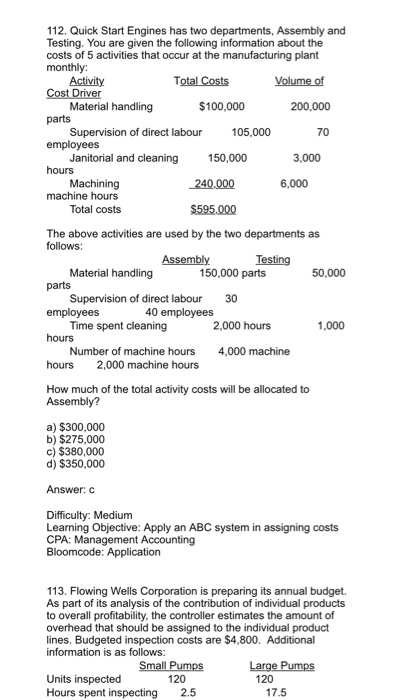

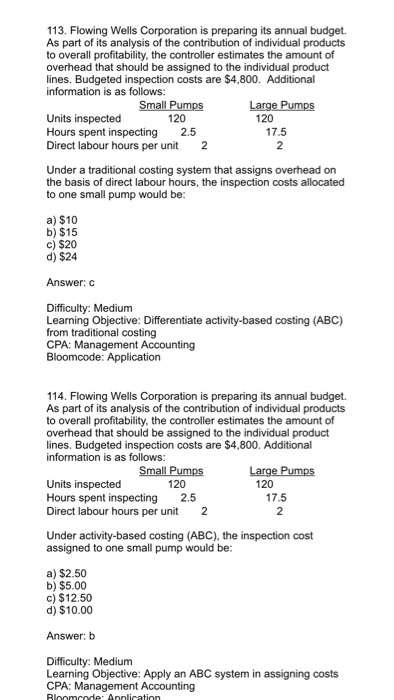

109. Quick Start Engines has two departments, Assembly and Testing. You are given the following information about the costs of 5 activities that occur at the manufacturing plant Activity Material handling Supervision of direct labour 105,000 Janitorial and cleaning 150,000 Total Costs $100,000 200,000 parts 70 3,000 hours 240,000 6,000 machine hours Total costs S595.000 The above activities are used by the two departments as Testing Material handling Supervision of direct labour Time spent cleaning Number of machine hours 150,000 parts 50,000 parts 30 2,000 hours 4,000 machine 40 employees 1,000 hours hours 2,000 machine hours How much of the material handling cost will be allocated to a) $75,000 b) $25,000 c) $66,667 d) $33,333 Answer: a Difficulty: Easy Learning Objective: Apply an ABC system in assigning costs 110. Quick Start Engines has two departments, Assembly and Testing. You are given the following information about the costs of 5 activities that occur at the manufacturing plant Total Costs Material handling $100,000 200,000 parts Supervision of direct labour 105,000 70 110. Quick Start Engines has two departments, Assembly and Testing. You are given the following information about the costs of 5 activities that occur at the manufacturing plant Total Costs Material handling Supervision of direct labour Janitorial and cleaning $100,000 200,000 parts 105,000 70 150,000 240,000 S595.000 3,000 hours 6,000 machine hours Total costs The above activities are used by the two departments as Testing Material handling Supervision of direct labour Time spent cleaning Number of machine hours 150,000 parts 50,000 parts 30 2,000 hours 4,000 machine 40 employees 1,000 hours hours 2,000 machine hours What is the ABC allocation rate for supervision of direct labour? a) $3,500 per employee b) $1.500 per employee c) $0.50 per part d) $50 per hour spent in supervision Answer: b Difficulty: Easy Learning Objective: Apply an ABC system in assigning costs CPA: Management Accounting 111. Quick Start Engines has two departments, Assembly and Testing. You are given the following information about the costs of 5 activities that occur at the manufacturing plant Total Costs Material handling $100,000 200,000 parts Supervision of direct labour 105,000 70 111. Quick Start Engines has two departments, Assembly and Testing. You are given the following information about the costs of 5 activities that occur at the manufacturing plant Total Costs Material handling Supervision of direct labour 105,000 Janitorial and cleaning 150,000 Machining Total costs $100,000 200,000 parts 70 3,000 hours 240,000 6,000 machine hours The above activities are used by the two departments as follows: Testing Material handling Supervision of direct labour Time spent cleaning Number of machine hours 150,000 parts 50,000 parts 30 2,000 hours 4,000 machine 40 employees 1,000 hours hours 2,000 machine hours How much of the janitorial costs will be allocated to Testing? a) $25,000 b) $75,000 c) $100,000 d) $50,000 Answer: d Difficulty: Easy Learning Objective: Apply an ABC system in assigning costs CPA: Management Accounting 112. Quick Start Engines has two departments, Assembly and Testing. You are given the following information about the costs of 5 activities that occur at the manufacturing plant Total Costs $100,000 200,000 Material handling Supervision of direct labour 105,000 Janitorial and cleaning 150,000 parts 70 3,000 112. Quick Start Engines has two departments, Assembly and Testing. You are given the following information about the costs of 5 activities that occur at the manufacturing plant monthly: Volume of Activity Material handling Supervision of direct labour105.000 Janitorial and cleaning 150,000 Machining Total costs Total Costs $100,000 200,000 parts 70 3,000 hours 240,000 6,000 machine hours S595.000 The above activities are used by the two departments as follows Testing Material handling Supervision of direct labour Time spent cleaning Number of machine hours 150,000 parts 50,000 30 2,000 hours 4,000 machine 40 employees 1,000 hours 2,000 machine hours How much of the total activity costs will be allocated to a) $300,000 b) $275,000 c) $380,000 d) $350,000 Answer:c Difficulty: Medium Learning Objective: Apply an ABC system in assigning costs 113. Flowing Wells Corporation is preparing its annual budget. As part of its analysis of the contribution of individual products to overall profitability, the controller estimates the amount of overhead that should be assigned to the individual product lines. Budgeted inspection costs are $4,800. Additional information is as follows 120 Units inspected Hours spent inspecting 120 2.5 17.5 113. Flowing Wells Corporation is preparing its annual budget. As part of its analysis of the contribution of individual products to overall profitability, the controller estimates the amount of overhead that should be assigned to the individual product lines. Budgeted inspection costs are $4,800. Additional information is as follows: Small Pumps Large Pumps Units inspected Hours spent inspecting 2.5 Direct labour hours per unit 2 120 120 17.5 2 Under a traditional costing system that assigns overhead on the basis of direct labour hours, the inspection costs allocated to one small pump would be: a) $10 b) $15 c) $20 d) $24 Answer: c Difficulty: Medium Learning Objective: Differentiate activity-based costing (ABC) from traditional costing CPA: Management Accounting 114. Flowing Wells Corporation is preparing its annual budget. As part of its analysis of the contribution of individual products to overall profitability, the controller estimates the amount of overhead that should be assigned to the individual product lines. Budgeted inspection costs are $4,800. Additional information is as follows 120 Units inspected Hours spent inspecting 2.5 Direct labour hours peunit 2 120 17.5 Under activity-based costing (ABC), the inspection cost assigned to one small pump would be a) $2.50 b) $5.00 c) $12.50 d) $10.00 Answer: b Difficulty: Medium Learning Objective: Apply an ABC system in assigning costs CPA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts