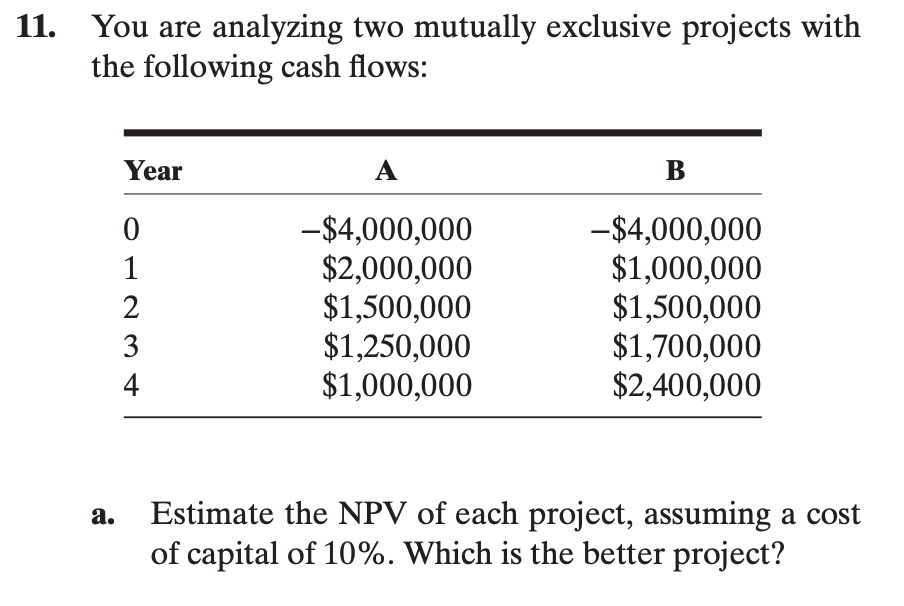

Question: 11. You are analyzing two mutually exclusive projects with the following cash flows: Year A B 0 1 2 3 4 -$4,000,000 $2,000,000 $1,500,000 $1,250,000

11. You are analyzing two mutually exclusive projects with the following cash flows: Year A B 0 1 2 3 4 -$4,000,000 $2,000,000 $1,500,000 $1,250,000 $1,000,000 -$4,000,000 $1,000,000 $1,500,000 $1,700,000 $2,400,000 a. Estimate the NPV of each project, assuming a cost of capital of 10%. Which is the better project? C. b. Estimate the IRR for each project. Which is the bet- ter project? What reinvestment rate assumptions are made by each of these rules? Can you show the effect on fu- ture cash flows of these assumptions? d. What is the MIRR on each of these projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts