Question: 11. You are a financial analyst for Zero Plus Inc. The director of capital budgeting has asked you to analyze two proposed capital investments, Projects

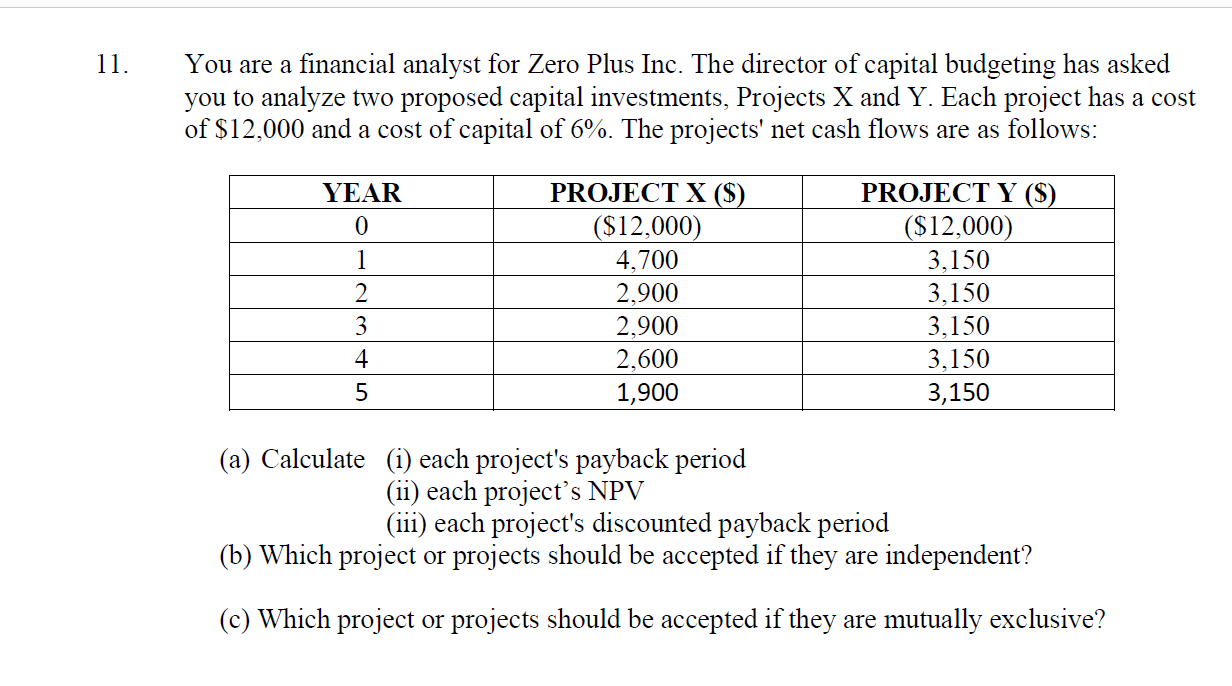

11. You are a financial analyst for Zero Plus Inc. The director of capital budgeting has asked you to analyze two proposed capital investments, Projects X and Y. Each project has a cost of $12,000 and a cost of capital of 6%. The projects' net cash flows are as follows: YEAR 0 1 2 3 4 5 PROJECT X ($) ($12,000) 4,700 2,900 2.900 2,600 1,900 PROJECT Y ($) ($12,000) 3,150 3,150 3,150 3,150 3,150 (a) Calculate (i) each project's payback period (ii) each project's NPV (iii) each project's discounted payback period (b) Which project or projects should be accepted if they are independent? (c) Which project or projects should be accepted if they are mutually exclusive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts