Question: 11. ( 4 points) On June 30, a Treasury bond is 3-year away from the maturity date, with face value of $100 and annual coupon

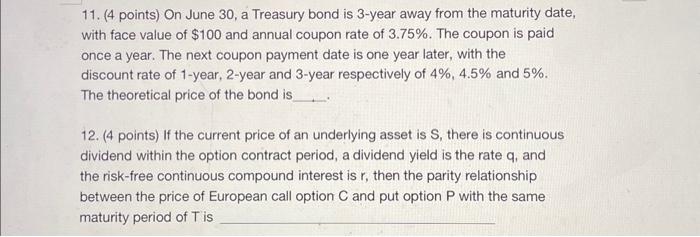

11. ( 4 points) On June 30, a Treasury bond is 3-year away from the maturity date, with face value of $100 and annual coupon rate of 3.75%. The coupon is paid once a year. The next coupon payment date is one year later, with the discount rate of 1 -year, 2-year and 3 -year respectively of 4%,4.5% and 5%. The theoretical price of the bond is 12. (4 points) If the current price of an underlying asset is S, there is continuous dividend within the option contract period, a dividend yield is the rate q, and the risk-free continuous compound interest is r, then the parity relationship between the price of European call option C and put option P with the same maturity period of T is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts