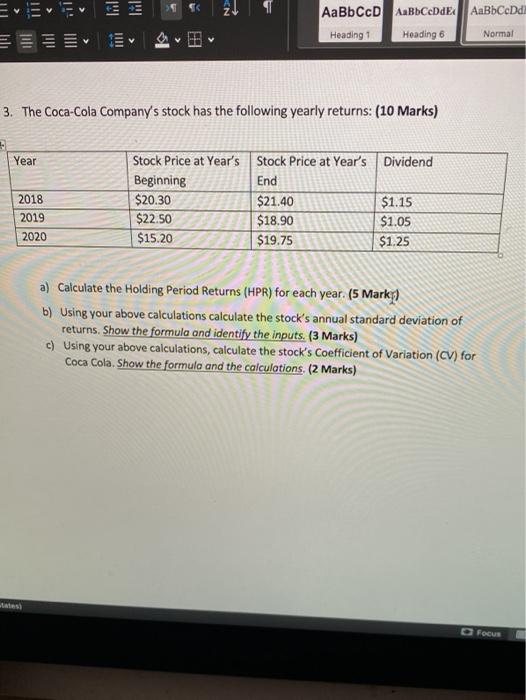

Question: 11 KN e AaBbCcD AaBbCcDdEx AaBbCeDd Heading 1 Heading 6 Normal 3. The Coca-Cola Company's stock has the following yearly returns: (10 Marks) Year 2018

11 KN e AaBbCcD AaBbCcDdEx AaBbCeDd Heading 1 Heading 6 Normal 3. The Coca-Cola Company's stock has the following yearly returns: (10 Marks) Year 2018 Stock Price at Year's Stock Price at Year's Dividend Beginning End $20.30 $21.40 $1.15 $22.50 $18.90 $1.05 $15.20 $19.75 $1.25 2019 2020 a) Calculate the Holding Period Returns (HPR) for each year. (5 Marks) b) Using your above calculations calculate the stock's annual standard deviation of returns. Show the formula and identify the inputs. (3 Marks) c) Using your above calculations, calculate the stock's Coefficient of Variation (CV) for Coca Cola. Show the formula and the calculations. (2 Marks) O Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts