Question: 11. How would you put on a hedge using 91-day Treasury bill futures to hedge the impact of interest rate changes on the market value

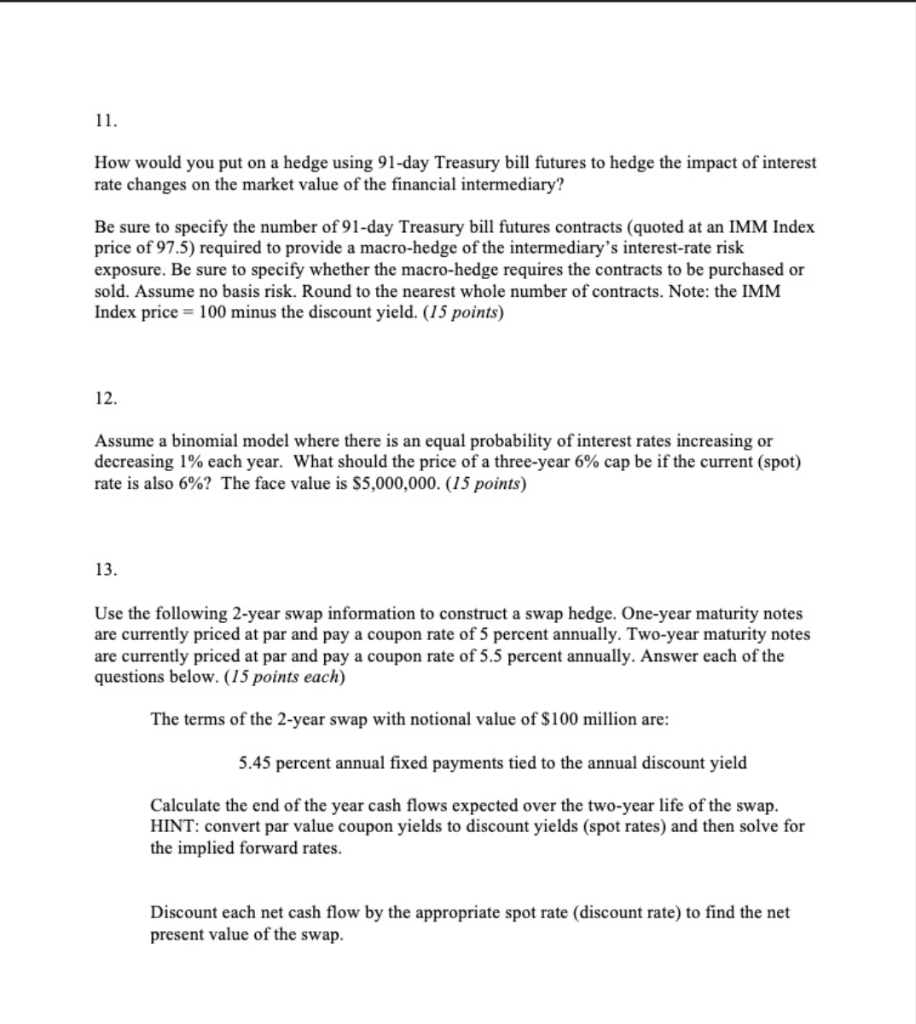

11. How would you put on a hedge using 91-day Treasury bill futures to hedge the impact of interest rate changes on the market value of the financial intermediary? Be sure to specify the number of 91-day Treasury bill futures contracts (quoted at an IMM Index price of 97.5) required to provide a macro-hedge of the intermediary's interest-rate risk exposure. Be sure to specify whether the macro-hedge requires the contracts to be purchased or sold. Assume no basis risk. Round to the nearest whole number of contracts. Note: the IMM Index price = 100 minus the discount yield. (15 points) 12. Assume a binomial model where there is an equal probability of interest rates increasing or decreasing 1% each year. What should the price of a three-year 6% cap be if the current (spot) rate is also 6%? The face value is $5,000,000. (15 points) 13. Use the following 2-year swap information to construct a swap hedge. One-year maturity notes are currently priced at par and pay a coupon rate of 5 percent annually. Two-year maturity notes are currently priced at par and pay a coupon rate of 5.5 percent annually. Answer each of the questions below. (15 points each) The terms of the 2-year swap with notional value of $ 100 million are: 5.45 percent annual fixed payments tied to the annual discount yield Calculate the end of the year cash flows expected over the two-year life of the swap. HINT: convert par value coupon yields to discount yields (spot rates) and then solve for the implied forward rates. Discount each net cash flow by the appropriate spot rate (discount rate) to find the net present value of the swap. 11. How would you put on a hedge using 91-day Treasury bill futures to hedge the impact of interest rate changes on the market value of the financial intermediary? Be sure to specify the number of 91-day Treasury bill futures contracts (quoted at an IMM Index price of 97.5) required to provide a macro-hedge of the intermediary's interest-rate risk exposure. Be sure to specify whether the macro-hedge requires the contracts to be purchased or sold. Assume no basis risk. Round to the nearest whole number of contracts. Note: the IMM Index price = 100 minus the discount yield. (15 points) 12. Assume a binomial model where there is an equal probability of interest rates increasing or decreasing 1% each year. What should the price of a three-year 6% cap be if the current (spot) rate is also 6%? The face value is $5,000,000. (15 points) 13. Use the following 2-year swap information to construct a swap hedge. One-year maturity notes are currently priced at par and pay a coupon rate of 5 percent annually. Two-year maturity notes are currently priced at par and pay a coupon rate of 5.5 percent annually. Answer each of the questions below. (15 points each) The terms of the 2-year swap with notional value of $ 100 million are: 5.45 percent annual fixed payments tied to the annual discount yield Calculate the end of the year cash flows expected over the two-year life of the swap. HINT: convert par value coupon yields to discount yields (spot rates) and then solve for the implied forward rates. Discount each net cash flow by the appropriate spot rate (discount rate) to find the net present value of the swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts