Question: 11. Triangular arbitrage Three currency traders quote the following spot exchange rates: Clotho Lachesis Atropos EUR/USD $1.110 USD/TRY 5.900 EUR/TRY 6.600 a. Which of the

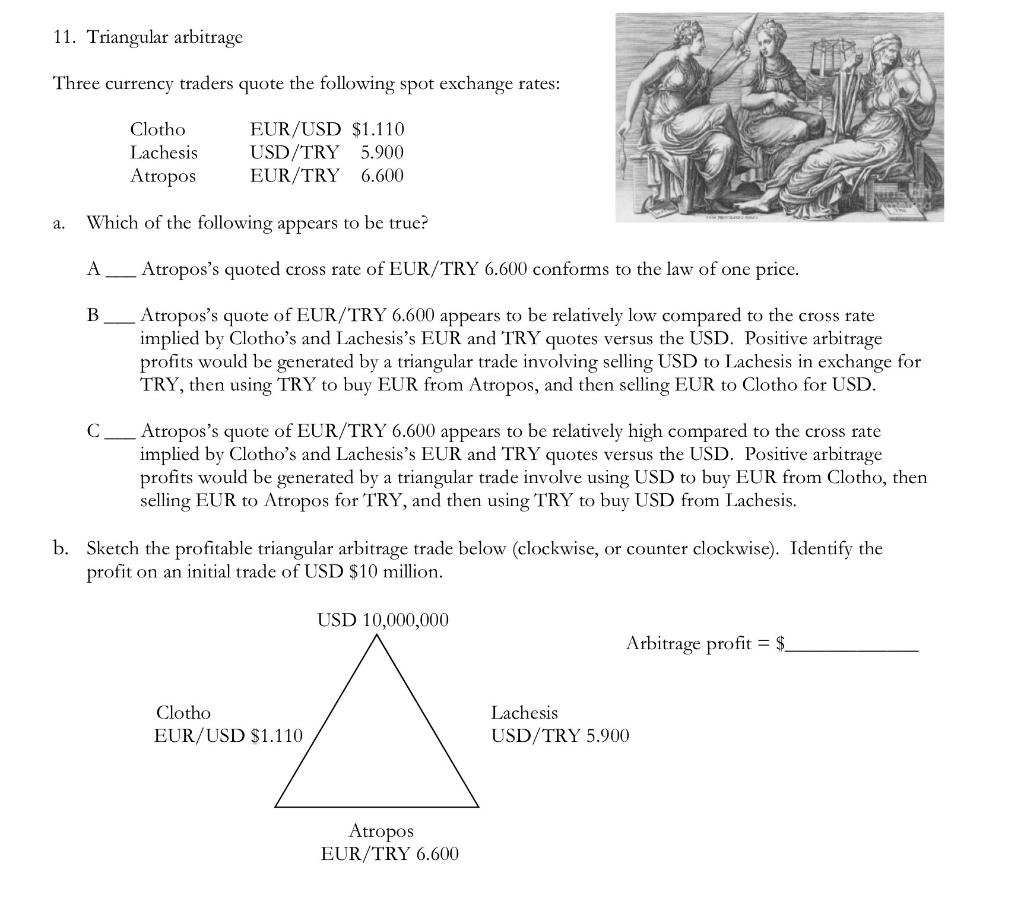

11. Triangular arbitrage Three currency traders quote the following spot exchange rates: Clotho Lachesis Atropos EUR/USD $1.110 USD/TRY 5.900 EUR/TRY 6.600 a. Which of the following appears to be true? A Atropos's quoted cross rate of EUR/TRY 6.600 conforms to the law of one price. B Atropos's quote of EUR/TRY 6.600 appears to be relatively low compared to the cross rate implied by Clotho's and Lachesis's EUR and TRY quotes versus the USD. Positive arbitrage profits would be generated by a triangular trade involving selling USD to Lachesis in exchange for TRY, then using TRY to buy EUR from Atropos, and then selling EUR to Clotho for USD. Atropos's quote of EUR/TRY 6.600 appears to be relatively high compared to the cross rate implied by Clotho's and Lachesis's EUR and TRY quotes versus the USD. Positive arbitrage profits would be generated by a triangular trade involve using USD to buy EUR from Clotho, then selling EUR to Atropos for TRY, and then using TRY to buy USD from Lachesis. b. Sketch the profitable triangular arbitrage trade below (clockwise, or counter clockwise). Identify the profit on an initial trade of USD $10 million. USD 10,000,000 Arbitrage profit = $_ Clotho EUR/USD $1.110 Lachesis USD/TRY 5.900 Atropos EUR/TRY 6.600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts