Question: 11 in Skege true&returnUrl https%3A%2F%2Fcon connecti ti 0 Required information The following information applies to the questions displayed below Woolard Supplies (a sole-proprietorship) has taxable

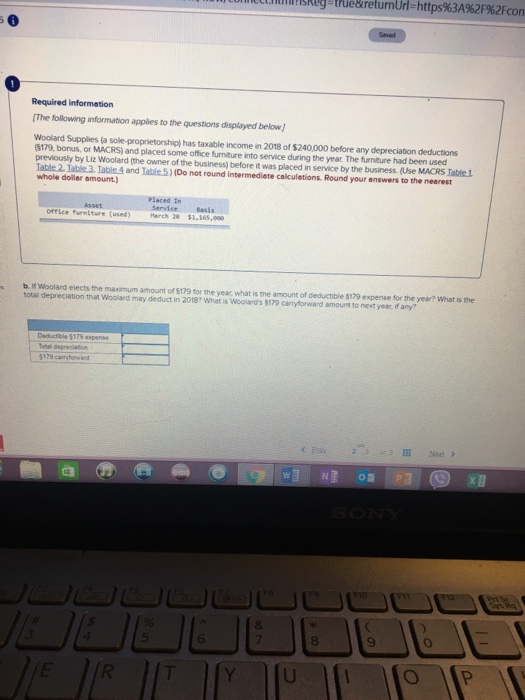

11 in Skege true&returnUrl https%3A%2F%2Fcon connecti ti 0 Required information The following information applies to the questions displayed below Woolard Supplies (a sole-proprietorship) has taxable income in 2018 of $240,000 before any depreciation deductions (5179, bonus, or MACRS) and placed some office furniture into service during the year The furniture had been used previously by Liz Woolard (the owner of the business) before it was placed in service by the business. (Use MACRS Table 1 Table 2 Table 3. Table 4 and Table 5) (Do not round intermediete calculetions. Round your answers to the nearest whole doller amount.) Placed In Service Basis sset s b. If Woolard elects the maximum amount of 5179 for the year, what is the amount of deductible s179 expense for the year? What is the total depreciation that Woolard may deduct in 2018? What is Woolard's $179 carryforward amouns to next year if any? Deductible $179 expese 179 carrytforwand 8 7 6 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts