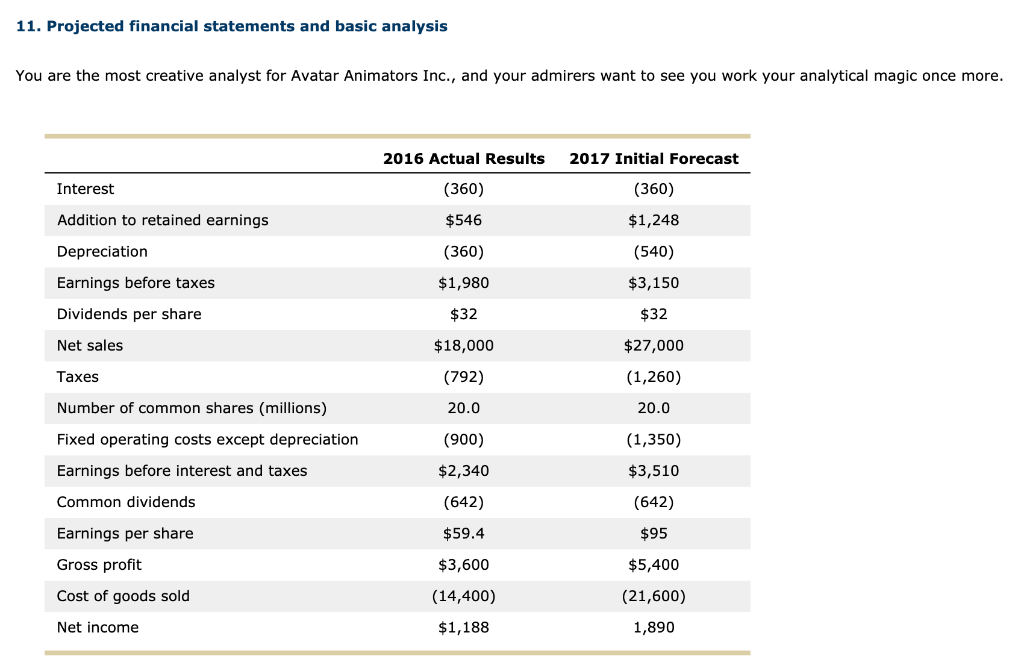

Question: 11. Projected financial statements and basic analysis You are the most creative analyst for Avatar Animators Inc., and your admirers want to see you work

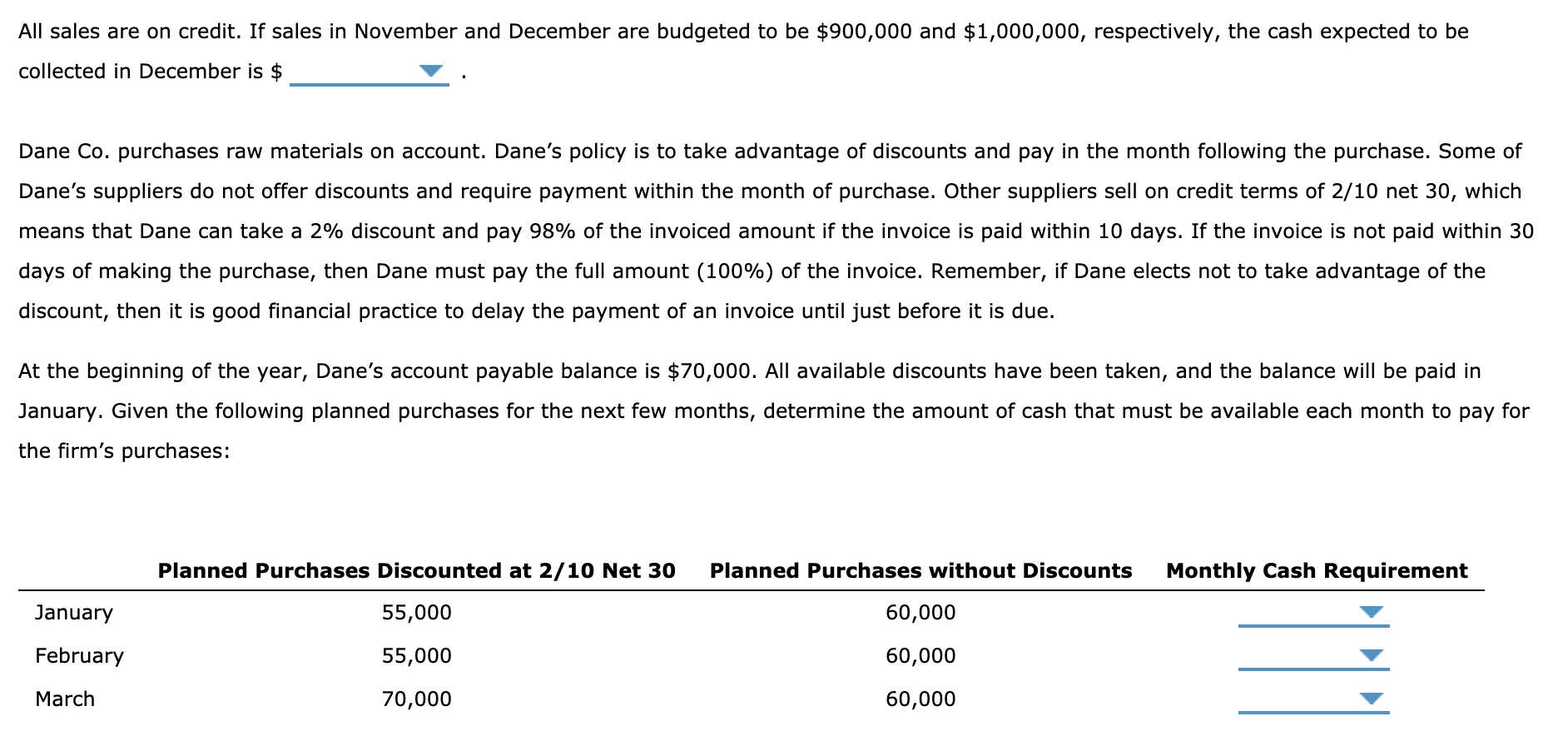

11. Projected financial statements and basic analysis You are the most creative analyst for Avatar Animators Inc., and your admirers want to see you work your analytical magic once more. 2016 Actual Results 2017 Initial Forecast Interest (360) (360) Addition to retained earnings $546 $1,248 Depreciation (360) (540) Earnings before taxes $1,980 $3,150 Dividends per share $32 $32 Net sales $18,000 $27,000 (1,260) Taxes (792) 20.0 20.0 Number of common shares (millions) Fixed operating costs except depreciation (900) (1,350) Earnings before interest and taxes $2,340 $3,510 Common dividends (642) (642) Earnings per share $59.4 $95 Gross profit $3,600 $5,400 Cost of goods sold (14,400) $1,188 (21,600) 1,890 Net income All sales are on credit. If sales in November and December are budgeted to be $900,000 and $1,000,000, respectively, the cash expected to be collected in December is $ Dane Co. purchases raw materials on account. Dane's policy is to take advantage of discounts and pay the month following the purchase. Some of Dane's suppliers do not offer discounts and require payment within the month of purchase. Other suppliers sell on credit terms of 2/10 net 30, which means that Dane can take a 2% discount and pay 98% of the invoiced amount if the invoice is paid within 10 days. If the invoice is not paid within 30 days of making the purchase, then Dane must pay the full amount (100%) of the invoice. Remember, if Dane elects not to take advantage of the discount, then it is good financial practice to delay the payment of an invoice until just before it is due. At the beginning of the year, Dane's account payable balance is $70,000. All available discounts have been taken, and the balance will be paid in January. Given the following planned purchases for the next few months, determine the amount of cash that must be available each month to pay for the firm's purchases: Planned Purchases Discounted at 2/10 Net 30 Planned Purchases without Discounts Monthly Cash Requirement January 55,000 60,000 February 55,000 60,000 March 70,000 60,000 11. Projected financial statements and basic analysis You are the most creative analyst for Avatar Animators Inc., and your admirers want to see you work your analytical magic once more. 2016 Actual Results 2017 Initial Forecast Interest (360) (360) Addition to retained earnings $546 $1,248 Depreciation (360) (540) Earnings before taxes $1,980 $3,150 Dividends per share $32 $32 Net sales $18,000 $27,000 (1,260) Taxes (792) 20.0 20.0 Number of common shares (millions) Fixed operating costs except depreciation (900) (1,350) Earnings before interest and taxes $2,340 $3,510 Common dividends (642) (642) Earnings per share $59.4 $95 Gross profit $3,600 $5,400 Cost of goods sold (14,400) $1,188 (21,600) 1,890 Net income All sales are on credit. If sales in November and December are budgeted to be $900,000 and $1,000,000, respectively, the cash expected to be collected in December is $ Dane Co. purchases raw materials on account. Dane's policy is to take advantage of discounts and pay the month following the purchase. Some of Dane's suppliers do not offer discounts and require payment within the month of purchase. Other suppliers sell on credit terms of 2/10 net 30, which means that Dane can take a 2% discount and pay 98% of the invoiced amount if the invoice is paid within 10 days. If the invoice is not paid within 30 days of making the purchase, then Dane must pay the full amount (100%) of the invoice. Remember, if Dane elects not to take advantage of the discount, then it is good financial practice to delay the payment of an invoice until just before it is due. At the beginning of the year, Dane's account payable balance is $70,000. All available discounts have been taken, and the balance will be paid in January. Given the following planned purchases for the next few months, determine the amount of cash that must be available each month to pay for the firm's purchases: Planned Purchases Discounted at 2/10 Net 30 Planned Purchases without Discounts Monthly Cash Requirement January 55,000 60,000 February 55,000 60,000 March 70,000 60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts