Question: 1)1120S: https://www.irs.gov/pub/irs-pdf/f1120s.pdf 2)1120S Schedule D: https://www.irs.gov/pub/irs-pdf/f1120ssd.pdf 3)1120S Schedule K-1(2): https://www.irs.gov/pub/irs-pdf/f1120ssk.pdf 4)4797: https://www.irs.gov/pub/irs-pdf/f4797.pdf 5)1125-A: https://www.irs.gov/pub/irs-pdf/f1125a.pdf 6)1125-E: https://www.irs.gov/pub/irs-pdf/f1125e.pdf 7)4562: https://www.irs.gov/pub/irs-pdf/f4562.pdf 8)4684: https://www.irs.gov/pub/irs-pdf/f4684.pdf Can you fill this forms

1)1120S:

https://www.irs.gov/pub/irs-pdf/f1120s.pdf

2)1120S Schedule D:

https://www.irs.gov/pub/irs-pdf/f1120ssd.pdf

3)1120S Schedule K-1(2):

https://www.irs.gov/pub/irs-pdf/f1120ssk.pdf

4)4797:

https://www.irs.gov/pub/irs-pdf/f4797.pdf

5)1125-A:

https://www.irs.gov/pub/irs-pdf/f1125a.pdf

6)1125-E:

https://www.irs.gov/pub/irs-pdf/f1125e.pdf

7)4562:

https://www.irs.gov/pub/irs-pdf/f4562.pdf

8)4684:

https://www.irs.gov/pub/irs-pdf/f4684.pdf

Can you fill this forms using the following information:

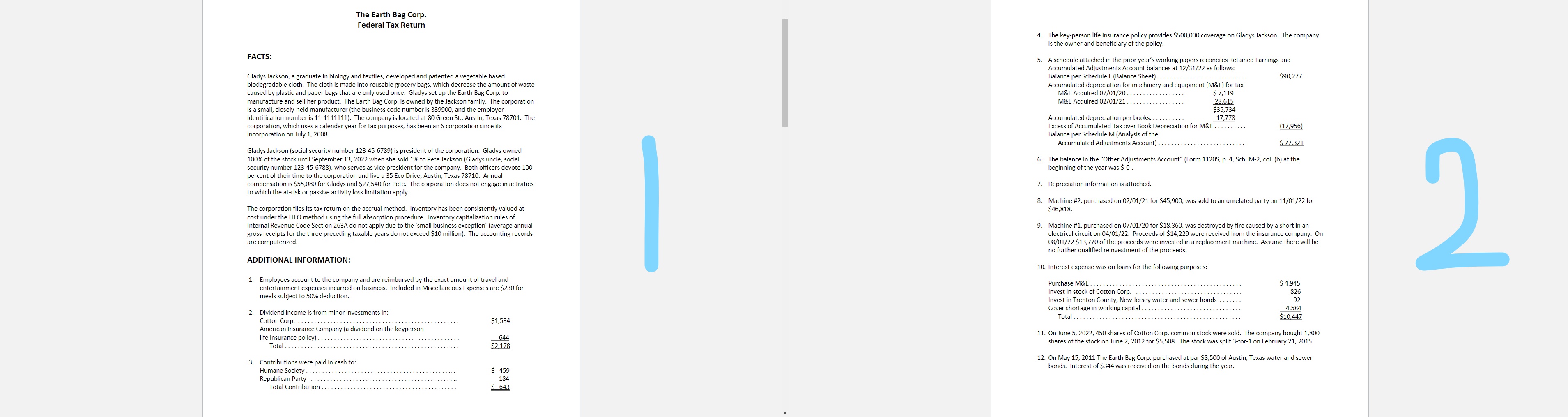

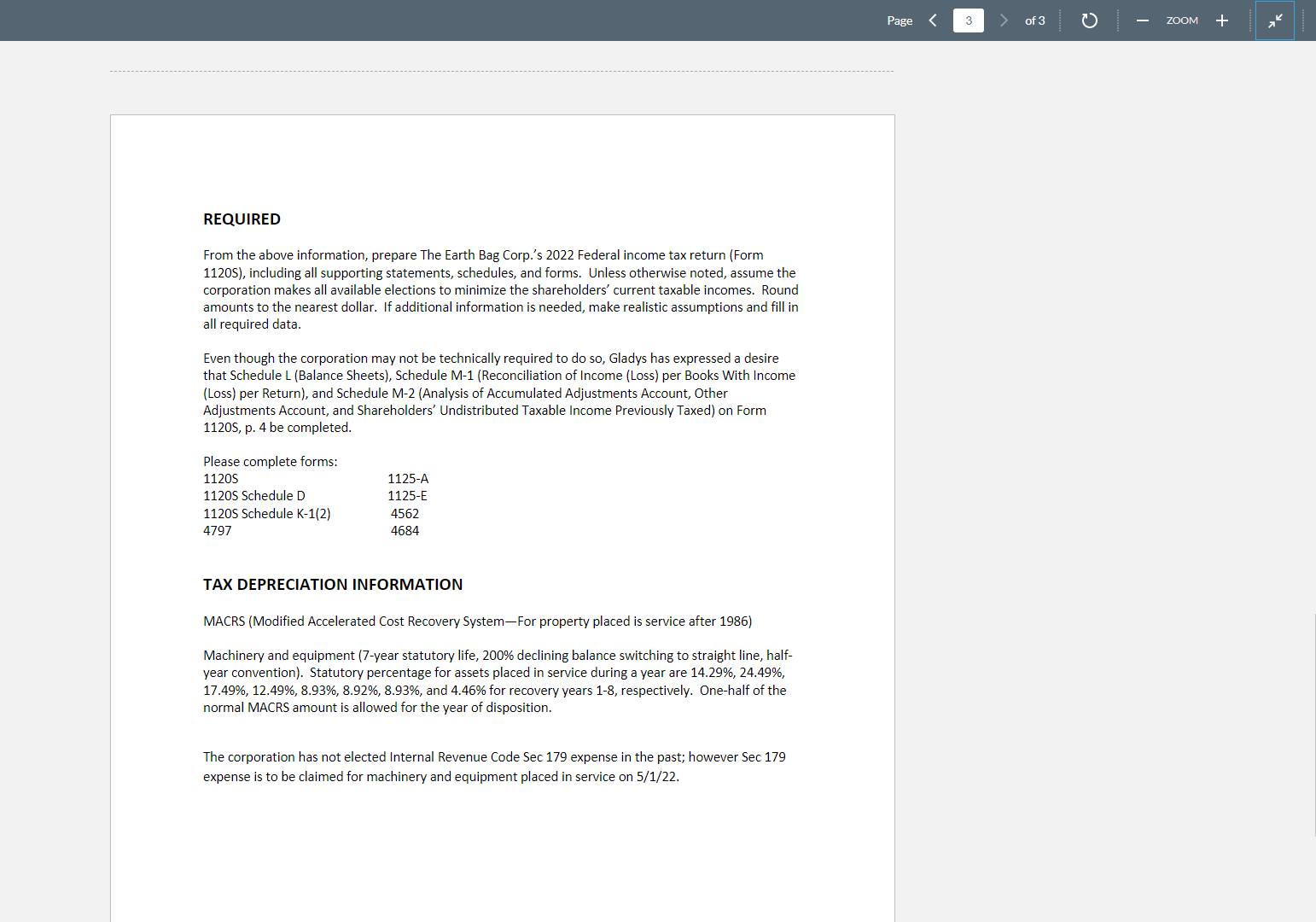

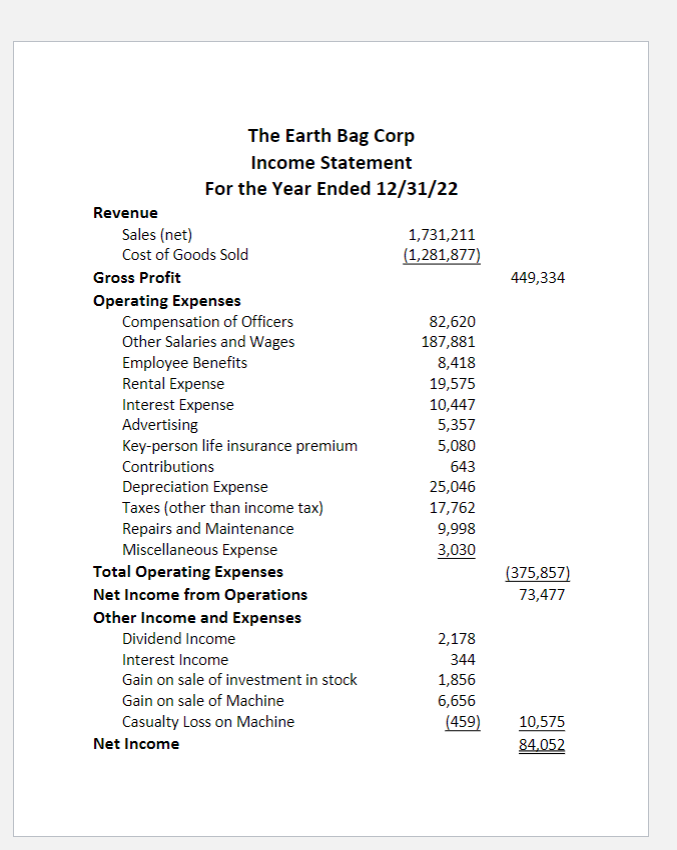

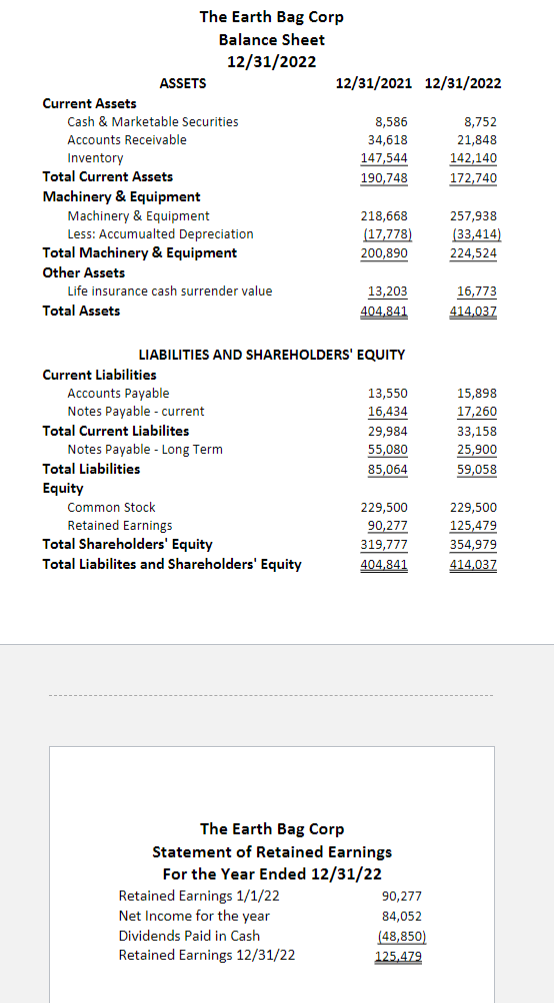

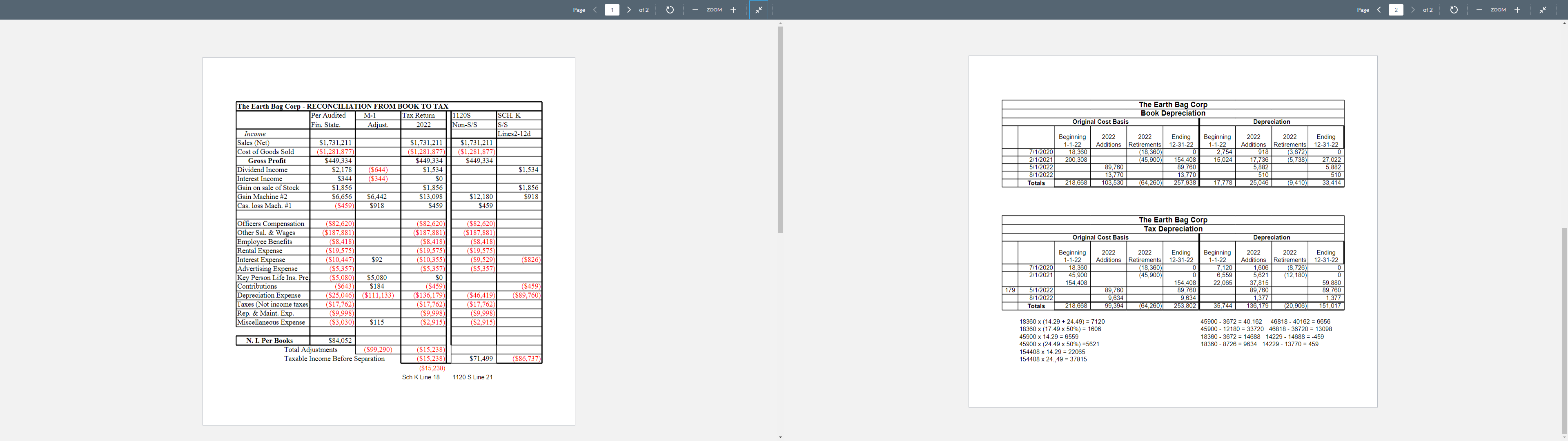

The Earth Bag Corp. Federal Tax Return 4. The key-person life insurance policy provides $500,000 coverage on Gladys Jackson. The company is the owner and beneficiary of the policy. FACTS: A schedule attached in the prior year's wo prior year's working papers reconciles Retained Earnings and Accumulated Adjustments Account balances at 12/31/22 as follows: ys Jackson, a graduate in biology and textiles, developed and patented a vegetable based Balance per Schedule L (Balance Sheet) ... $90,277 biodegradable cloth. The cloth is made into reusable grocery bags, which decrease the amount of waste cumulated depreciation for machinery and equipment (M&E) for tax caused by plastic and paper bags that are only used once. Gladys set up the ForhostThe co Mat Acquired 07/01/20 ... .. . .. . . . ....... $ 7,119 hall, closely-held manufacturer (the business code number is 320 son ,family: The corporation M&E Acquired 02/01/21 . ..... .. . . . .. . .... 28,615 535 73 identification number is 11-1111111). The company is located at 80 G The company is located at 80 Green St., Austin, Texas 78701. The Accumulated depreciation per books. . . . ... . 17,778 corporation, which uses a calendar year for tax purposes, has been an S corporation since its Accumulated Tax over Book Depreciation for M&E .......... (17,956) incorporation on July 1, 2008. Balance per Schedule M (Analysis of the Accumulated Adjustments Account) .. $ 72.321 Gladys Jackson (social security number 123-45-6789) is president of the corporation. Gladys owned 100% of the stock until September 13, 2022 when she sold 1% to Pete Jackson (Gladys uncle, social 6. The balance in the "Other Adjustments Account" (Form 11205, p. 4, Sch. M-2, col. (b) at the number 123-45-6788), who serves as vice president for the company. Both officers devote 100 beginning of the year was $-0-. percent of their time to the corporation and live a 35 Eco Drive, Austin, Texas 78710. Annual compensation is $55,080 for Gladys and $27,540 for Pete. The corporation does not engage in activities . Depreciation information is attached to which the at-risk or passive activity loss limitation apply. B. Machine #2, purchased on 02/01/21 for $45,900, was sold to an unrelated party on 11/01/22 for The corporation files its tax return on the accrual method. Inventory has been consistently valued at $46,818. cost under the FIFO method using the full absorption procedure. Inventory capitalization rules of Internal Revenue Code Section 263A do not apply due to the 'small business exception' (average annual 9. Machine #1, purchased on 07/01/20 for $18,360, was destroyed by fire caused by a short in an gross receipts for the three preceding taxable years do not exceed $10 million). The accounting records electrical circuit on 04/01/22. Proceeds of $14,229 were received from the insurance company. On are computerized. 08/01/22 $13,770 of the proceeds were invested in a replacement machine. Assume there will be no further qualified reinvestment of the proceeds. 2 ADDITIONAL INFORMATION: 10. Interest expense was on loans for the following purposes: 1. Employees account to the company and are reimbursed by the exact amount of travel and entertainment expenses incurred on business. Included in Miscellaneous Expenses are $230 for Purchase M&E ....... . . ....... Invest in stock of Cotton Corp. $ 4,945 meals subject to 50% deduction. Invest in Trenton County, New Jersey water and sewer bonds . 826 Cover shortage in working capital . . .... . .... . 4,584 2. Dividend income is from minor investments in: $10.447 Cotton Corp. .. $1,534 Total ... . . . . .... American Insurance Company (a dividend on the keyperson ife insurance policy) . .... .. .. ........................... 11. On June 5, 2022, 450 shares of Cotton Corp. common stock were sold. The company bought 1,800 644 Total .. . . . . . . . . ......... $2.178 shares of the stock on June 2, 2012 for $5,508. The stock was split 3-for-1 on February 21, 2015. 3. Contributions were paid in cash to: 2. On May 15, 2011 The Earth Bag Corp. purchased at par $8,500 of Austin, Texas water and sewer Humane Society . . . bonds. Interest of $344 was received on the bonds during the year. Republican Party 184 Total Contribution ... .. . . . . . . . . . . . . .........................REQUIRED From the above information, prepare The Earth Bag Corpfs 2022 Federal income tax return [Form 11205), including all supporting statements, schedules, and forms. Unless otherwise noted, assume the corporation makes all available elections to minimize the shareholders' current taxable incomes. Round amounts to the nearest dollar. If additional information is needed, make realistic assumptions and fill in all required data. Even though the corporation may not be technically required to do so, Gladys has expressed a desire that Schedule L (Balance Sheets], Schedule M71 {Reconciliation of income [Loss) per Books With Income (Loss) per Return), and Schedule M-2 (Analysis of Accumulated Adjustments Account, Other Adjustments Account, and Shareholders' Undistributed Taxable Income Previously Taxed) on Form 11205, p. 4 be completed. Please complete forms: 11205 1125-A 11205 Schedule D 1125-E 11205 Schedule K71EZ) 4562 4797 4634 TAX DEPRECIATION INFORMATION MACRS (Mod itied Accelerated Cost Recovery SystemiFor property placed is service after 1986] Machinery and equipment (7ayear statutory life, 200% declining balance switching to straight line, half, year convention). Statutory percentage for assets placed in service during a year are 14.29%, 24.49%, 17.49%, 12.49%, 8.93%, 8.92%, 8.93%, and 4.46% tor recovery years 1-8, respectively. One-halt of the normal MACRS amount is allowed for the year of disposition. The corporation has not elected Internal Revenue Code Sec 179 expense in the past; however Sec 179 expense is to be claimed for machinery and equipment placed in service on 5/11'22. Page of2 0 ZOOM Page of2 0 ZOOM The Earth Bag Corp - RECONCILIATION FROM BOOK TO TAX The Earth Bag Corp Per Audited M-1 Tax Return 11205 SCH. K Book Depreciation Fin. State. Adjust. 2022 on-S/ Original Cost Basis Depreciation Income Lines2-12d Beginning 2022 2022 Ending Beginning 2022 2022 Ending Sales (Net) 1,731,211 1-1-22 Cost of Goods Sold 1.281.877 18 360 Additions Retirements 12-31-22 itions Retirements 12-31-22 1-1-22 Additions (31,261,677) ($1,281,877) 7/1/2020 2 754 Gross Profit $449.554 $449,534 $449,334 2/1/2021 18,360 200,308 (45.900) 154,408 15.024 17 736 (5,738) 27.022 Dividend Income ($644) $1,534 89,760 89 760 5.882 5 882 Interest Income $344 ($344) SO 8/1/2022 Gain on sale of Stock $1,856 $1,856 $1,856 Totals 218.668 103,530 (64.260) 257,938 17 778 25.046 (9,410 33,414 Gain Machine #2 $6,656 $6,442 $13,098 $12,180 $918 Cas. loss Mach. #1 ($459) $918 $459 $459 Officers Compensation The Earth Bag Corp Other Sal. & Wages $187,88 ($187,881) Tax Depreciation Employee Benefits ($8,418) ($8.418) (S& 418 ) Original Cost Basis Depreciation Rental Expense ($19.575) ($19 575) 2022 ($10,355) Ending Interest Expense ($10.447) Beginning 2022 2022 $92 ($9,529) ($826) 1-1-22 2022 Retirements 12-31-22 Advertising Expense ($5,357 ($5.357) ($5.357 18.360 Additions Retirement 7/1/2020 7.120 Addition $5.080 2/1/2021 (45.900) (8,726) 6 559 (12.180) Key Person Life Ins. Pre Contributions $184 ($459) ($459) 154,408 22,065 37.815 ($111,133) ($89,760) 179 5/1/2022 9,760 89,760 Depreciation Expense ($17. 762 (6136.179) 8/1/2022 9.634 9 634 1,377 Taxes (Not income taxes ($17,762) Totals 218,668 99 394 (4,260) 253,802 35,744 1 Maint. Exp. ($9,998) ($9.998) ($9,998) 136,179 (20 906) 151,017 Miscellaneous Expense ($3,030) $115 ($2.915) ($2,915) 18360 x (14.29 + 24.49) = 7120 45900 - 3672 = 40.162 46818 - 40162 = 6656 18560 *(17.48 X 5076) = 1606 167 20 - 18090 N. I. Per Books $84,052 45900 X (24 49 x 50%) = 18360 - 8726 = 9634 14229 - 13770 = 459 Total Adjustments ($99,290) 516 738) 154408 x 14.29 = 22065 Taxable Income Before Separation $71,499 ($86,737 ) 154408 x 24.,49 = 37815 ($15,238) Sch K Line 18 1120 S Line 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts