Question: 11 points 3) A company purchased a machine for BD 120,000 and learned that a similar new machine can be purchased now at BD

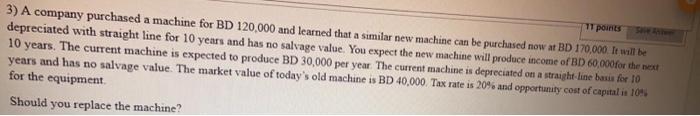

11 points 3) A company purchased a machine for BD 120,000 and learned that a similar new machine can be purchased now at BD 170,000. It will be depreciated with straight line for 10 years and has no salvage value. You expect the new machine will produce income of BD 60,000 for the next 10 years. The current machine is expected to produce BD 30,000 per year. The current machine is depreciated on a straight-line basis for 10 years and has no salvage value. The market value of today's old machine is BD 40,000. Tax rate is 20% and opportunity cost of capital in 10% for the equipment. Should you replace the machine?

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Yes you should replace the machine The cost of the new mac... View full answer

Get step-by-step solutions from verified subject matter experts