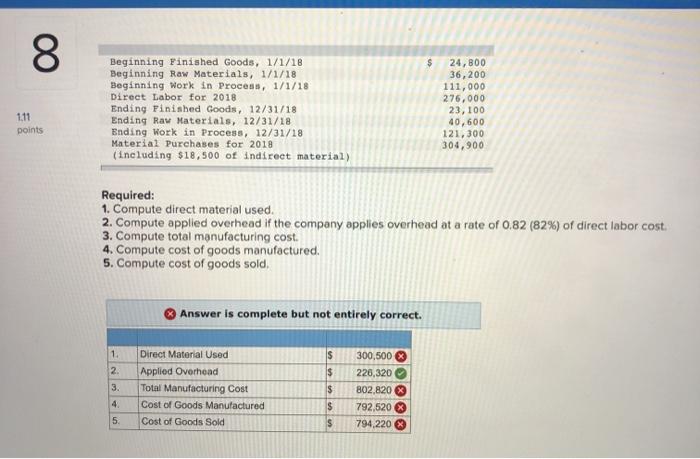

Question: 1.11 8 00 points Beginning Finished Goods, 1/1/18 Beginning Raw Materials, 1/1/18 Beginning Work in Process, 1/1/18 Direct Labor for 2018 Ending Finished Goods,

1.11 8 00 points Beginning Finished Goods, 1/1/18 Beginning Raw Materials, 1/1/18 Beginning Work in Process, 1/1/18 Direct Labor for 2018 Ending Finished Goods, 12/31/18 Ending Raw Materials, 12/31/18 Ending Work in Process, 12/31/18 Material Purchases for 2018 $ 24,800 36,200 111,000 276,000 23,100 40,600 121,300 304,900 (including $18,500 of indirect material) Required: 1. Compute direct material used. 2. Compute applied overhead if the company applies overhead at a rate of 0.82 (82%) of direct labor cost. 3. Compute total manufacturing cost. 4. Compute cost of goods manufactured. 5. Compute cost of goods sold. Answer is complete but not entirely correct. 1. Direct Material Used $ 300,500 2. Applied Overhead $ 220,320 3. Total Manufacturing Cost $ 802,820 4. Cost of Goods Manufactured $ 792,520 5. Cost of Goods Sold S 794,220

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts