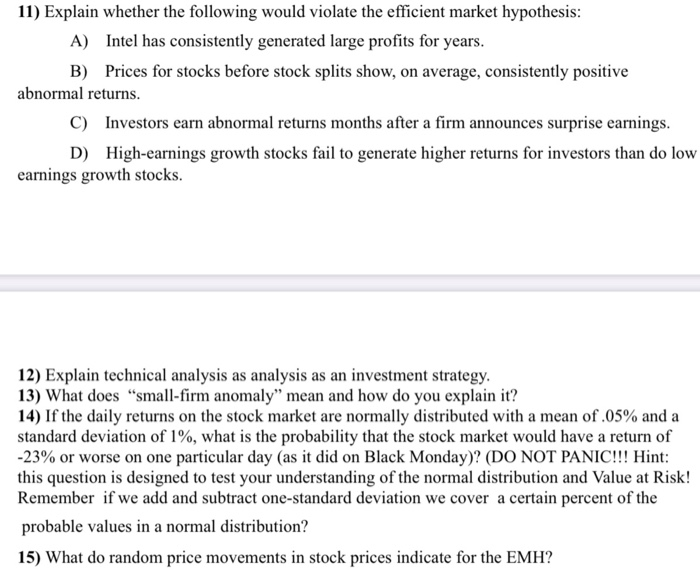

Question: 11) Explain whether the following would violate the efficient market hypothesis: A) Intel has consistently generated large profits for years. B) Prices for stocks before

11) Explain whether the following would violate the efficient market hypothesis: A) Intel has consistently generated large profits for years. B) Prices for stocks before stock splits show, on average, consistently positive abnormal returns. C) Investors earn abnormal returns months after a firm announces surprise earnings. D) High-earnings growth stocks fail to generate higher returns for investors than do low earnings growth stocks. 12) Explain technical analysis as analysis as an investment strategy. 13) What does "small-firm anomaly" mean and how do you explain it? 14) If the daily returns on the stock market are normally distributed with a mean of .05% and a standard deviation of 1%, what is the probability that the stock market would have a return of -23% or worse on one particular day (as it did on Black Monday)? (DO NOT PANIC!!! Hint: this question is designed to test your understanding of the normal distribution and Value at Risk! Remember if we add and subtract one-standard deviation we cover a certain percent of the probable values in a normal distribution? 15) What do random price movements in stock prices indicate for the EMH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts