Question: 11. (6 points) Ojibwe Company is considering two mutually exclusive investment projects. Ojibwe's cost of capital is 10%. Following is information regarding each of the

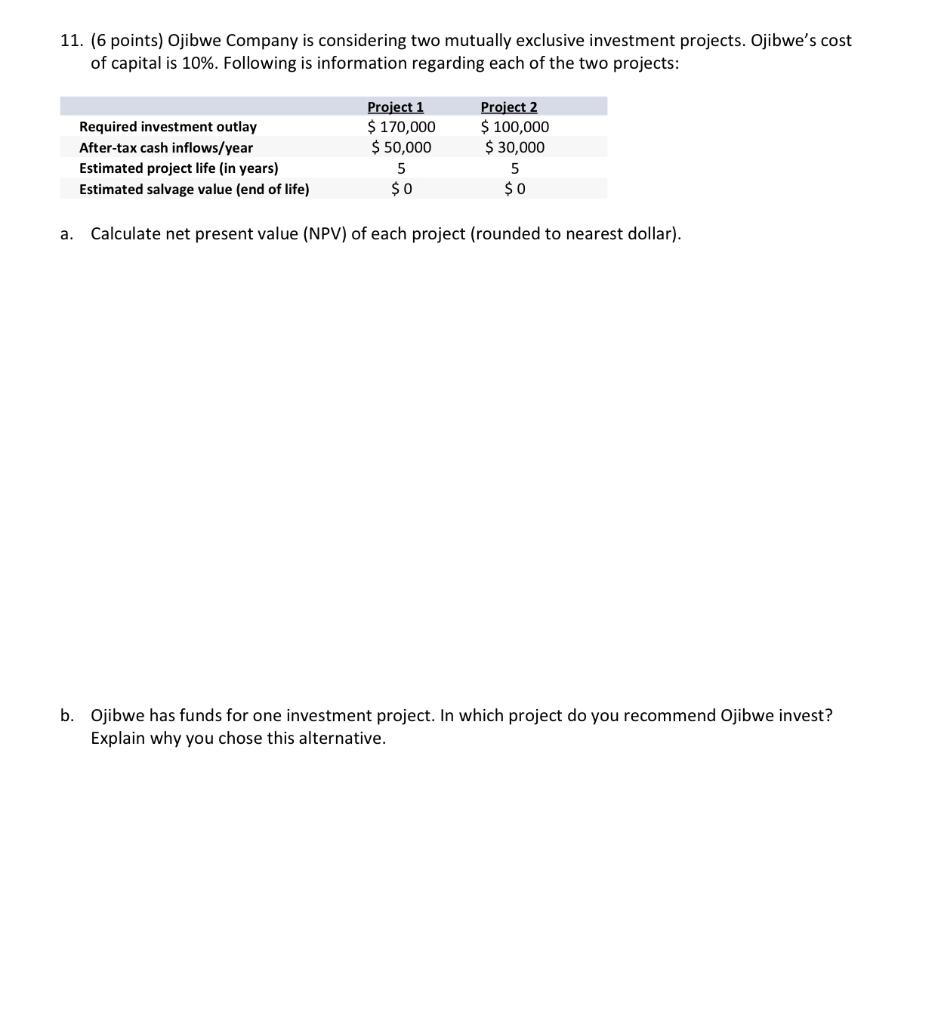

11. (6 points) Ojibwe Company is considering two mutually exclusive investment projects. Ojibwe's cost of capital is 10%. Following is information regarding each of the two projects: Required investment outlay After-tax cash inflows/year Project 1 $170,000 $ 50,000 Project 2 $100,000 $ 30,000 5 Estimated project life (in years) Estimated salvage value (end of life) 5 $0 $0 a. Calculate net present value (NPV) of each project (rounded to nearest dollar). b. Ojibwe has funds for one investment project. In which project do you recommend Ojibwe invest? Explain why you chose this alternative

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock