Question: 11/26/18 1 Build a Model 2 Chapter: 3 Problem: 10 23 4 5 Gardial Fisheries is considering two mutually exclusive investments. The projects' expected net

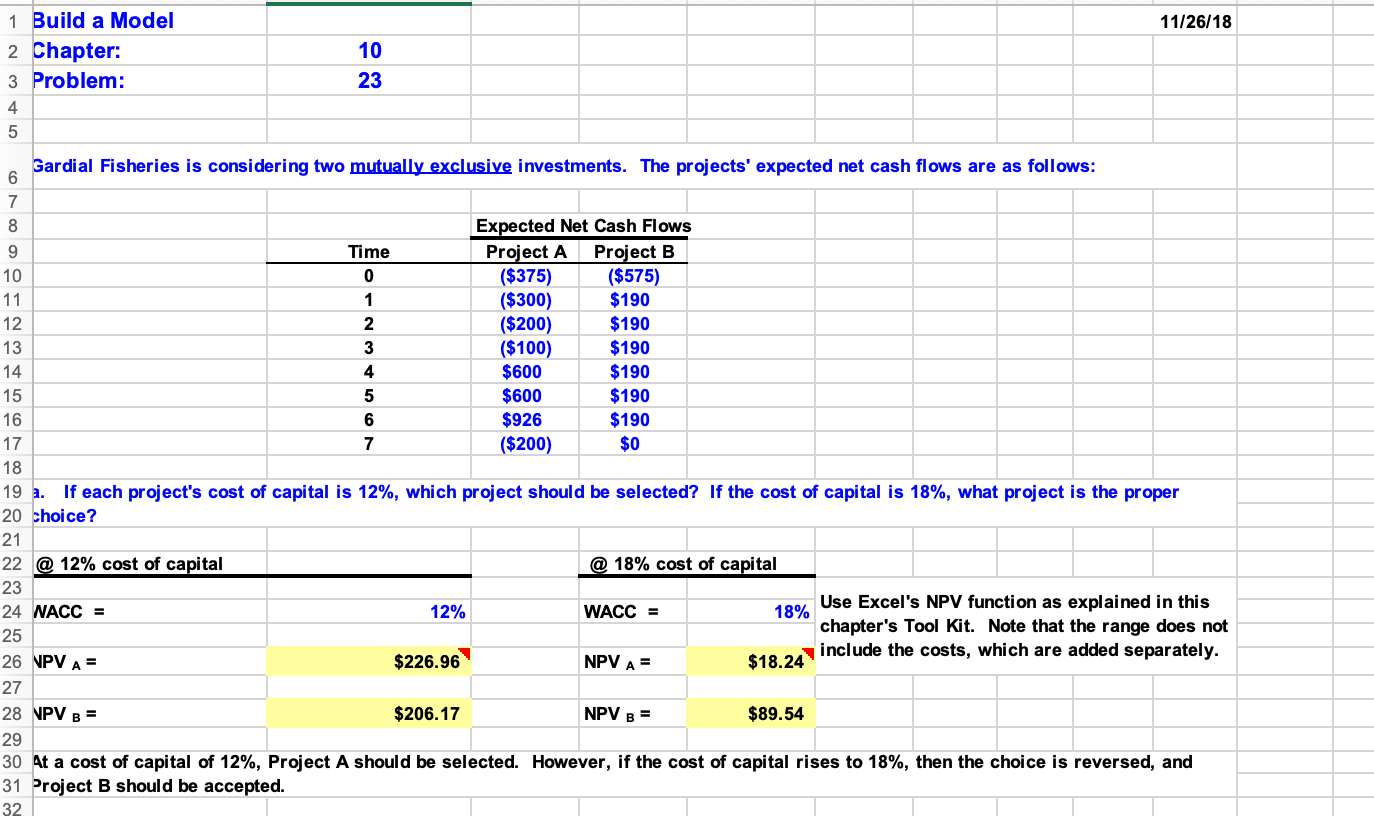

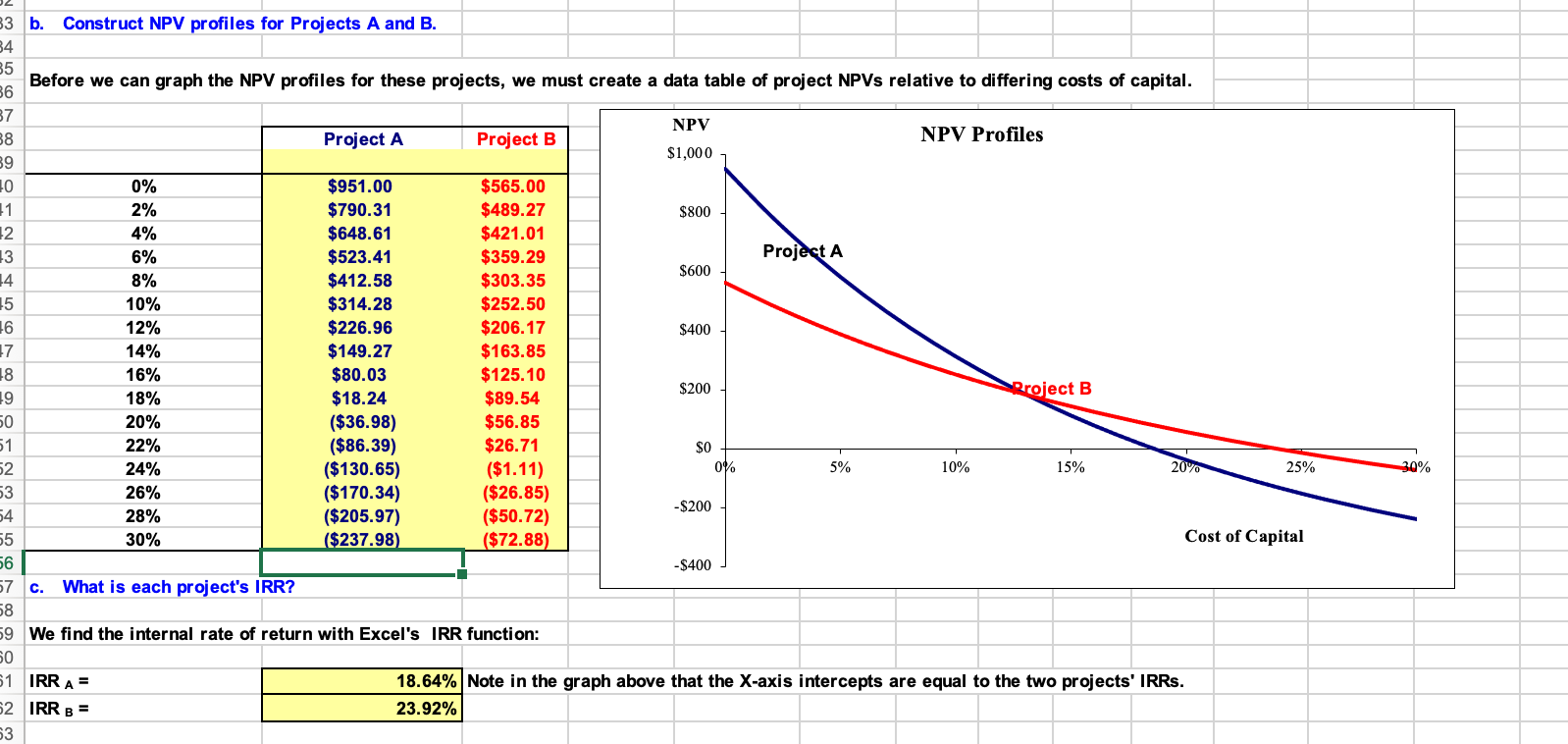

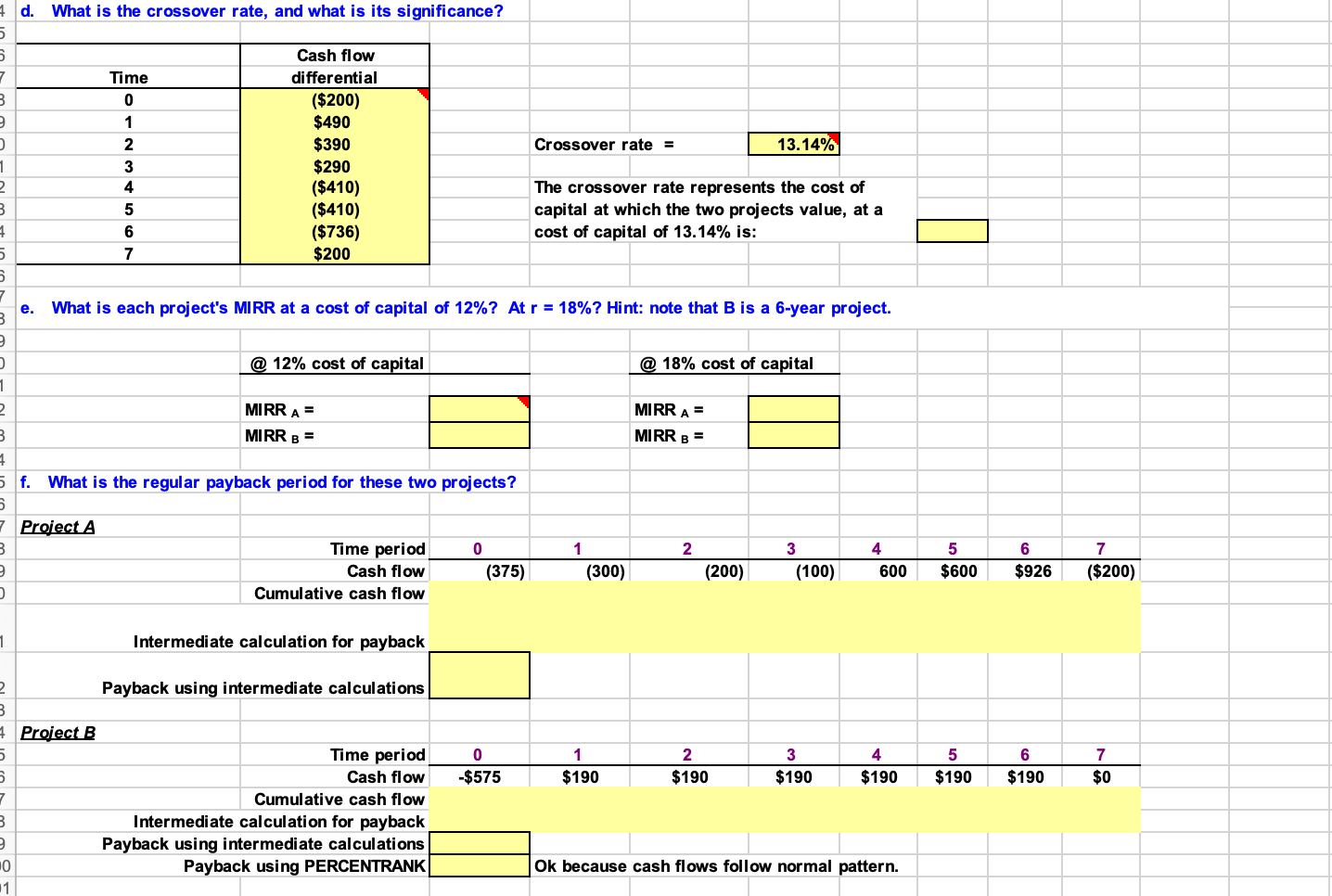

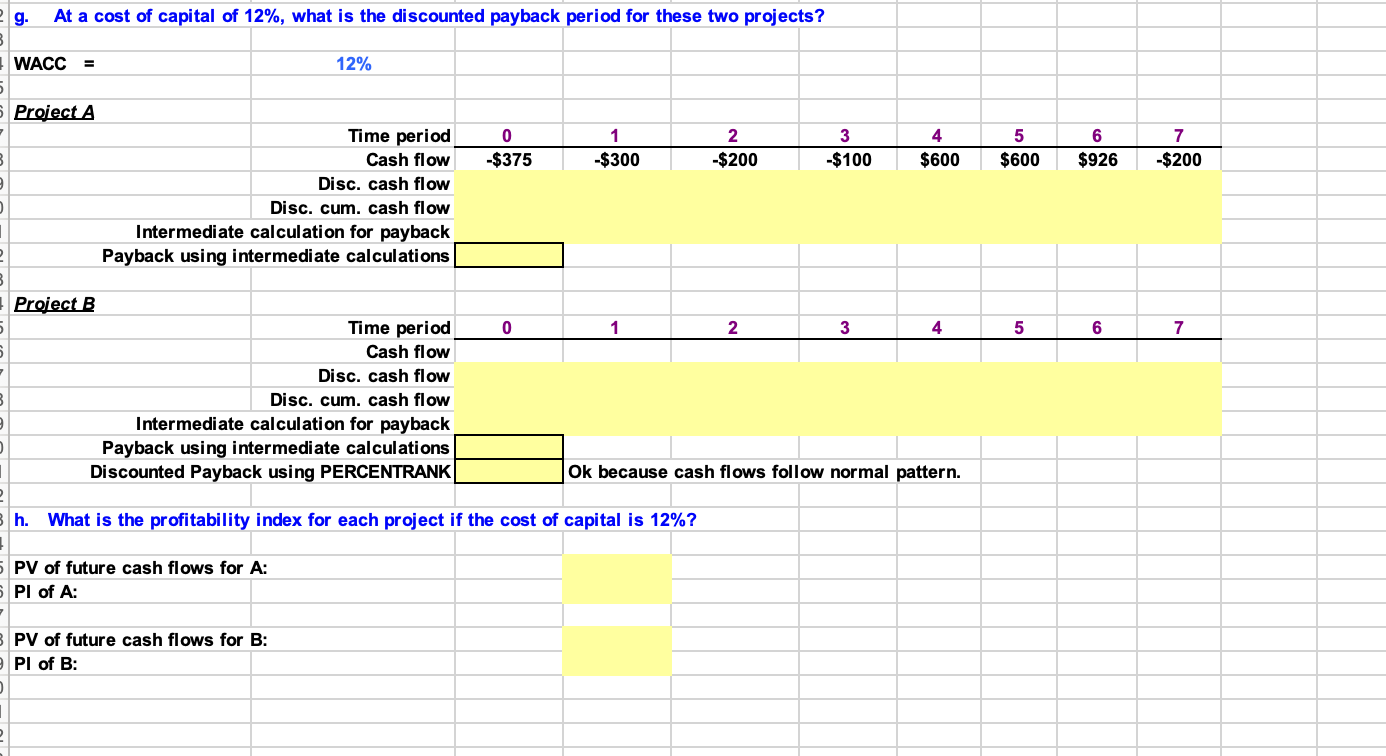

11/26/18 1 Build a Model 2 Chapter: 3 Problem: 10 23 4 5 Gardial Fisheries is considering two mutually exclusive investments. The projects' expected net cash flows are as follows: 6 7 8 Expected Net Cash Flows 9 Time Project A Project B 10 0 ($375) ($575) 11 1 ($300) $190 12 2 ($200) $190 13 3 ($100) $190 14 4 $600 $190 15 5 $600 $190 16 6 $926 $190 17 7 ($200) $0 18 19 a. If each project's cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper 20 choice? 21 22 @ 12% cost of capital @ 18% cost of capital 23 24 NACC = Use Excel's NPV function as explained in this WACC = 18% 25 chapter's Tool Kit. Note that the range does not 26 NPV A = $226.96 NPV A = $18.24 include the costs, which are added separately. 27 28 NPV B= $206.17 NPV B = $89.54 29 30 At a cost of capital of 12%, Project A should be selected. However, if the cost of capital rises to 18%, then the choice is reversed, and 31 Project B should be accepted. 32 12% 3 b. Construct NPV profiles for Projects A and B. 34 35 Before we can graph the NPV profiles for these projects, we must create a data table of project NPVs relative to differing costs of capital. 36 87 NPV 38 Project A Project B NPV Profiles $1,000 39 10 0% $951.00 $565.00 11 2% $790.31 $489.27 $800 2 4% $648.61 $421.01 13 6% $523.41 $359.29 Project A $600 14 8% $412.58 $303.35 15 10% $314.28 $252.50 16 12% $226.96 $206.17 $400 17 14% $149.27 $163.85 18 16% $80.03 $125.10 $200 19 18% $18.24 Project B $89.54 50 20% ($36.98) $56.85 51 22% ($86.39) $26.71 $0 52 24% ($130.65) ($1.11) OV 5% 10% 15% 20% 53 26% ($170.34) ($26.85) -$200 54 28% ($205.97) ($50.72) 55 30% ($237.98) ($72.88) Cost of Capital 56 -$400 57 c. What is each project's IRR? 58 59 We find the internal rate of return with Excel's IRR function: SO 51 IRR A = 18.64% Note in the graph above that the X-axis intercepts are equal to the two projects' IRRs. 52 IRR B = 23.92% 53 25% 30% 4 d. What is the crossover rate, and what is its significance? 5 5 Cash flow 7 Time differential B 0 ($200) 2 1 $490 2 $390 Crossover rate = 13.14% 1 3 $290 2 4 ($410) The crossover rate represents the cost of 3 5 ($410) capital at which the two projects value, at a 1 6 ($736) cost of capital of 13.14% is: 5 7 $200 5 7 What is each project's MIRR at a cost of capital of 12%? At r = 18%? Hint: note that B is a 6-year project. B e. @ 18% cost of capital MIRRA = MIRR B = @ 12% cost of capital 1 2 MIRRA = 3 MIRR B = 1 5 f. What is the regular payback period for these two projects? 5 7 Project A 3 Time period 0 2 Cash flow (375) Cumulative cash flow 2 1 (300) 3 (100) 4 600 5 $600 6 $926 (200) 7 ($200) 1 Intermediate calculation for payback 0 $575 1 $190 2 $190 3 $190 4 $190 5 $190 6 $190 7 $0 2 Payback using intermediate calculations 3 4 Project B Time period 5 Cash flow 7 Cumulative cash flow 3 Intermediate calculation for payback Payback using intermediate calculations 10 Payback using PERCENTRANK 1 Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 0 -$375 1 -$300 2 $200 3 -$100 4 $600 5 $600 6 $926 7 -$200 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations 0 1 2 3 4 5 6 7 Project B Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations Discounted Payback using PERCENTRANK Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? 5 PV of future cash flows for A: Pl of A: PV of future cash flows for B: PI of B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts