Question: [11. You have been informed that the SSH cheque (No. 110463 )received from Mr. Coker was dishonoured Required 3] Update the lm's cash book. b)

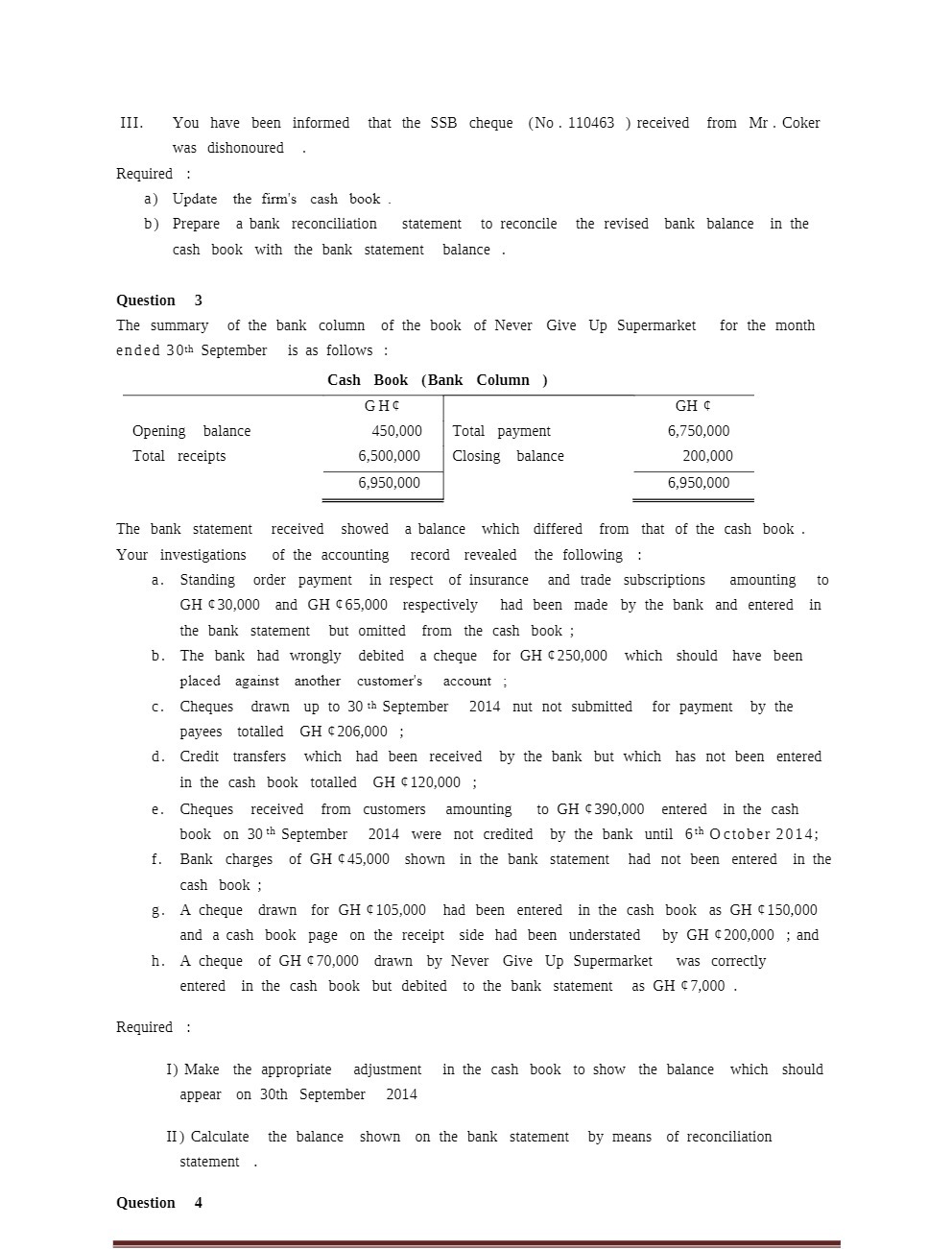

[11. You have been informed that the SSH cheque (No. 110463 )received from Mr. Coker was dishonoured Required 3] Update the lm's cash book. b) Prepare a bank reconciliation statement to reconcile the revised bank balance in the cash book with the bank statement balance . Question 3 The summary of the bank column of the book of Never Give Up Supermarket for the month ended 30th September is as follows : Cash Book (Bank Column ) GH$ GH $ Opening balance 450,000 Total payment 6,750,000 Total receipts 6,500,000 Closing balance 200,000 6,950,000 6,950,000 The banlr statement received showed a balance which differed from that of the cash book. Your investigations of the accounting record revealed the following a. Standing order payment in respect of insurance and trade subscriptions amounting to GH $30,000 and GH $65,000 respectively had been made by the bank and entered in the bank statement but omitted from the cash book ,' b. The bank had wrongly debited a cheque for CH $250,000 which should have been placed against another customer's account ; c. Cheques drawn up to 30th September 2014 nut not submitted for payment by the payees totalled GH $206,000 ; (1. Credit transfers which had been received by the bank but which has not been entered in the cash book totalled GH $120,000 ; e. Cheques received from customers amounting to GH $390,000 entered in the cash book on 30'-h September 201-11 were not credited by the bank until '6'II October 2014; f. Bank charges of GH $45,000 shown in the bank statement had not been entered in the cash book ; g. A cheque drawn for GH$105,000 had been entered in the cash book as GH $150,000 and a cash book page on the receipt side had been understated by GH $200,000 ;and h. A cheque of GH $7'0,000 drawn by Never Give Up Supermarket was correctly entered in the cash book but debited to the bank statement as GH $7,000 . Required I) Mal-re the appropriate adjushnent in the cash book to show the balance which should appear on 30th September 2014 ll) Calculate the balance shown on the bank statement by means of reconciliation statement Question 4