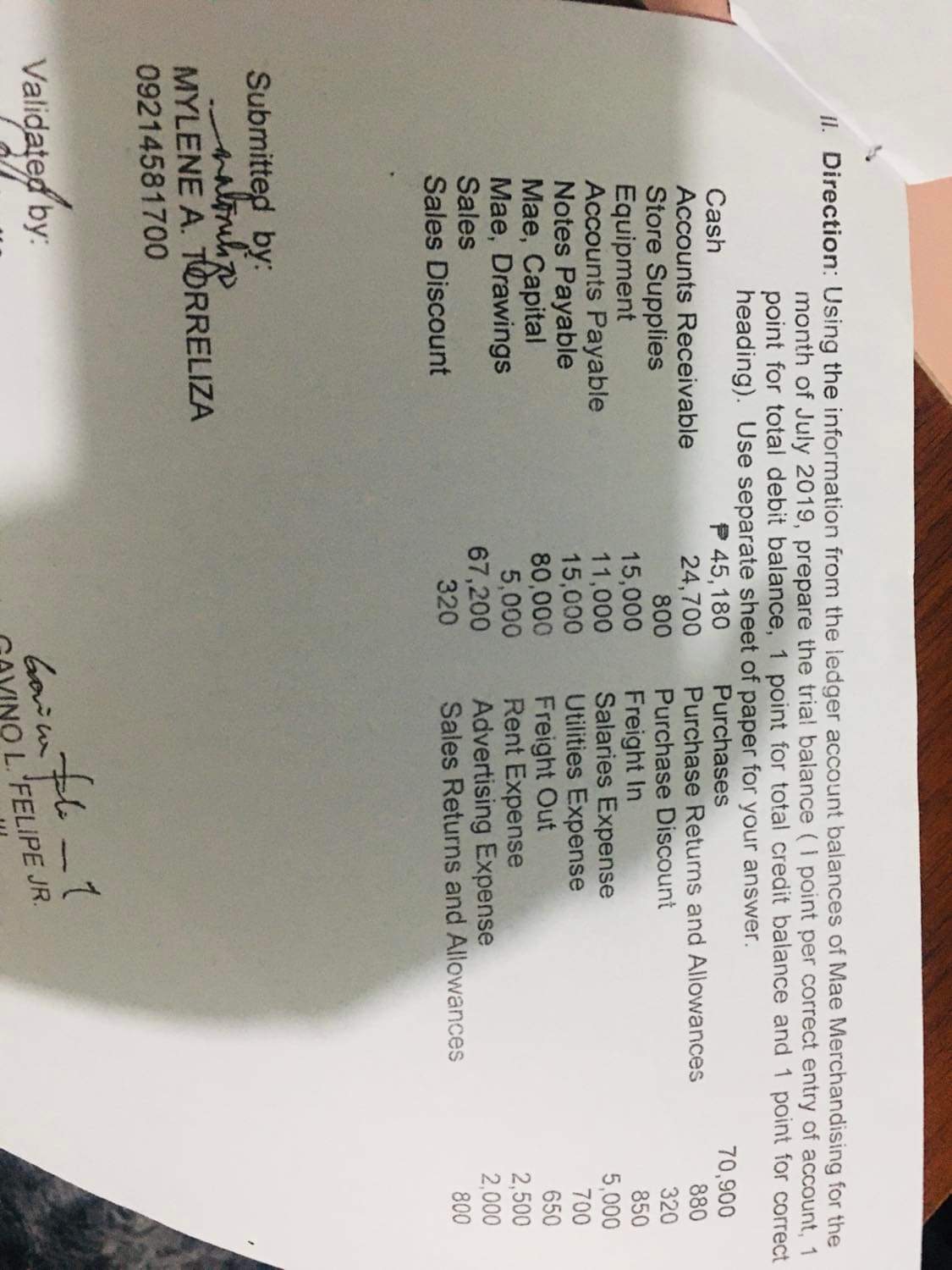

Question: 11. Direction: Using the information from the ledger account balances of Mae Merchandising for the month of July 2019, prepare the trial balance ( I

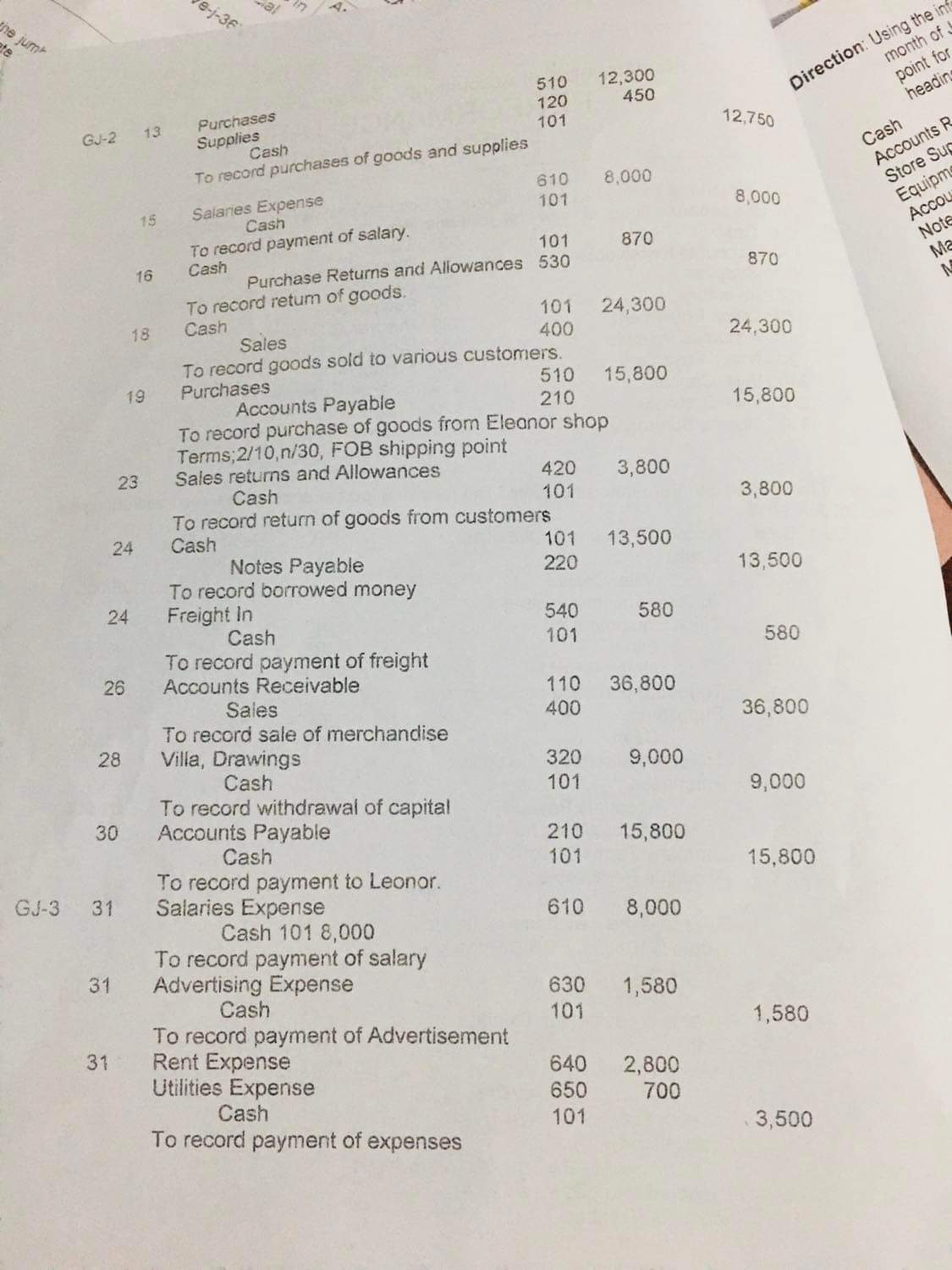

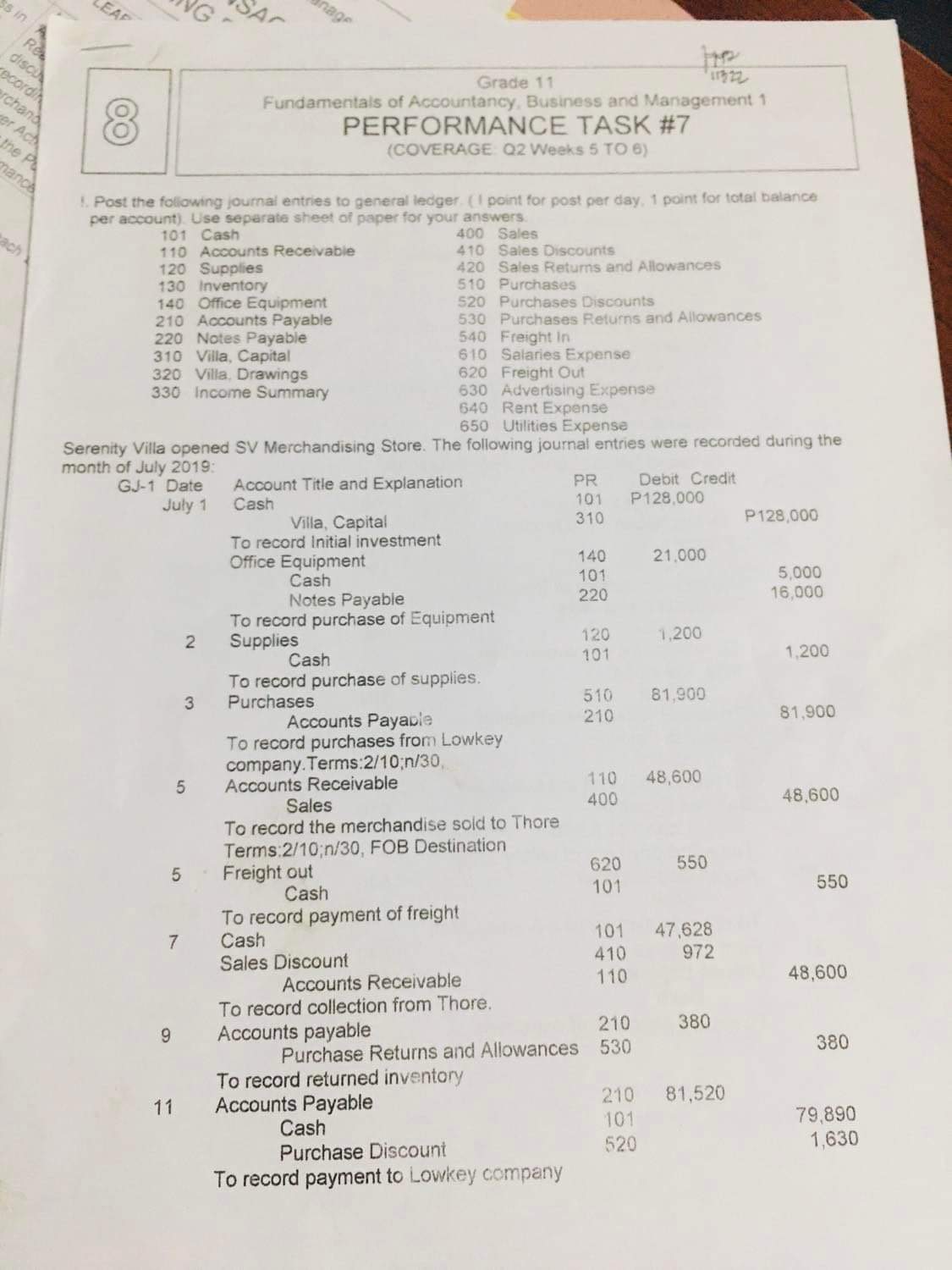

11. Direction: Using the information from the ledger account balances of Mae Merchandising for the month of July 2019, prepare the trial balance ( I point per correct entry of account, 1 point for total debit balance, 1 point for total credit balance and 1 point for correct heading). Use separate sheet of paper for your answer. Cash P 45, 180 Purchases 70,900 Accounts Receivable 24,700 Purchase Returns and Allowances 880 Store Supplies 800 Purchase Discount 320 Equipment 15,000 Freight In 850 Accounts Payable 11,000 Salaries Expense 5,000 Notes Payable 15,000 Utilities Expense 700 Mae, Capital 80,000 Freight Out 650 Mae, Drawings 5,000 Rent Expense 2,500 Sales 67,200 Advertising Expense 2,000 Sales Discount 320 Sales Returns and Allowances 800 Submitted by: MYLENE A. TORRELIZA 09214581700 Validated by: AVINO L. FELIPE JR.Direction: Using the i month of 510 12,300 point for 120 450 headin Purchases GJ-2 13 Supplies 101 12,750 Cash Cash To record purchases of goods and supplies Accounts 610 8,000 Store Su 15 Salaries Expense 101 8,000 Equipm Cash Acco To record payment of salary. 101 870 Note 16 Cash Purchase Returns and Allowances 530 370 Ma To record return of goods. Cash 101 24,300 18 Sales 400 24,300 To record goods sold to various customers 19 Purchases 510 15,800 Accounts Payable 210 15,800 To record purchase of goods from Eleanor shop Terms;2/10,n/30, FOB shipping point 23 Sales returns and Allowances 420 3,800 Cash 101 3,800 To record return of goods from customers 24 Cash 101 13,500 Notes Payable 220 13,500 To record borrowed money 24 Freight In 540 580 Cash 101 580 To record payment of freight 26 Accounts Receivable 110 36,800 Sales 400 To record sale of merchandise 36,800 28 Villa, Drawings 320 9,000 Cash 101 To record withdrawal of capital 9,000 30 Accounts Payable 210 15,800 Cash 101 To record payment to Leonor. 15,800 GJ-3 31 Salaries Expense 610 Cash 101 8,000 8,000 To record payment of salary 31 Advertising Expense 630 Cash 1,580 101 To record payment of Advertisement 1,580 31 Rent Expense 640 Utilities Expense 2,800 Cash 650 700 101 To record payment of expenses 3,500Ra disco ecordin Grade 11 chand Fundamentals of Accountancy, Business and Management 1 er Ac 8 PERFORMANCE TASK #7 (COVERAGE Q2 Weeks 5 TO 6) and 1. Post the following journal entries to general ledger, ( I point for post per day, 1 point for total balance per account). Use separate sheet of paper for your answers. 101 Cash 400 Sales 110 Accounts Receivable 410 Sales Discounts 120 Supplies 420 Sales Returns and Allowances 130 Inventory 510 Purchases 140 Office Equipment 520 Purchases Discounts 210 Accounts Payable 530 Purchases Returns and Allowances 220 Notes Payable 540 Freight In 310 Villa, Capital 610 Salaries Expense 320 Villa, Drawings 620 Freight Out 330 Income Summary 630 Advertising Expense 640 Rent Expense 650 Utilities Expense Serenity Villa opened SV Merchandising Store. The following journal entries were recorded during the month of July 2019: GJ-1 Date Account Title and Explanation PR Debit Credit July 1 Cash 101 P128,000 Villa, Capital 310 P128,000 To record Initial investment Office Equipment 140 21.000 Cash 101 5,000 Notes Payable 220 16,000 To record purchase of Equipment 2 Supplies 120 1,200 Cash 101 1,200 To record purchase of supplies. 3 Purchases 510 81,900 Accounts Payable 210 81,900 To record purchases from Lowkey company. Terms:2/10;n/30, 5 Accounts Receivable 1 10 48,600 Sales 400 48,600 To record the merchandise sold to Thore Terms:2/10;n/30, FOB Destination 5 Freight out 620 550 Cash 101 550 To record payment of freight 7 Cash 101 47.628 Sales Discount 410 972 Accounts Receivable 110 48,600 To record collection from Thore. 9 Accounts payable 210 380 Purchase Returns and Allowances 530 380 To record returned inventory 11 Accounts Payable 210 81,520 Cash 101 79,890 Purchase Discount 520 1,630 To record payment to Lowkey company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts