Question: 11. A forward contract: A) Requires that payment be made in full when the contract is originated. B) Provides the buyer with an option to

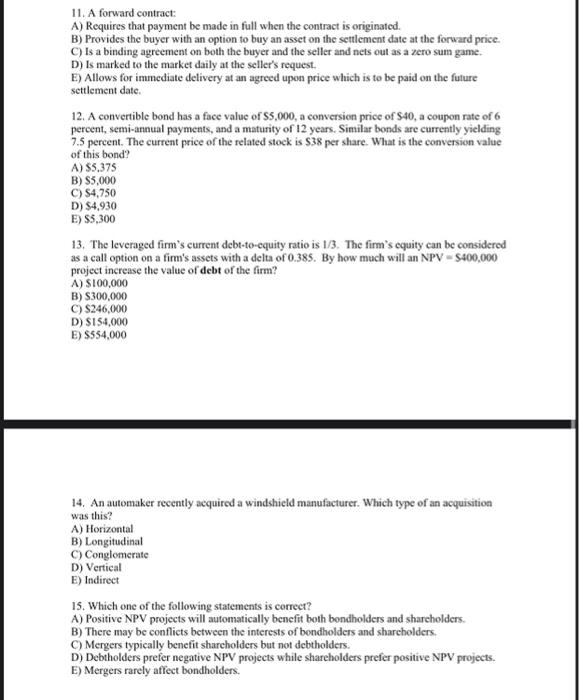

11. A forward contract: A) Requires that payment be made in full when the contract is originated. B) Provides the buyer with an option to buy an asset on the settlement date at the forward price C) Is a binding agreement on both the buyer and the seller and nets out as a zero sum game. D) is marked to the market daily at the seller's request. E) Allows for immediate delivery at an agreed upon price which is to be paid on the future settlement date. 12. A convertible bond has a face value of $5,000, a conversion price of $40, a coupon rate of 6 percent, semi-annual payments, and a maturity of 12 years. Similar bonds are currently yielding 7.5 percent. The current price of the related stock is $38 per share. What is the conversion value of this bond? A) S5,375 B) $5,000 C) $4,750 D) $4.930 E) $5,300 13. The leveraged firm's current debt-to-equity ratio is 1/3. The firm's equity can be considered as a call option on a firm's assets with a delta of 0.385. By how much will an NPV - $400,000 project increase the value of debt of the firm? A) S100,000 B) $300,000 C) S246,000 D) SIS4,000 E) $554.000 14. An automaker recently acquired a windshield manufacturer. Which type of an acquisition was this? A) Horizontal B) Longitudinal C) Conglomerate D) Vertical E) Indirect 15. Which one of the following statements is correct? A) Positive NPV projects will automatically benefit both bondholders and sharcholders. B) There may be conflicts between the interests of bondholders and shareholders. C) Mergers typically benefit sharcholders but not debtholders. D) Debtholders prefer negative NPV projects while shareholders prefer positive NPV projects. E) Mergers rarely affect bondholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts