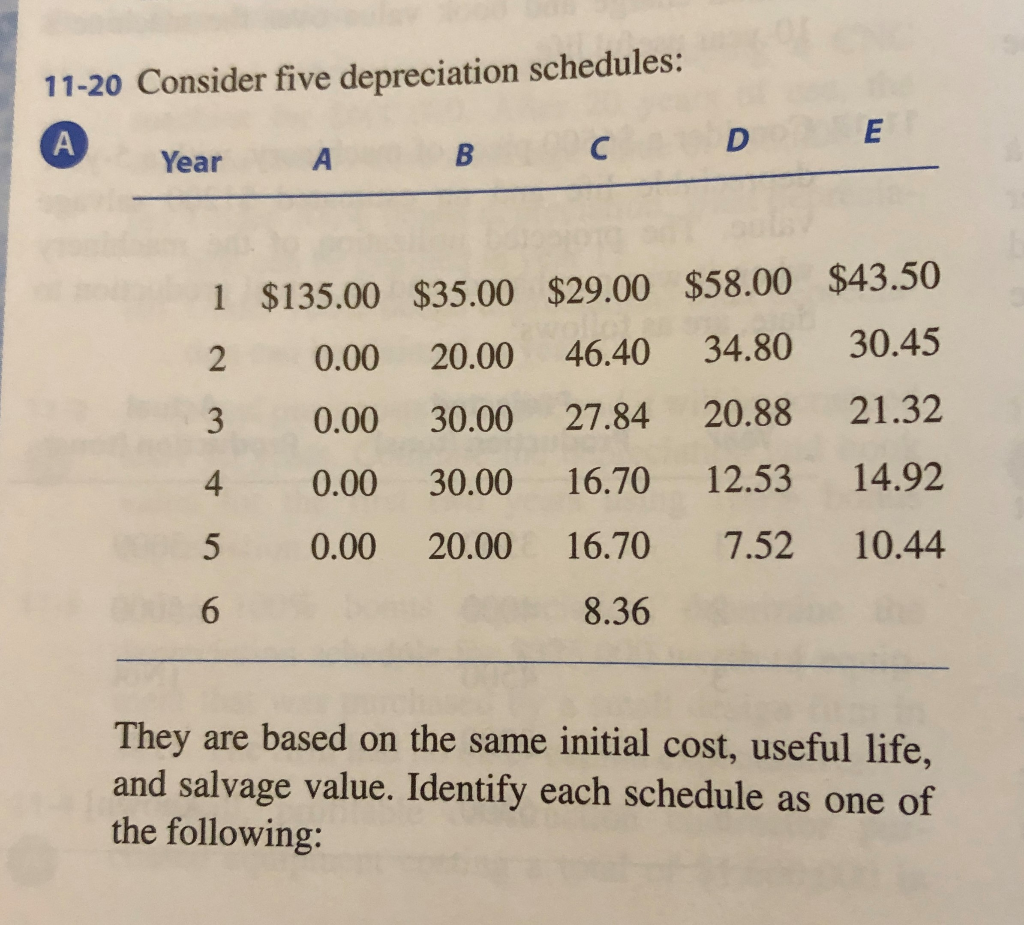

Question: 11-20 Consider five depreciation schedules: A Year A B C D E 1 $135.00 $35.00 $29.00 $58.00 $43.50 | 2 0.00 20.00 46.40 34.80 30.45

11-20 Consider five depreciation schedules: A Year A B C D E 1 $135.00 $35.00 $29.00 $58.00 $43.50 | 2 0.00 20.00 46.40 34.80 30.45 3 0.00 30.00 27.84 20.88 21.32 4 0.00 30.00 16.70 12.53 14.92 5 0.00 20.00 16.70 7.52 10.44 8.36 They are based on the same initial cost, useful life, and salvage value. Identify each schedule as one of the following: Straight-line depreciation 100% bonus depreciation 150% declining balance depreciation Double declining balance depreciation Unit-of-production depreciation . Modified accelerated cost recovery system 11-20 Consider five depreciation schedules: A Year A B C D E 1 $135.00 $35.00 $29.00 $58.00 $43.50 | 2 0.00 20.00 46.40 34.80 30.45 3 0.00 30.00 27.84 20.88 21.32 4 0.00 30.00 16.70 12.53 14.92 5 0.00 20.00 16.70 7.52 10.44 8.36 They are based on the same initial cost, useful life, and salvage value. Identify each schedule as one of the following: Straight-line depreciation 100% bonus depreciation 150% declining balance depreciation Double declining balance depreciation Unit-of-production depreciation . Modified accelerated cost recovery system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts