Question: (11 points) Consider a one-period security market model with two assets - a bond and a stock. The interest rate is assumed to be 0

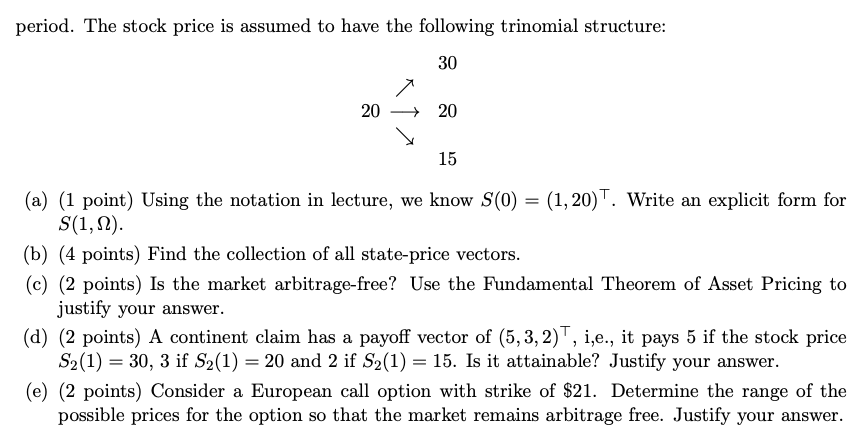

(11 points) Consider a one-period security market model with two assets - a bond and a stock. The interest rate is assumed to be 0 so that the bond sells for $1 and pays $1 at the end of the period. The stock price is assumed to have the following trinomial structure: (a) (1 point) Using the notation in lecture, we know S(0)=(1,20). Write an explicit form for S(1,). (b) (4 points) Find the collection of all state-price vectors. (c) (2 points) Is the market arbitrage-free? Use the Fundamental Theorem of Asset Pricing to justify your answer. (d) (2 points) A continent claim has a payoff vector of (5,3,2), i,e., it pays 5 if the stock price S2(1)=30,3 if S2(1)=20 and 2 if S2(1)=15. Is it attainable? Justify your answer. (e) (2 points) Consider a European call option with strike of $21. Determine the range of the possible prices for the option so that the market remains arbitrage free. Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts