Question: 11 A project is expected to create operating cash flows of $73,000 per year for eight years. The fixed assets required for the project cost

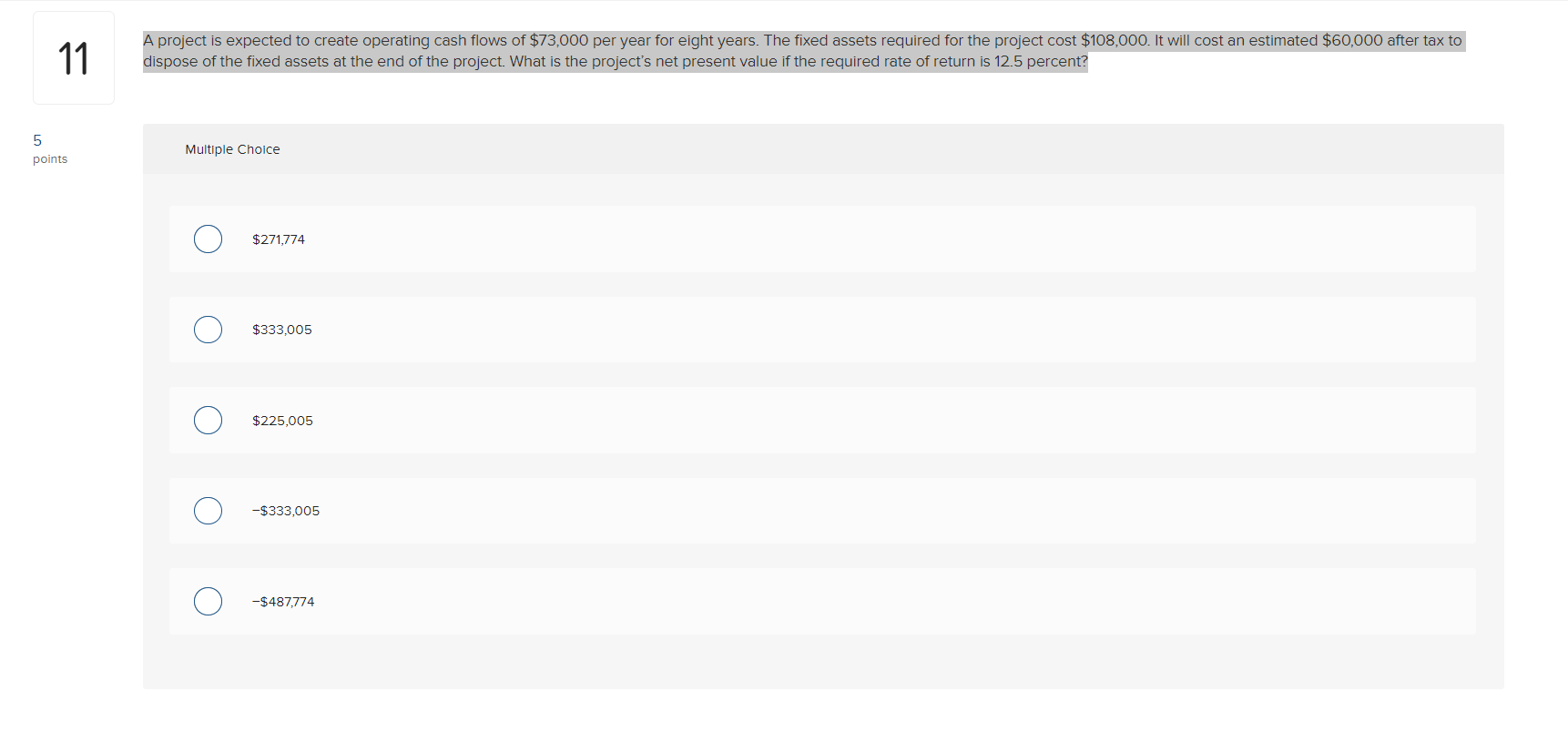

11 A project is expected to create operating cash flows of $73,000 per year for eight years. The fixed assets required for the project cost $108,000. It will cost an estimated $60,000 after tax to dispose of the fixed assets at the end of the project. What is the project's net present value if the required rate of return is 12.5 percent? 5 points Multiple Choice $271,774 $333,005 $225,005 -$333,005 -$487,774

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts