Question: 11. If a large cap equity manager is able to consistently outperform the market by investing in companies that have low P/E ratios, which form

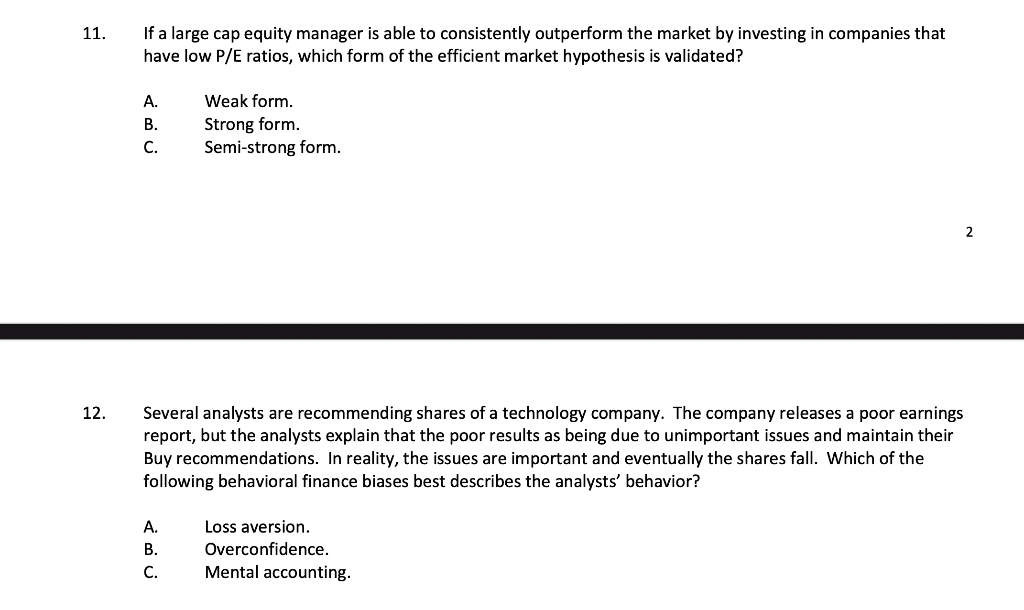

11. If a large cap equity manager is able to consistently outperform the market by investing in companies that have low P/E ratios, which form of the efficient market hypothesis is validated? A. B. C. Weak form. Strong form. Semi-strong form. 2 12. Several analysts are recommending shares of a technology company. The company releases a poor earnings report, but the analysts explain that the poor results as being due to unimportant issues and maintain their Buy recommendations. In reality, the issues are important and eventually the shares fall. Which of the following behavioral finance biases best describes the analysts' behavior? A. B. C. Loss aversion. Overconfidence. Mental accounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts