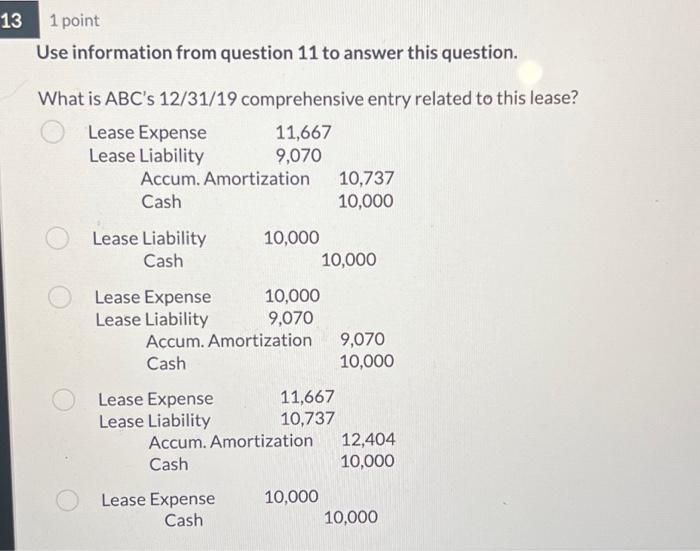

Question: 11-14 Use information from question 11 to answer this question. What is ABC 's 12/31/19 comprehensive entry related to this lease 1 point Use information

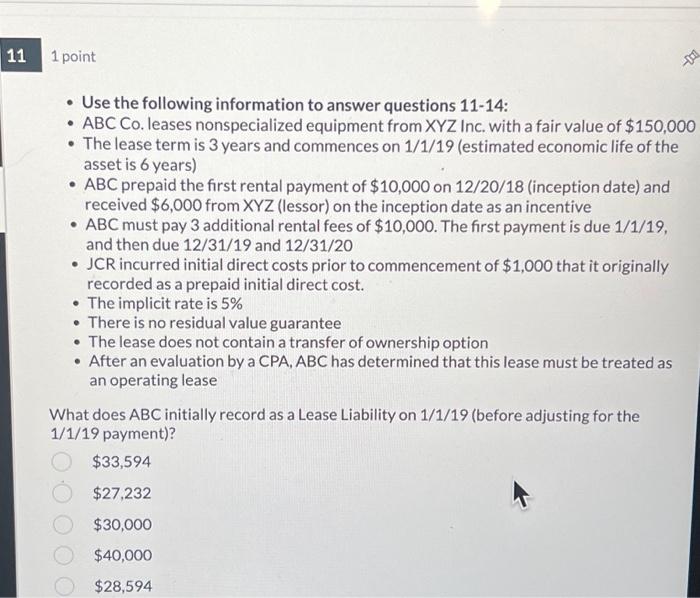

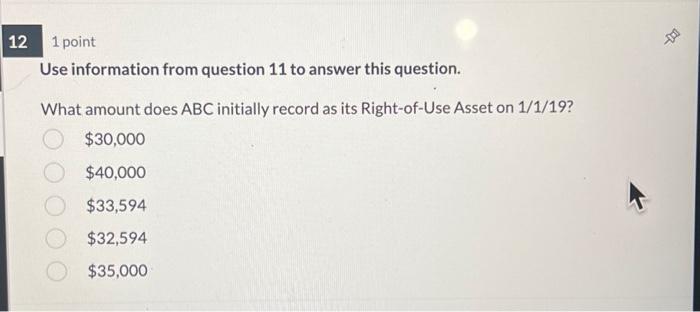

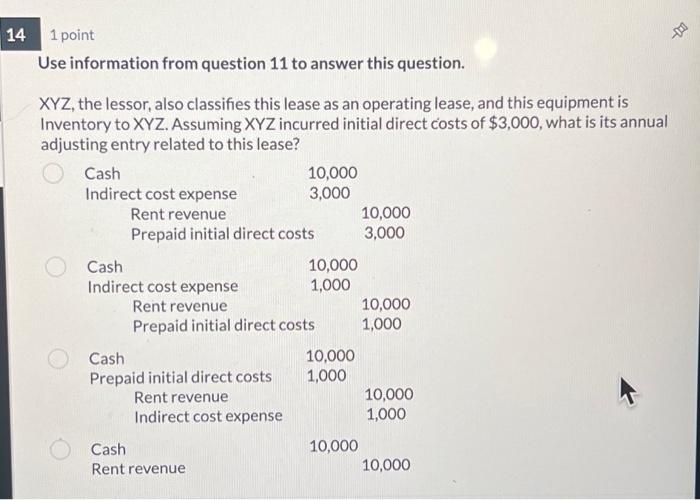

Use information from question 11 to answer this question. What is ABC 's 12/31/19 comprehensive entry related to this lease 1 point Use information from question 11 to answer this question. What amount does ABC initially record as its Right-of-Use Asset on 1/1/19? $30,000$40,000$33,594$32,594$35,000 Use information from question 11 to answer this question. XYZ, the lessor, also classifies this lease as an operating lease, and this equipment is Inventory to XYZ. Assuming XYZ incurred initial direct costs of $3,000, what is its annual adjusting entry related to this lease? - Use the following information to answer questions 11-14: - ABC Co. leases nonspecialized equipment from XYZ Inc. with a fair value of $150,000 - The lease term is 3 years and commences on 1/1/19 (estimated economic life of the asset is 6 years) - ABC prepaid the first rental payment of $10,000 on 12/20/18 (inception date) and received $6,000 from XYZ (lessor) on the inception date as an incentive - ABC must pay 3 additional rental fees of $10,000. The first payment is due 1/1/19, and then due 12/31/19 and 12/31/20 - JCR incurred initial direct costs prior to commencement of $1,000 that it originally recorded as a prepaid initial direct cost. - The implicit rate is 5% - There is no residual value guarantee - The lease does not contain a transfer of ownership option - After an evaluation by a CPA, ABC has determined that this lease must be treated as an operating lease What does ABC initially record as a Lease Liability on 1/1/19 (before adjusting for the 1/1/19 payment)? $33,594 $27,232 $30,000 $40,000 $28,594

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts