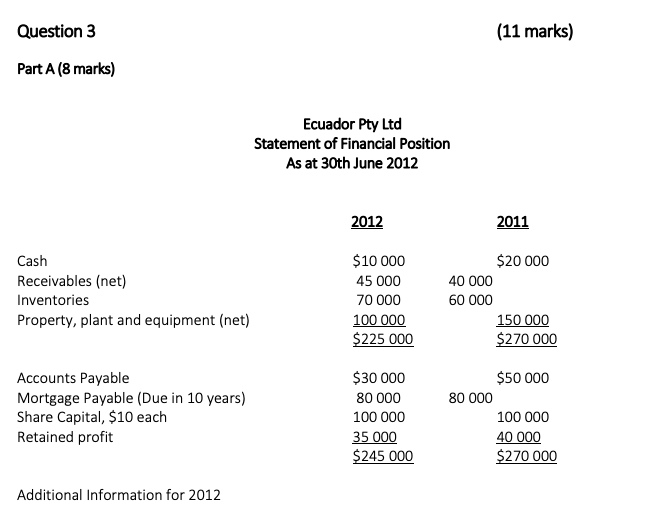

Question: (11 marks) Question 3 Part A (8 marks) Ecuador Pty Ltd Statement of Financial Position As at 30th June 2012 2011 2012 $10 000 $20

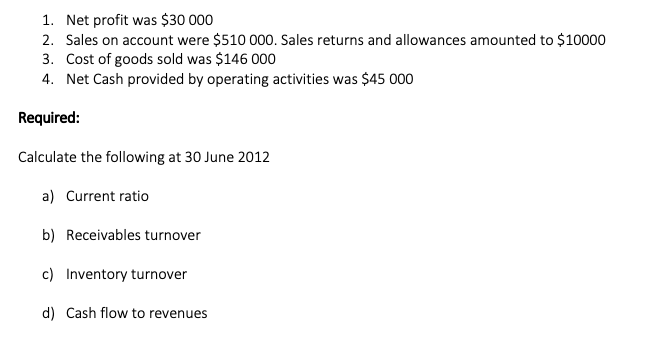

(11 marks) Question 3 Part A (8 marks) Ecuador Pty Ltd Statement of Financial Position As at 30th June 2012 2011 2012 $10 000 $20 000 Cash Receivables (net) 45 000 40 000 70 000 60000 Inventories 100 000 $225 000 150 000 $270 000 Property, plant and equipment (net) $30 000 $50 000 Accounts Payable Mortgage Payable (Due in 10 years) Share Capital, $10 each Retained profit 80 000 80 000 100 000 100 000 40 000 $270 000 35 000 $245 000 Additional Information for 2012 1. Net profit 2. Sales on account were $510 000. Sales returns and allowances amounted to $10000 3. Cost of goods sold was $146 000 4. Net Cash provided by operating activities was $45 000 $30 000 was Required: Calculate the following at 30 June 2012 a) Current ratio b) Receivables turnover c) Inventory turnover d) Cash flow to revenues Part B (3 marks) Identify the following transactions into the appropriate (i) subsidiary ledgers, and (ii) special or general journals. If there are any accounts that you believe have no impact on the subsidiary ledger, mark it as 'N/A Transaction Subsidiary Ledger Special Journal Purchased a computer from Dell on credit Inventory sold to Shiney Shoes on credit Sold inventory for $550 cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts