Question: 11. The forecasting model provided as Exhibit 3 in the online exhibits forecasts that Tesla's operating margin will grow from -5.8% in 2014 to 10.9%

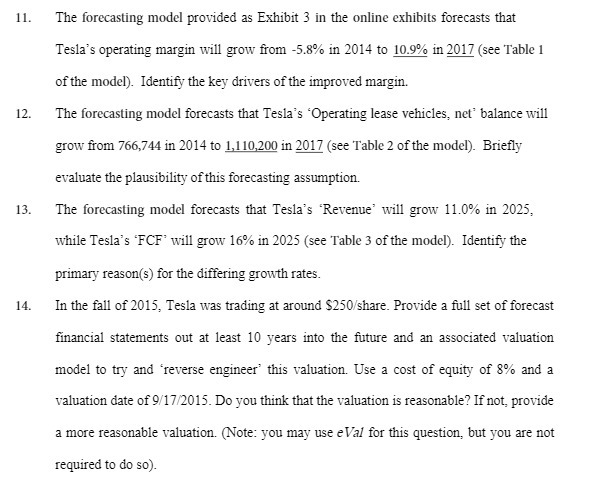

11. The forecasting model provided as Exhibit 3 in the online exhibits forecasts that Tesla's operating margin will grow from -5.8% in 2014 to 10.9% in 2017 (see Table 1 of the model). Identify the key drivers of the improved margin. 12. The forecasting model forecasts that Tesla's 'Operating lease vehicles, net' balance will grow from 766,744 in 2014 to 1,1 10,200 in 2017 (see Table 2 of the model). Briefly evaluate the plausibility of this forecasting assumption. 13. The forecasting model forecasts that Tesla's 'Revenue' will grow 11.0% in 2025, while Tesla's 'FCF' will grow 16% in 2025 (see Table 3 of the model). Identify the primary reason(s) for the differing growth rates. 14. In the fall of 2015, Tesla was trading at around $250/share. Provide a full set of forecast financial statements out at least 10 years into the future and an associated valuation model to try and reverse engineer' this valuation. Use a cost of equity of 8% and a valuation date of 9/17/2015. Do you think that the valuation is reasonable? If not, provide a more reasonable valuation. (Note: you may use eVal for this question, but you are not required to do so)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts