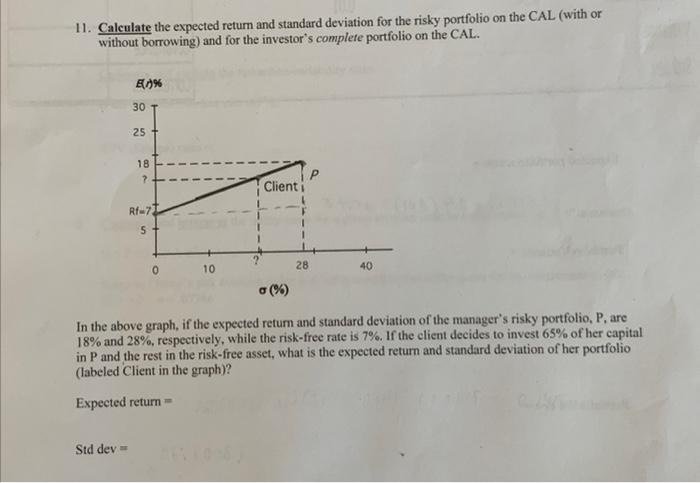

Question: 11. Calculate the expected return and standard deviation for the risky portfolio on the CAL (with or without borrowing) and for the investor's complete

11. Calculate the expected return and standard deviation for the risky portfolio on the CAL (with or without borrowing) and for the investor's complete portfolio on the CAL. 8(,1)% Std dev= 30 25 18 87 ? Rf-71 S+ 10 ? Clienti 28 40 (%) In the above graph, if the expected return and standard deviation of the manager's risky portfolio, P, are 18% and 28%, respectively, while the risk-free rate is 7%. If the client decides to invest 65% of her capital in P and the rest in the risk-free asset, what is the expected return and standard deviation of her portfolio (labeled Client in the graph)? Expected return ==

Step by Step Solution

There are 3 Steps involved in it

The image contains a Capital Allocation Line CAL with two specific points marked on it the riskfree ... View full answer

Get step-by-step solutions from verified subject matter experts