Question: 11-1 Practice Exercises 27 Required information State and Local Tax Saved 1.5 points eBook Print G's Kitchen, Inc. (GK, Inc.) has been crafting fine

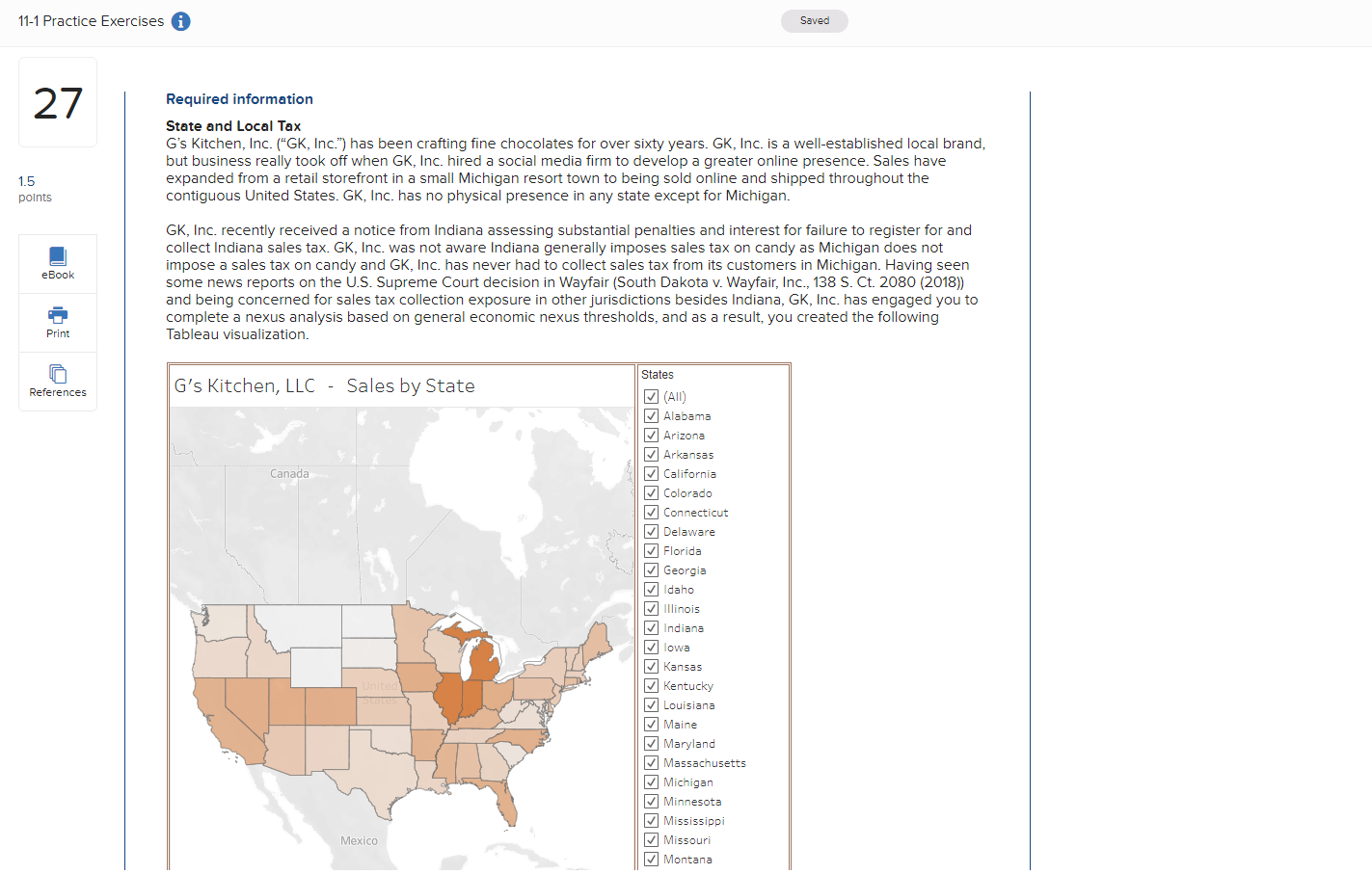

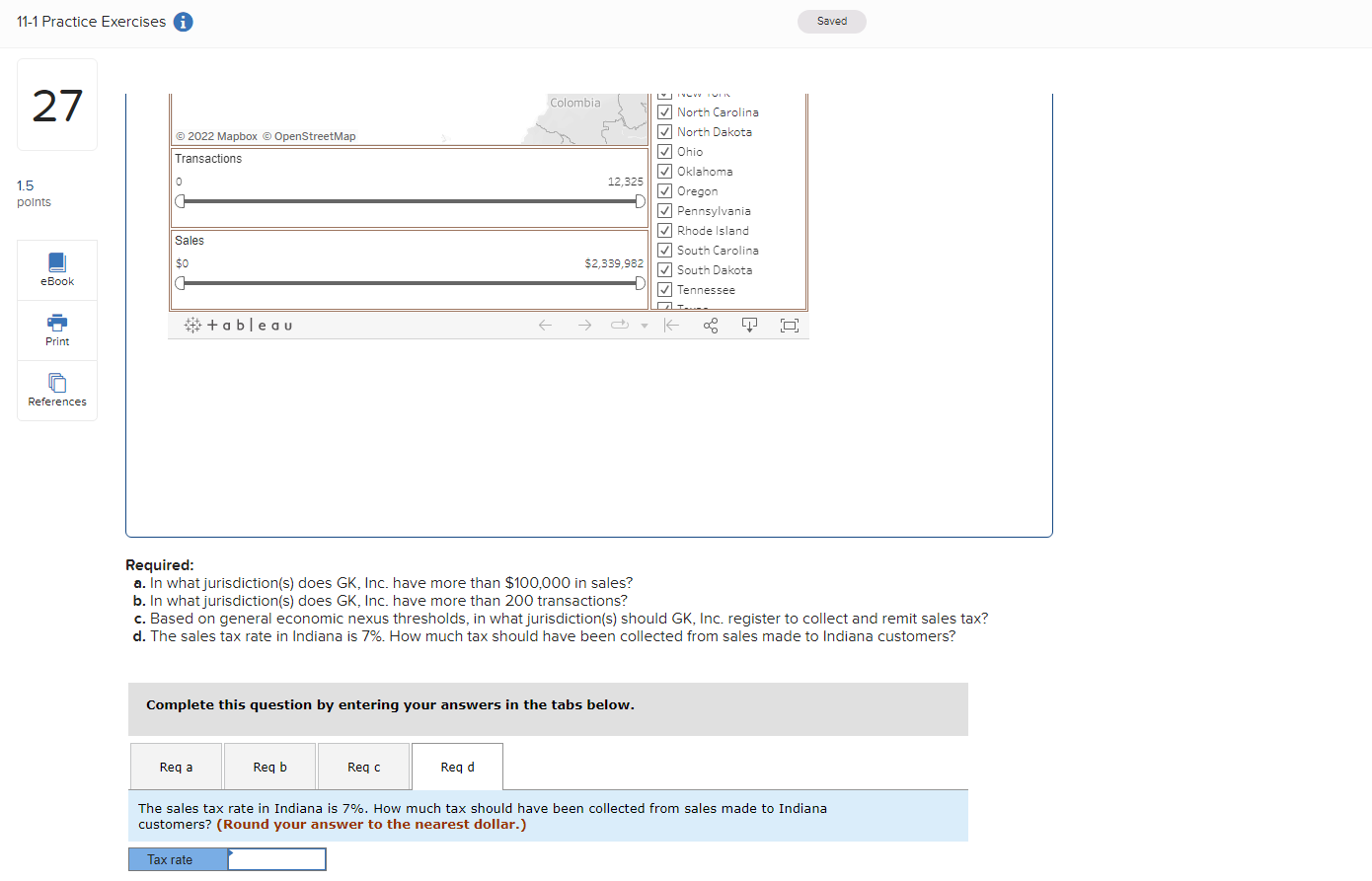

11-1 Practice Exercises 27 Required information State and Local Tax Saved 1.5 points eBook Print G's Kitchen, Inc. ("GK, Inc.") has been crafting fine chocolates for over sixty years. GK, Inc. is a well-established local brand, but business really took off when GK, Inc. hired a social media firm to develop a greater online presence. Sales have expanded from a retail storefront in a small Michigan resort town to being sold online and shipped throughout the contiguous United States. GK, Inc. has no physical presence in any state except for Michigan. GK, Inc. recently received a notice from Indiana assessing substantial penalties and interest for failure to register for and collect Indiana sales tax. GK, Inc. was not aware Indiana generally imposes sales tax on candy as Michigan does not impose a sales tax on candy and GK, Inc. has never had to collect sales tax from its customers in Michigan. Having seen some news reports on the U.S. Supreme Court decision in Wayfair (South Dakota v. Wayfair, Inc., 138 S. Ct. 2080 (2018)) and being concerned for sales tax collection exposure in other jurisdictions besides Indiana, GK, Inc. has engaged you to complete a nexus analysis based on general economic nexus thresholds, and as a result, you created the following Tableau visualization. References G's Kitchen, LLC Sales by State Canada States (All) Alabama Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Idaho Illinois Indiana Iowa Kansas United States Mexico Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts