Question: 11. A lender evaluating whether to issue mortgage loans considers many things, including two important ratios. These are: A. Loan-to-value (LTV) and debt-to-income (DTI) ratios.

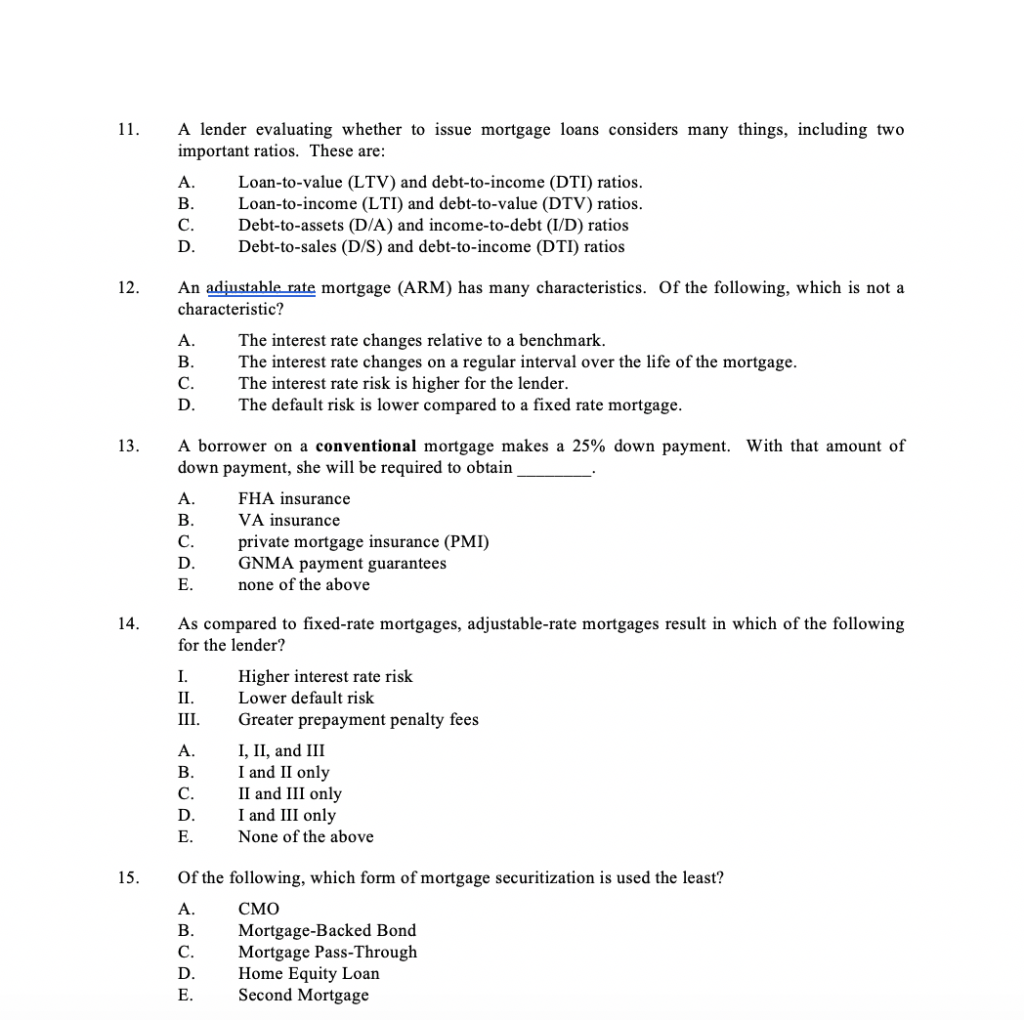

11. A lender evaluating whether to issue mortgage loans considers many things, including two important ratios. These are: A. Loan-to-value (LTV) and debt-to-income (DTI) ratios. B. Loan-to-income (LTI) and debt-to-value (DTV) ratios. C. Debt-to-assets (D/A) and income-to-debt (I/D) ratios D. Debt-to-sales (D/S) and debt-to-income (DTI) ratios 12. An adjustable rate mortgage (ARM) has many characteristics. Of the following, which is not a characteristic? A. The interest rate changes relative to a benchmark. B. The interest rate changes on a regular interval over the life of the mortgage. C. The interest rate risk is higher for the lender. D. The default risk is lower compared to a fixed rate mortgage. 13. A borrower on a conventional mortgage makes a 25% down payment. With that amount of down payment, she will be required to obtain A. FHA insurance B. VA insurance C. private mortgage insurance (PMI) D. GNMA payment guarantees E. none of the above 14. As compared to fixed-rate mortgages, adjustable-rate mortgages result in which of the following for the lender? I. Higher interest rate risk II. Lower default risk III. Greater prepayment penalty fees A. I, II, and III B. I and II only C. II and III only D. I and III only E. None of the above 15. Of the following, which form of mortgage securitization is used the least? A. CMO B. Mortgage-Backed Bond C. Mortgage Pass-Through D. Home Equity Loan E. Second Mortgage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts