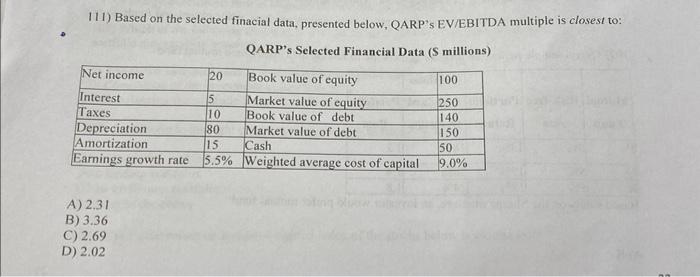

Question: 111) Based on the selected finacial data, presented below, QARP's EV/EBITDA multiple is closest to: QARP's Selected Financial Data (S millions) 112) Financial analyst uses

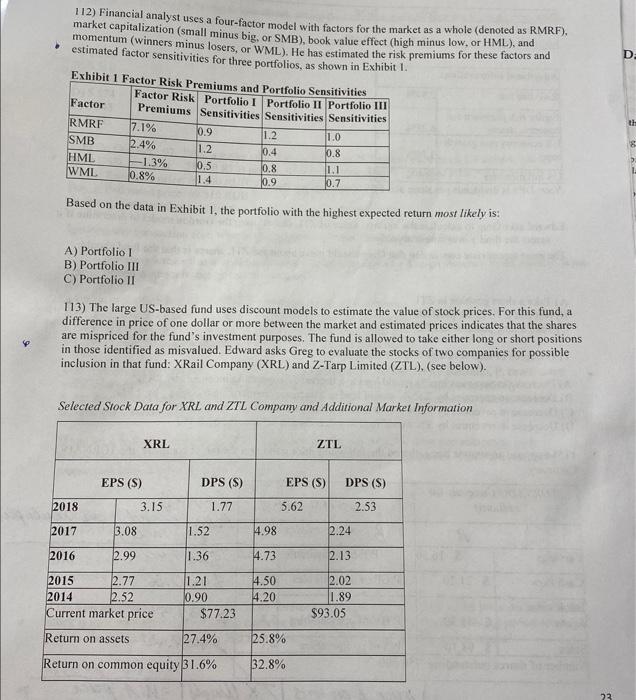

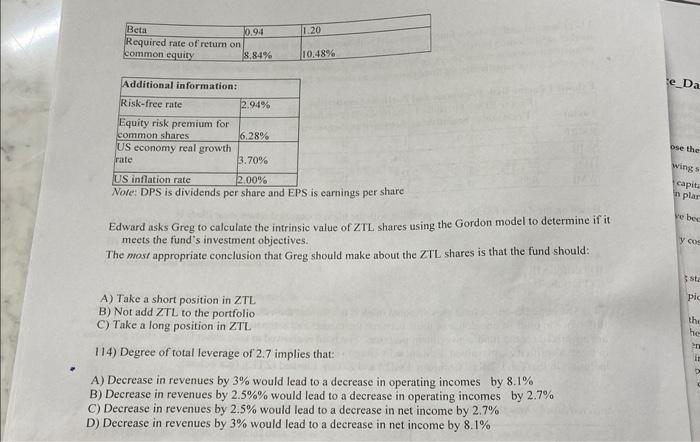

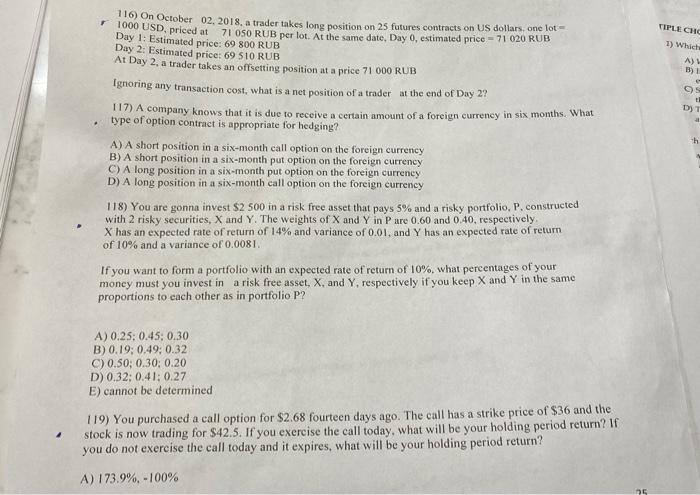

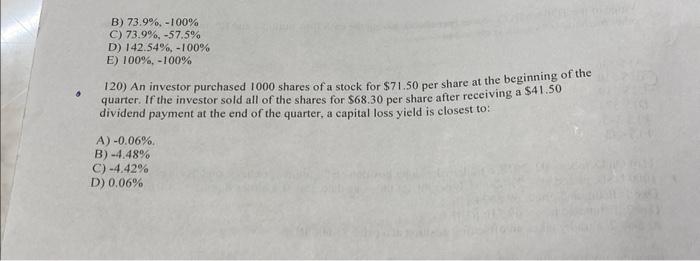

111) Based on the selected finacial data, presented below, QARP's EV/EBITDA multiple is closest to: QARP's Selected Financial Data (S millions) 112) Financial analyst uses a four-factor model with factors for the market as a whole (denoted as RMRF). market capitalization (small minus big, or SMB), book value effect (high minus low, or HML), and momentum (winners minus losers, or WML). He has estimated the risk premiums for these factors and estimated factor sensitivities for three portfolios, as shown in Exhibit. 1 . Based on the data in Exhibit 1, the portfolio with the highest expected return most likely is: A) Portfolio I B) Portfolio III C) Portfolio II 113) The large US-based fund uses discount models to estimate the value of stock prices. For this fund, a difference in price of one dollar or more between the market and estimated prices indicates that the shares are mispriced for the fund's investment purposes. The fund is allowed to take either long or short positions in those identified as misvalued. Edward asks Greg to evaluate the stocks of two companies for possible inclusion in that fund: XRail Company (XRL) and Z-Tarp Limited (ZTL), (see below). Nove: DPS is drvidends per share and EPS is earnings per share Edward asks Greg to calculate the intrinsic value of ZIL shares using the Gordon model to determine if it meets the fund's investment objectives. The most appropriate conclusion that Greg should make about the ZTL shares is that the fund should: A) Take a short position in ZTL B) Not add ZTL to the portfolio C) Take a long position in ZTL 114) Degree of total leverage of 2.7 implies that: A) Decrease in revenues by 3% would lead to a decrease in operating incomes by 8.1% B) Decrease in revenues by 2.5%% would lead to a decrease in operating incomes by 2.7% C) Decrease in revenues by 2.5% would lead to a decrease in net income by 2.7% D) Decrease in revenues by 3% would lead to a decrease in net income by 8.1% 116) On October 02,2018 , a trader takes long position on 25 futures contracts on US dollars, one lot = 1000 USD, priced at 71050 RUB per lot. At the same date, Day 0 , estimated price =71020 RUB Day 1: Estimated price: 69800 RUB Day 2: Estimated price: 69510 RUB At Day 2, a trader takes an offsetting position at a price 71000 RUB Igrioring any transaction cost, what is a net position of a trader at the end of Day 2 ? 117) A company knows that it is due to receive a certain amount of a foreign currency in six months. What type of option contract is appropriate for hedging? A) A short position in a six-month call option on the foreign currency B) A short position in a six-month put option on the foreign currency C) A long position in a six-month put option on the foreign currency D) A long position in a six-month call option on the foreign currency 118) You are gonna invest $2500 in a risk free asset that pays 5% and a risky portfolio, P, constructed with 2 risky securities, X and Y. The weights of X and Y in P are 0.60 and 0.40 , respectively. X has an expected rate of return of 14% and variance of 0.01 , and Y has an expected rate of return of 10% and a variance of 0.0081 . If you want to form a portfolio with an expected rate of return of 10%, what percentages of your money must you invest in a risk free asset, X, and Y, respectively if you keep X and Y in the same proportions to each other as in portfolio P? A) 0.25;0.45;0.30 B) 0.19;0.49;0.32 C) 0.50;0.30;0.20 D) 0.32;0.41;0.27 E) cannot be determined 119) You purchased a call option for $2.68 fourteen days ago. The call has a strike price of $36 and the stock is now trading for $42.5. If you exereise the call today, what will be your holding period return? If you do not exercise the call today and it expires, what will be your holding period return? A) 173.9%,100% B) 73.9%,100% C) 73.9%,57.5% D) 142.54%,100% E) 100%,100% 120) An investor purchased 1000 shares of a stock for $71.50 per share at the beginning of the quarter. If the investor sold all of the shares for $68.30 per share after receiving a $41.50 dividend payment at the end of the quarter, a capital loss yield is closest to: A) 0.06% B) 4.48% C) 4.42% D) 0.06%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts