Question: 11. Accelerated Solutions has the following data for the year ended December 31, Year 1: Accounts receivable (January 1, Year 1) Credit sales Collections from

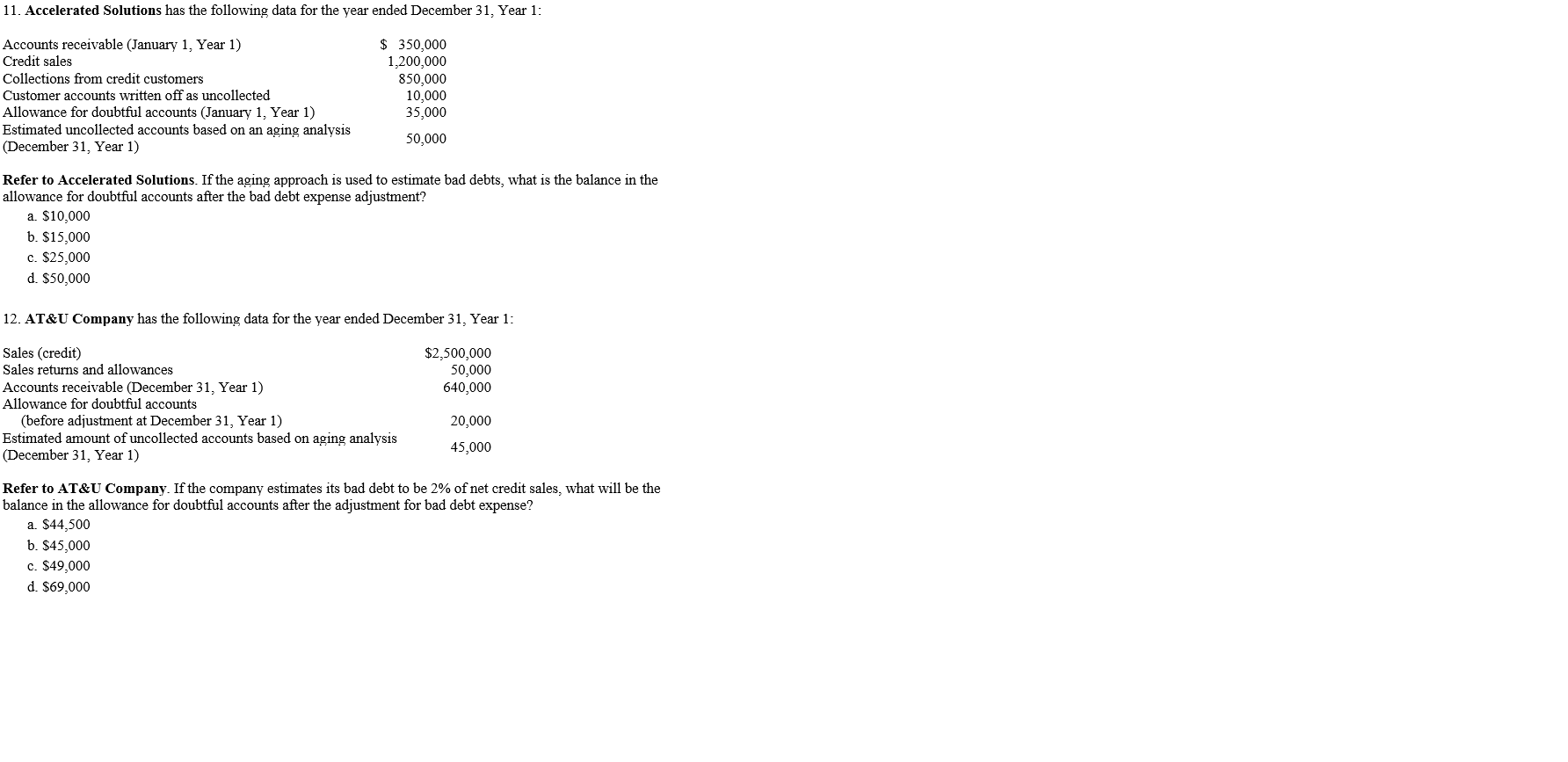

11. Accelerated Solutions has the following data for the year ended December 31, Year 1: Accounts receivable (January 1, Year 1) Credit sales Collections from credit customers Customer accounts written off as uncollected Allowance for doubtful accounts (January 1, Year 1) Estimated uncollected accounts based on an aging analysis (December 31, Year 1) $ 350,000 1,200,000 850,000 10,000 35,000 50,000 Refer to Accelerated Solutions. If the aging approach is used to estimate bad debts, what is the balance in the allowance for doubtful accounts after the bad debt expense adjustment? a. $10,000 b. $15,000 c. $25,000 d. $50,000 12. AT&U Company has the following data for the year ended December 31, Year 1: $2,500,000 50,000 640,000 Sales (credit) Sales returns and allowances Accounts receivable (December 31, Year 1) Allowance for doubtful accounts (before adjustment at December 31, Year 1) Estimated amount of uncollected accounts based on aging analysis (December 31, Year 1) 20,000 45,000 Refer to AT&U Company. If the company estimates its bad debt to be 2% of net credit sales, what will be the balance in the allowance for doubtful accounts after the adjustment for bad debt expense? a. $44,500 b. $45,000 c. $49,000 d. $69,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts