Question: 11. Bams Beothers capital structure is 100% equity and 0% debt. Currently there are 100,000 equily hares of common stock outstanding. Barns has decided to

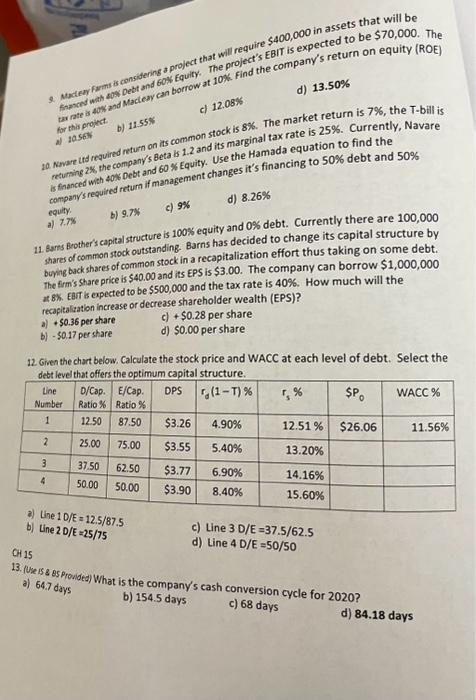

11. Bams Beothers capital structure is 100% equity and 0% debt. Currently there are 100,000 equily hares of common stock outstanding. Barns has decided to change its capital structure by bumb back shares of common stock in a recapitalization effort thus taking on some debt. The frrm's share price is $40.00 and its EPS is $3.00. The company can borrow $1,000,000 at 8%. EAr is expected to be $500,000 and the tax rate is 40%. How much will the recapitaleation increase or decrease shareholder wealth (EPS)? a) +50.36 per share c) +$0.28 per share b) - So.17 per share d) $0.00 per share 12. Gien the chart below. Calculate the stock price and WACC at each level of debt. Select the diat lounl that offers the ootimum caoital structure. (2) Whe 1D/E=12.5/87.5 b) Line 2D/E=25/75 c) Line 3D/E=37.5/62.5 CCH 15 d) Line 4D/E=50/50 13. (Ue is \& 85 prouded) What is the company's cash conversion cycle for 2020? a) 64.7 days b) 154.5 days c) 68 days d) 84.18 days 11. Bams Beothers capital structure is 100% equity and 0% debt. Currently there are 100,000 equily hares of common stock outstanding. Barns has decided to change its capital structure by bumb back shares of common stock in a recapitalization effort thus taking on some debt. The frrm's share price is $40.00 and its EPS is $3.00. The company can borrow $1,000,000 at 8%. EAr is expected to be $500,000 and the tax rate is 40%. How much will the recapitaleation increase or decrease shareholder wealth (EPS)? a) +50.36 per share c) +$0.28 per share b) - So.17 per share d) $0.00 per share 12. Gien the chart below. Calculate the stock price and WACC at each level of debt. Select the diat lounl that offers the ootimum caoital structure. (2) Whe 1D/E=12.5/87.5 b) Line 2D/E=25/75 c) Line 3D/E=37.5/62.5 CCH 15 d) Line 4D/E=50/50 13. (Ue is \& 85 prouded) What is the company's cash conversion cycle for 2020? a) 64.7 days b) 154.5 days c) 68 days d) 84.18 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts