Question: + 110% Questions 4 and 5. BioTech Tools, Inc. Dylan Hamilton, CFO of a medical device manufacturer, BioTech Tools, Inc., was approached by a Japanese

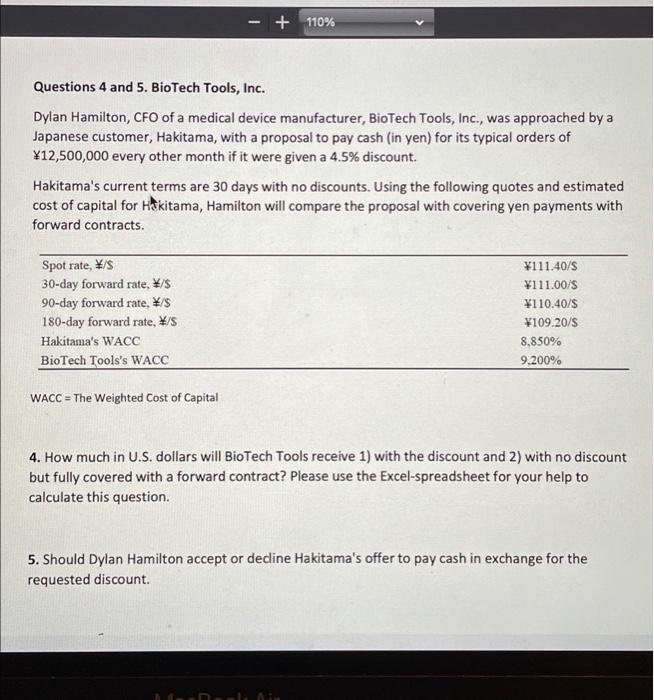

+ 110% Questions 4 and 5. BioTech Tools, Inc. Dylan Hamilton, CFO of a medical device manufacturer, BioTech Tools, Inc., was approached by a Japanese customer, Hakitama, with a proposal to pay cash (in yen) for its typical orders of 12,500,000 every other month if it were given a 4.5% discount. Hakitama's current terms are 30 days with no discounts. Using the following quotes and estimated cost of capital for hokitama, Hamilton will compare the proposal with covering yen payments with forward contracts. Spot rate, W/$ 30-day forward rate, \/$ 90-day forward rate, W/S 180-day forward rate, W/S Hakitama's WACC BioTech Tools's WACC 111.40/8 111.00/5 110.40/5 109.20/5 8.850% 9.200% WACC = The Weighted Cost of Capital 4. How much in U.S. dollars will BioTech Tools receive 1) with the discount and 2) with no discount but fully covered with a forward contract? Please use the Excel-spreadsheet for your help to calculate this question. 5. Should Dylan Hamilton accept or decline Hakitama's offer to pay cash in exchange for the requested discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts