Question: 11. 6 Marks What is the implied 36 month rate if the spot 3 month (90 days) is 2.1% actual/ 360 and the spot 6

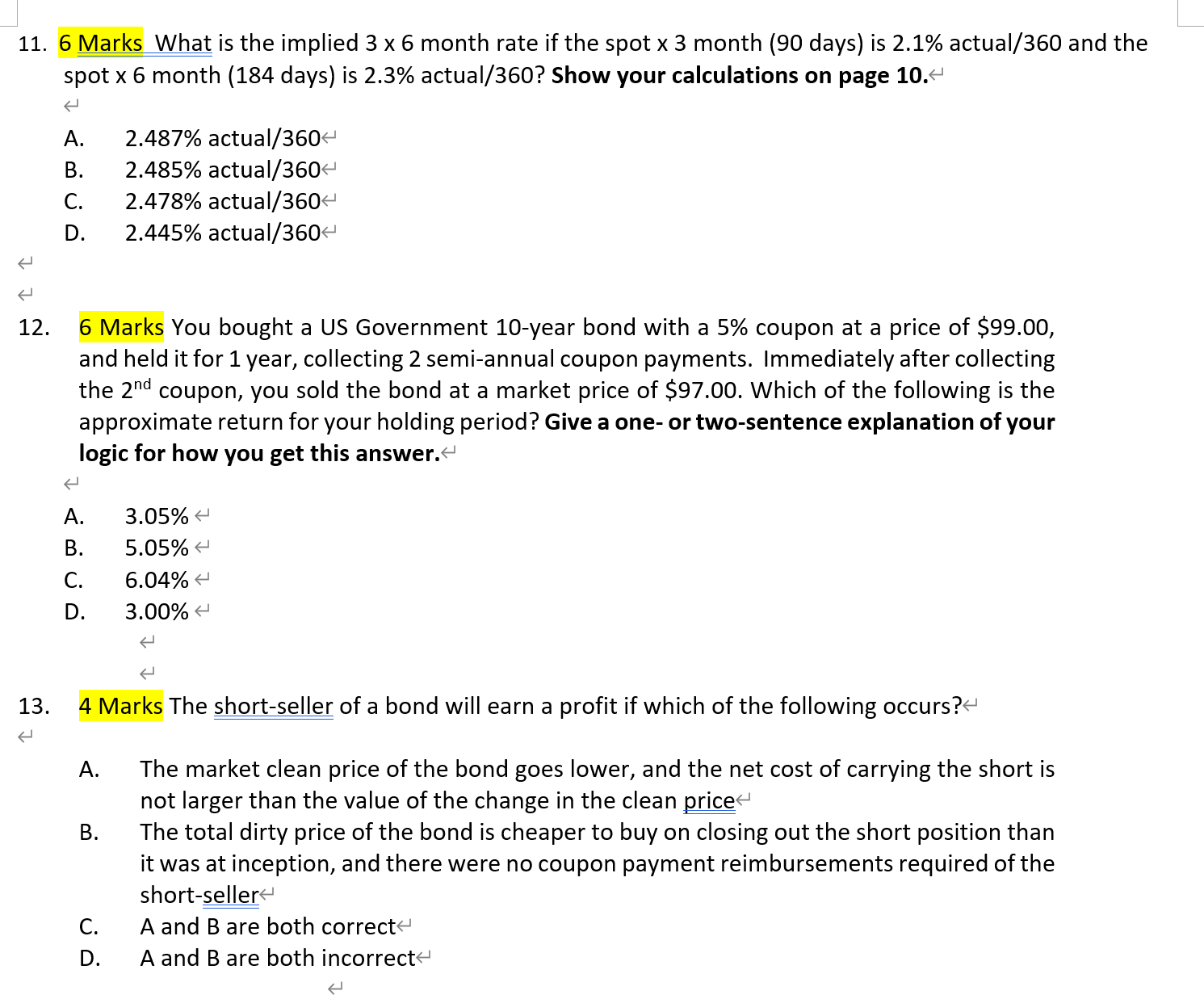

11. 6 Marks What is the implied 36 month rate if the spot 3 month (90 days) is 2.1% actual/ 360 and the spot 6 month (184 days) is 2.3% actual/360? Show your calculations on page 10. A. 2.487% actual /360 B. 2.485% actual /360 C. 2.478% actual /360 D. 2.445% actual /360 12. 6 Marks You bought a US Government 10 -year bond with a 5% coupon at a price of $99.00, and held it for 1 year, collecting 2 semi-annual coupon payments. Immediately after collecting the 2nd coupon, you sold the bond at a market price of $97.00. Which of the following is the approximate return for your holding period? Give a one- or two-sentence explanation of your logic for how you get this answer. A. 3.05% B. 5.05% C. 6.04% D. 3.00% 13. 4 Marks The short-seller of a bond will earn a profit if which of the following occurs? A. The market clean price of the bond goes lower, and the net cost of carrying the short is not larger than the value of the change in the clean price B. The total dirty price of the bond is cheaper to buy on closing out the short position than it was at inception, and there were no coupon payment reimbursements required of the short-seller C. A and B are both correct D. A and B are both incorrect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts