Question: 11. Calculating a potential investment return - Five steps Aa Aa E Calculating a stock's potential rate of return takes five steps: Step 1 -

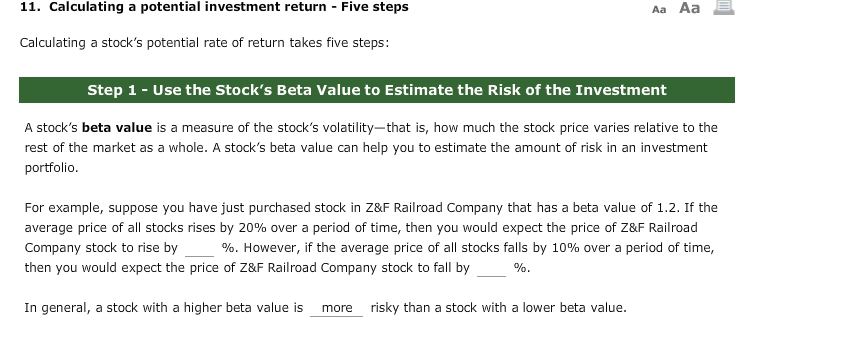

11. Calculating a potential investment return - Five steps Aa Aa E Calculating a stock's potential rate of return takes five steps: Step 1 - Use the Stock's Beta Value to Estimate the Risk of the Investment A stock's beta value is a measure of the stock's volatility-that is, how much the stock price varies relative to the rest of the market as a whole. A stock's beta value can help you to estimate the amount of risk in an investment portfolio. For example, suppose you have just purchased stock in Z&F Railroad Company that has a beta value of 1.2. If the average price of all stocks rises by 20% over a period of time, then you would expect the price of Z&F Railroad Company stock to rise by %. However, if the average price of all stocks falls by 10% over a period of time, then you would expect the price of Z&F Railroad Company stock to fall by %. In general, a stock with a higher beta value is more risky than a stock with a lower beta value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts