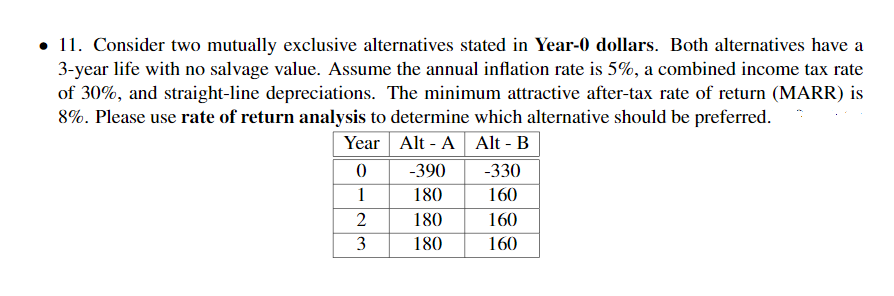

Question: . 11. Consider two mutually exclusive alternatives stated in Year-0 dollars. Both alternatives have a 3-year life with no salvage value. Assume the annual inflation

. 11. Consider two mutually exclusive alternatives stated in Year-0 dollars. Both alternatives have a 3-year life with no salvage value. Assume the annual inflation rate is 5%, a combined income tax rate of 30%, and straight-line depreciations. The minimum attractive after-tax rate of return (MARR) is 8%. Please use rate of return analysis to determine which alternative should be preferred. . Year Alt - A Alt-B 0 -390 -330 180 160 180 160 180 160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts