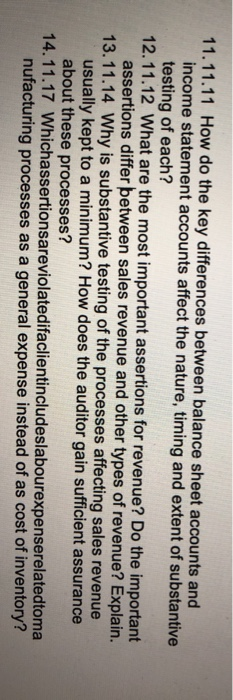

Question: 11.11.11 How do the key differences between balance sheet accounts and income statement accounts affect the nature, timing and extent of substantive testing of each?

11.11.11 How do the key differences between balance sheet accounts and income statement accounts affect the nature, timing and extent of substantive testing of each? 12.11.12 What are the most important assertions for revenue? Do the important assertions differ etween sales revenue and other types of revenue? Explain. 13.11.14 Why is substantive testing of the processes affecting sales revenue usually kept to a minimum? How does the auditor gain sufficient assurance about these processes? 14.11.17 Whichassertionsareviolatedifaclientincludeslabourexpenserelatedtoma nufacturing processes as a general expense instead of as cost of inventory? 11.11.11 How do the key differences between balance sheet accounts and income statement accounts affect the nature, timing and extent of substantive testing of each? 12.11.12 What are the most important assertions for revenue? Do the important assertions differ etween sales revenue and other types of revenue? Explain. 13.11.14 Why is substantive testing of the processes affecting sales revenue usually kept to a minimum? How does the auditor gain sufficient assurance about these processes? 14.11.17 Whichassertionsareviolatedifaclientincludeslabourexpenserelatedtoma nufacturing processes as a general expense instead of as cost of inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts