Question: a. What is the beta of a portfolio that has 40% invested in ExxonMobil and 60% in Newmont? b. Would you invest in this

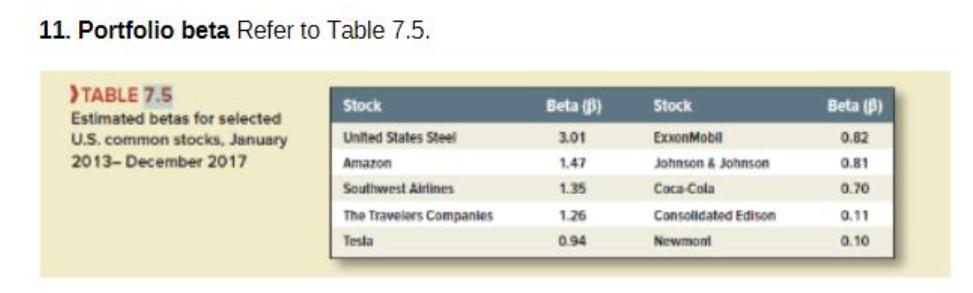

a. What is the beta of a portfolio that has 40% invested in ExxonMobil and 60% in Newmont? b. Would you invest in this portfolio if you had no superior information about the prospects for these stocks? Devise an alternative portfolio with the same expected return and less risk. c. Now repeat parts (a) and (b) with a portfolio that has 40% invested in Travelers and 60% in Amazon. 11. Portfolio beta Refer to Table 7.5. >TABLE 7.5 Estimated betas for selected U.S. common stocks, January 2013-December 2017 Stock United States Steel Amazon Southwest Airlines The Travelers Companies Testa Beta (3) 3.01 1.47 1.35 1.26 0.94 Stock ExxonMobil Johnson & Johnson Coca-Cola Consolidated Edison Newmont Beta (3) 0.82 0.81 0.70 0.11 0.10

Step by Step Solution

3.58 Rating (179 Votes )

There are 3 Steps involved in it

a To calculate the beta of a portfolio we need to use the weighted average of the individual stock betas Here the portfolio consists of 40 ExxonMobil and 60 Newmont The formula for calculating the bet... View full answer

Get step-by-step solutions from verified subject matter experts