Question: 11 Tail Risk Hedging (10 Points) Fund managers at Greenwoods Asset Management (GAM), a Hong Kong- based hedge fund, believe that the low interest rate

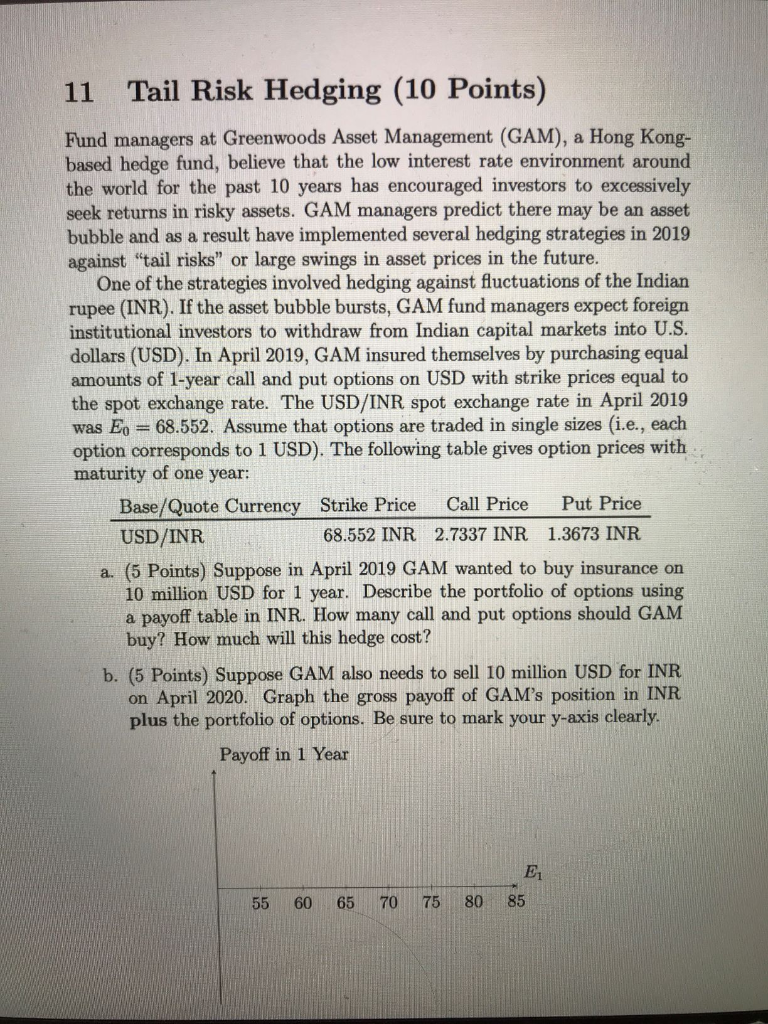

11 Tail Risk Hedging (10 Points) Fund managers at Greenwoods Asset Management (GAM), a Hong Kong- based hedge fund, believe that the low interest rate environment around the world for the past 10 years has encouraged investors to excessively seek returns in risky assets. GAM managers predict there may be an asset bubble and as a result have implemented several hedging strategies in 2019 against "tail risks" or large swings in asset prices in the future. One of the strategies involved hedging against fluctuations of the Indian rupee (INR). If the asset bubble bursts, GAM fund managers expect foreign institutional investors to withdraw from Indian capital markets into U.S. dollars (USD). In April 2019, GAM insured themselves by purchasing equal amounts of 1-year call and put options on USD with strike prices equal to the spot exchange rate. The USD/INR spot exchange rate in April 2019 was Eo = 68.552. Assume that options are traded in single sizes (i.e., each option corresponds to 1 USD). The following table gives option prices with maturity of one year: Base/Quote Currency Strike Price Call Price Put Price USD/INR 68.552 INR 2.7337 INR 1.3673 INR a. (5 Points) Suppose in April 2019 GAM wanted to buy insurance on 10 million USD for 1 year. Describe the portfolio of options using a payoff table in INR. How many call and put options should GAM buy? How much will this hedge cost? b. (5 Points) Suppose GAM also needs to sell 10 million USD for INR on April 2020. Graph the gross payoff of GAM's position in INR plus the portfolio of options. Be sure to mark your y-axis clearly. Payoff in 1 Year EL 18 60 65 70 75 80 85 11 Tail Risk Hedging (10 Points) Fund managers at Greenwoods Asset Management (GAM), a Hong Kong- based hedge fund, believe that the low interest rate environment around the world for the past 10 years has encouraged investors to excessively seek returns in risky assets. GAM managers predict there may be an asset bubble and as a result have implemented several hedging strategies in 2019 against "tail risks" or large swings in asset prices in the future. One of the strategies involved hedging against fluctuations of the Indian rupee (INR). If the asset bubble bursts, GAM fund managers expect foreign institutional investors to withdraw from Indian capital markets into U.S. dollars (USD). In April 2019, GAM insured themselves by purchasing equal amounts of 1-year call and put options on USD with strike prices equal to the spot exchange rate. The USD/INR spot exchange rate in April 2019 was Eo = 68.552. Assume that options are traded in single sizes (i.e., each option corresponds to 1 USD). The following table gives option prices with maturity of one year: Base/Quote Currency Strike Price Call Price Put Price USD/INR 68.552 INR 2.7337 INR 1.3673 INR a. (5 Points) Suppose in April 2019 GAM wanted to buy insurance on 10 million USD for 1 year. Describe the portfolio of options using a payoff table in INR. How many call and put options should GAM buy? How much will this hedge cost? b. (5 Points) Suppose GAM also needs to sell 10 million USD for INR on April 2020. Graph the gross payoff of GAM's position in INR plus the portfolio of options. Be sure to mark your y-axis clearly. Payoff in 1 Year EL 18 60 65 70 75 80 85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts