Question: 11. You would like to develop an office building. Your analysts forecast that it will cost you $1,000,000 immediately time 0), and it will cost

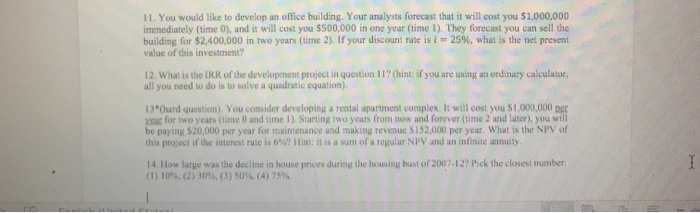

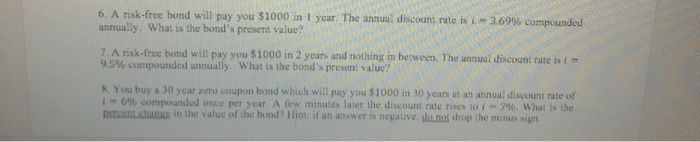

11. You would like to develop an office building. Your analysts forecast that it will cost you $1,000,000 immediately time 0), and it will cost you 5500,000 in one year (time 1). They forecast you can sell the building for $2,400,000 in two yeurs (time 2). If your discount rate is 25%, what is the net present value of this investment? 12. What is the IRR of the development project in question 11? (hint: if you are using an ordinary calculator, all you need to do is to solve a quadratic equation). 13"chard question). You consider developing a rental apartment complex. It will cost you $1,000,000 per year for two years time and time 1). Starting two years from now and forever (time 2 and later), you will be paying $20,000 per year for maintenance and making revenue $152,000 per year. What is the NPV of this project if the interest rate is 6%? Hint: it is a sum of a regular NPV and an infinite annuity 14. How large was the decline in house prices during the housing bust of 2007-12 Pick the closest number: (1) 10%, (2) 30%, (3) 50% (4) 75% 6. A risk-free bond will puy you $1000 in 1 year. The annual discount rate is -3.699 compounded annually. What is the bond's present value? 7. A risk-free bond will pay you 51000 in 2 years and nothing in between. The annual discount rate is - 9.5% compounded anmually. What is the bond's present value X. You buy a 30 yeater coupon bond which will pay you $1000 in 30 years at an annual discount rate of 1 - 6% compounded once per year. A few minutes later the discount rate rises to I-796. What is the Det hans in the value of the bond lint: if an answer is negative, do nos drop the minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts