Question: County Company had the following partially completed payroll register: Requirements 1. Complete the payroll register. Round to two decimals. 2. Journalize County, Companys salaries and

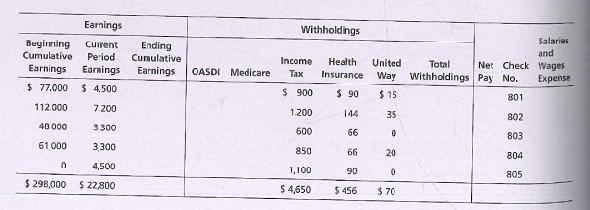

County Company had the following partially completed payroll register:

Requirements

1. Complete the payroll register. Round to two decimals.

2. Journalize County, Company’s salaries and wages expense accrual for the current Pay period.

3. Journalize County Company’s expenses for employer payroll taxes for the current pay period.

4. Journalize the payment to employees.

5. Journalize the payment for withholdings and employer payroll taxes.

Earnings Withholdings Salaries Begirning Cumulative Cuirent Ending Cumulative and Net Check Wages Expense Period Income Health United Total Earnings Earnings Earnings OASDI Medicare Tax Insurance Way Withholdings Pay No. $ 77,000 $ 4,500 $ 900 $ 90 $ 15 801 112.000 7.200 1.200 144 35 802 40 000 3300 600 66 803 61,000 3300 850 66 20 804 4,500 1,100 90 805 $ 298,000 $ 22,800 $ 4,650 $ 456 $ 70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts