Question: 11 Deductions - Above or Below (For or From AGI)? Trade/Business expenses State and local income tax Rent/Royalty expenses Home mortgage interest Contributions to IRA

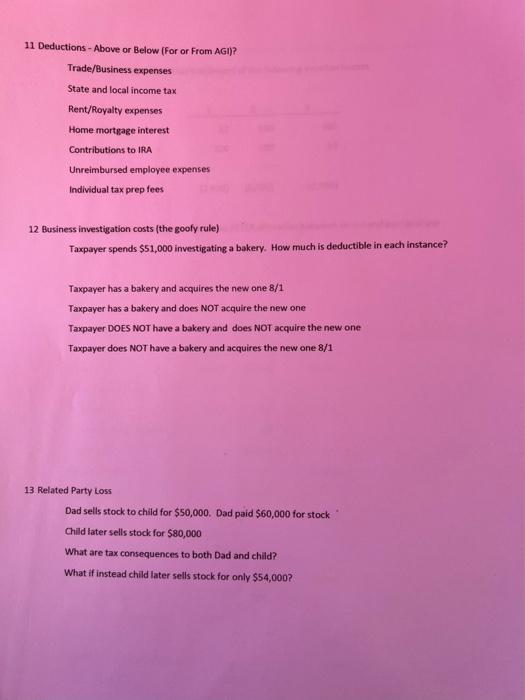

11 Deductions - Above or Below (For or From AGI)? Trade/Business expenses State and local income tax Rent/Royalty expenses Home mortgage interest Contributions to IRA Unreimbursed employee expenses Individual tax prep fees 12 Business investigation costs (the goofy rule) Taxpayer spends $51,000 investigating a bakery. How much is deductible in each instance? Taxpayer has a bakery and acquires the new one 8/1 Taxpayer has a bakery and does NOT acquire the new one Taxpayer DOES NOT have a bakery and does NOT acquire the new one Taxpayer does NOT have a bakery and acquires the new one 8/1 13. Related Party Loss Dad sells stock to child for $50,000. Dad paid $60,000 for stock Child later sells stock for $80,000 What are tax consequences to both Dad and child? What if instead child later sells stock for only $54,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts