Question: 11-1 Practice Exercises Saved 14 ! Required information Part 1 of 3 [The following information applies to the questions displayed below.] Delicious Dave's Maple

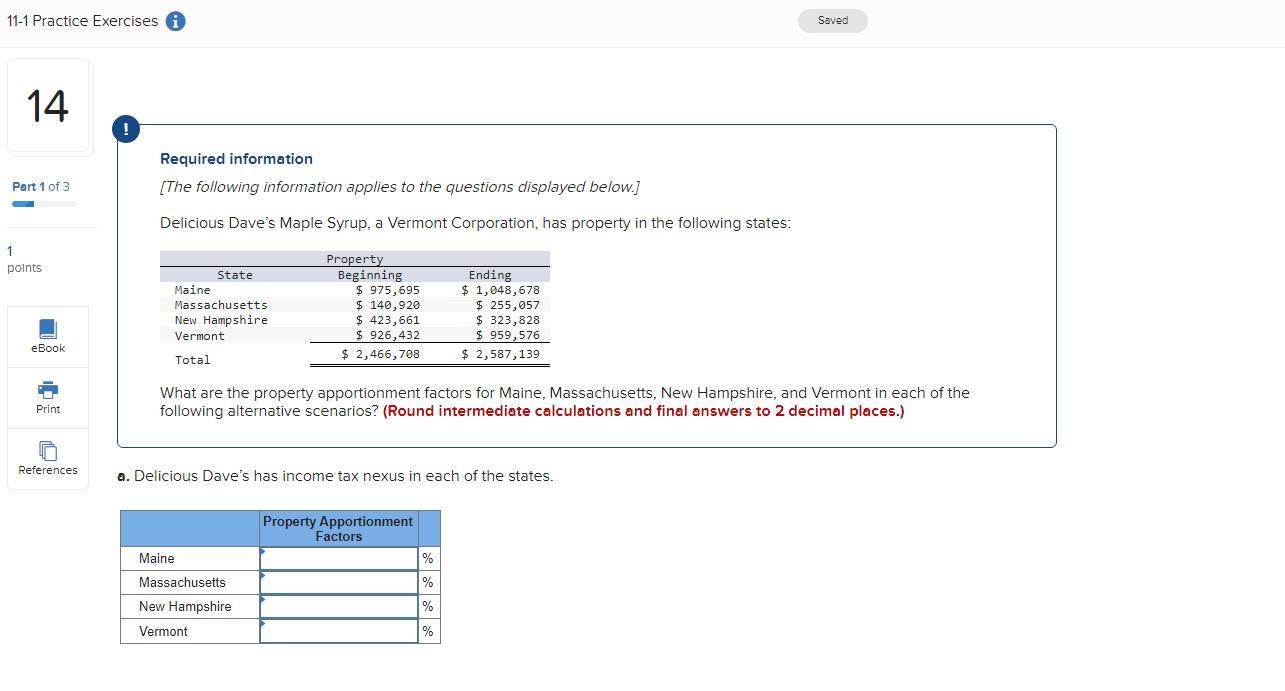

11-1 Practice Exercises Saved 14 ! Required information Part 1 of 3 [The following information applies to the questions displayed below.] Delicious Dave's Maple Syrup, a Vermont Corporation, has property in the following states: 1 Property Beginning $ 975,695 $ 140,920 $ 423,661 $ 926,432 polnts State Ending $ 1,048,678 $ 255,057 $ 323,828 $ 959,576 $ 2,587,139 Maine Massachusetts New Hampshire Vermont ook Total $ 2,466,708 What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont in each of the following alternative scenarios? (Round intermediate calculations and final answers to 2 decimal places.) Print References a. Delicious Dave's has income tax nexus in each of the states. Property Apportionment Factors Maine % % % Massachusetts New Hampshire Vermont %

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

a Beginning Ending Average Total average Property apporti... View full answer

Get step-by-step solutions from verified subject matter experts