Question: 11. MACRS COMPUTATIONS. Compute the allowable MACRS deduction under each of the following independent situations. Show computations for partial credit. 1. In 2021, Early

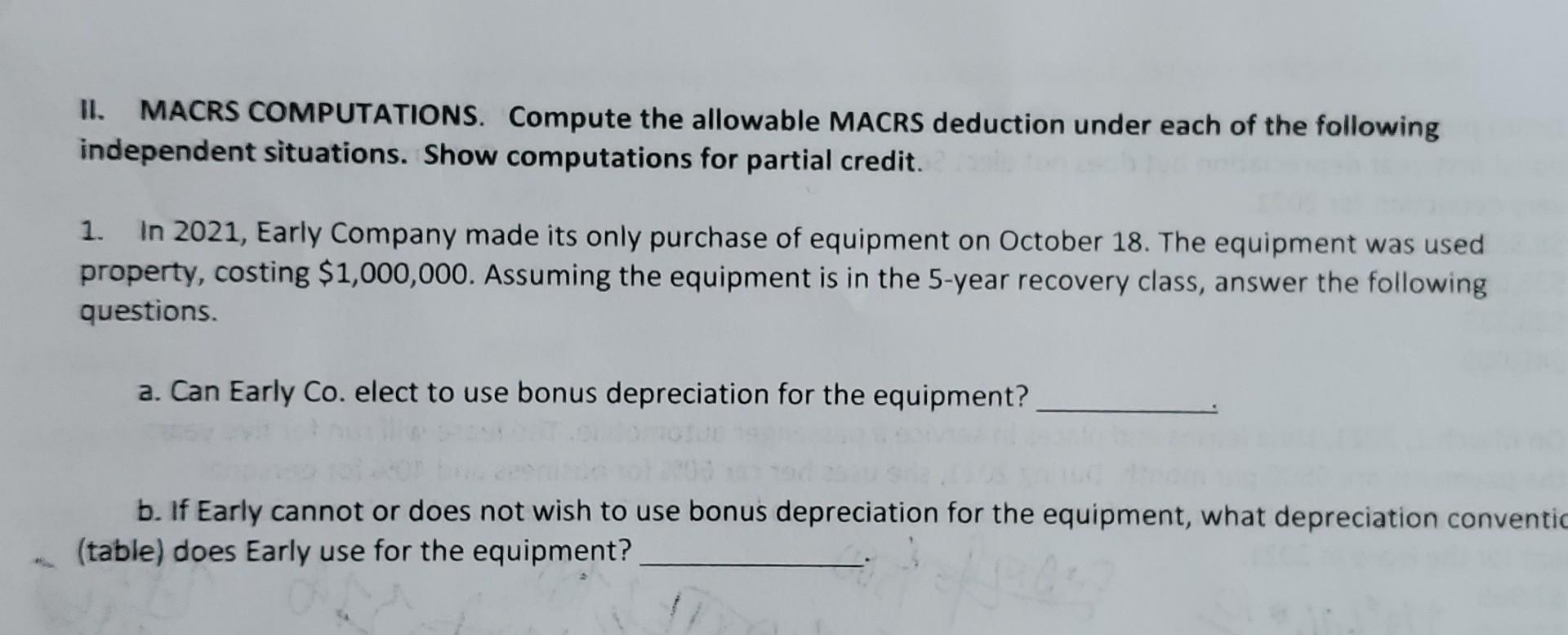

11. MACRS COMPUTATIONS. Compute the allowable MACRS deduction under each of the following independent situations. Show computations for partial credit. 1. In 2021, Early Company made its only purchase of equipment on October 18. The equipment was used property, costing $1,000,000. Assuming the equipment is in the 5-year recovery class, answer the following questions. a. Can Early Co. elect to use bonus depreciation for the equipment? b. If Early cannot or does not wish to use bonus depreciation for the equipment, what depreciation conventic (table) does Early use for the equipment?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts