Question: 11) If interest rates decrease by 15 basis points (original interest rate is 8%), what is the % price change for a 30 year zero-coupon

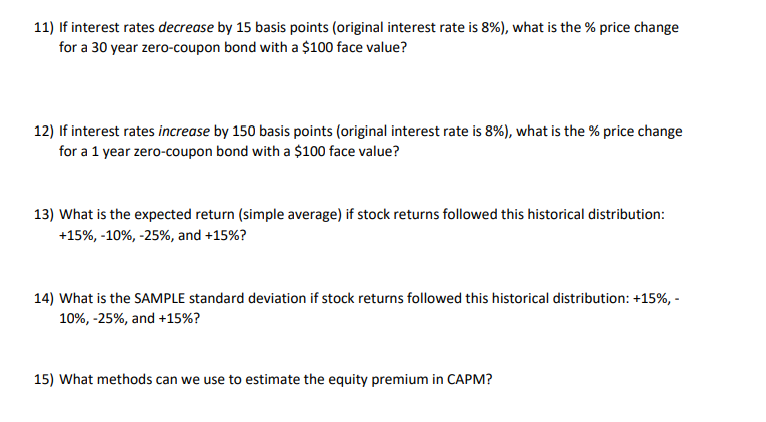

11) If interest rates decrease by 15 basis points (original interest rate is 8%), what is the % price change for a 30 year zero-coupon bond with a $100 face value? 12) If interest rates increase by 150 basis points (original interest rate is 8%), what is the % price change for a 1 year zero-coupon bond with a $100 face value? 13) What is the expected return (simple average) if stock returns followed this historical distribution: +15%, -10%, -25%, and +15%? 14) What is the SAMPLE standard deviation if stock returns followed this historical distribution: +15%, - 10%, -25%, and +15%? 15) What methods can we use to estimate the equity premium in CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts