Question: -11 Question 5 View Policies rt Current Attempt in Progress Ivanhoe's Candles will be producing a new line of dripless candles in the coming years

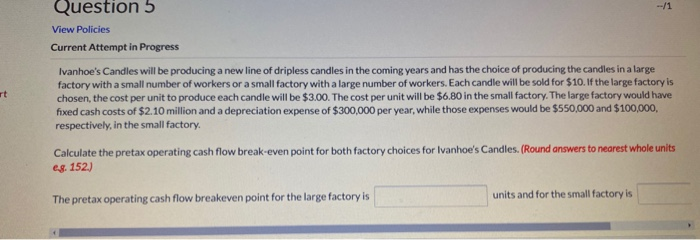

-11 Question 5 View Policies rt Current Attempt in Progress Ivanhoe's Candles will be producing a new line of dripless candles in the coming years and has the choice of producing the candles in a large factory with a small number of workers or a small factory with a large number of workers. Each candle will be sold for $10. If the large factory is chosen, the cost per unit to produce each candle will be $3.00. The cost per unit will be $6.80 in the small factory. The large factory would have fixed cash costs of $2.10 million and a depreciation expense of $300,000 per year, while those expenses would be $550,000 and $100,000, respectively, in the small factory. Calculate the pretax operating cash flow break-even point for both factory choices for Ivanhoe's Candles. (Round answers to nearest whole units eg. 152) units and for the small factory is The pretax operating cash flow breakeven point for the large factory is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts