Question: 11 SECTION A COMPULSORY QUESTION ONE a Financial angineering has been disparaged as nothing more than paper shulting Critics argue that resources used for rearranging

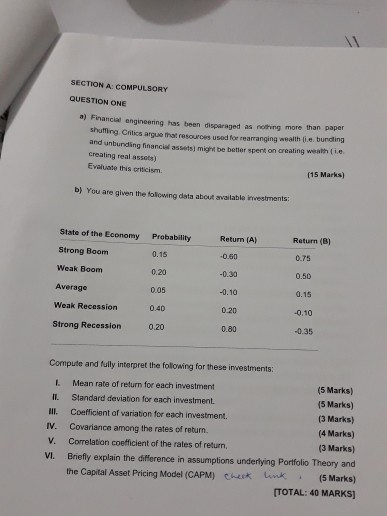

11 SECTION A COMPULSORY QUESTION ONE a Financial angineering has been disparaged as nothing more than paper shulting Critics argue that resources used for rearranging wealth i.e. bunding and unbunding financial assets) might be beatter spent on creating wealth tie creating real assets) Evaluate this criticism (15 Marks) b) You are given the fallowing data about available investments State of the Economy Return (A) Return (B) Probability Strong Boom 0.15 -0.60 0.75 Weak Boom 0.20 -0.30 0.50 Average 0.05 -0.10 0.15 Weak Recession 0.40 0.20 -0.10 Strong Recession 0.20 0.80 0.35 Compute and fully interpret the following for these investments: Mean rate of return for each investment (5 Marks) Standard deviation for each investment (5 Marks) Coefficient of variation for each investment. (3 Marks) Covariance among the rates of return. IV. (4 Marks) Correlation coefficient of the rates of return, V. (3 Marks) Briefly explain the difference in assumptions underlying Portfolio Theory and the Capital Asset Pricing Model (CAPM) Check nk VI. (5 Marks) TOTAL: 40 MARKS 11 SECTION A COMPULSORY QUESTION ONE a Financial angineering has been disparaged as nothing more than paper shulting Critics argue that resources used for rearranging wealth i.e. bunding and unbunding financial assets) might be beatter spent on creating wealth tie creating real assets) Evaluate this criticism (15 Marks) b) You are given the fallowing data about available investments State of the Economy Return (A) Return (B) Probability Strong Boom 0.15 -0.60 0.75 Weak Boom 0.20 -0.30 0.50 Average 0.05 -0.10 0.15 Weak Recession 0.40 0.20 -0.10 Strong Recession 0.20 0.80 0.35 Compute and fully interpret the following for these investments: Mean rate of return for each investment (5 Marks) Standard deviation for each investment (5 Marks) Coefficient of variation for each investment. (3 Marks) Covariance among the rates of return. IV. (4 Marks) Correlation coefficient of the rates of return, V. (3 Marks) Briefly explain the difference in assumptions underlying Portfolio Theory and the Capital Asset Pricing Model (CAPM) Check nk VI. (5 Marks) TOTAL: 40 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts