Question: 11:33 77% { K Chapter 16 - In class gr... ECON 302 - Ch. 16 In dass problem Fancy Inc provided the following information and

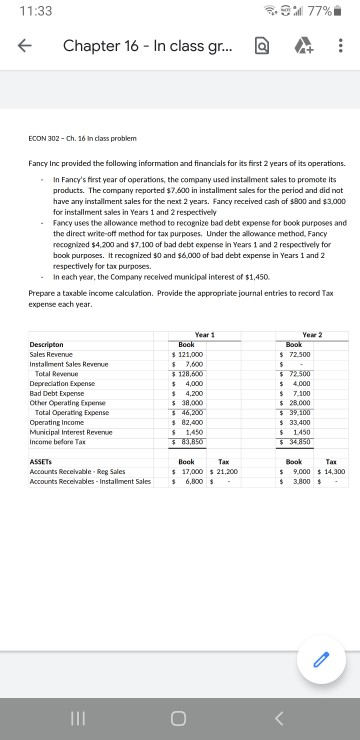

11:33 77% { K Chapter 16 - In class gr... ECON 302 - Ch. 16 In dass problem Fancy Inc provided the following information and financials for its first 2 years of its operations. In Fancy's first year of operations, the company used installment sales to promote its products. The company reported $7.800 in installment sales for the period and did not have any installment sales for the next 2 years. Fancy received cash of $800 and $3,000 for installment sales in Years 1 and 2 respectively Fancy uses the allowance method to recognize bad debt expense for book purposes and the direct write-off method for tax purposes. Under the allowance method, Fancy recognized $4.200 and $7.100 of bad debt expense in Years 1 and 2 respectively for bool purposes. It recognized 90 and $6,000 of bad debt expense in Years 1 and 2 respectively for tax purposes. . In each year, the Company received municipal interest of $1,450. Prepare a taxable income calculation. Provide the appropriate journal entries to record Tax expense each year. Descripton Sales Revenue Installment Sales Revenue Total Revenue Depreciation Expense Bad Debt Expense Other Operating Espense Total Operating Expense Operating Income Municipal Interest Revenge Income before Tax Year 1 Book $ 121,000 $ 2.000 $ 128,600 $ 4,000 $ 4,200 $ 38,000 $ 46,200 $ 82,400 $ 1.450 $ 83,850 Yew 2 Book $ 72.500 $ $ 7300 $ 4.000 $ 7.100 $ 20.000 $ 39.00 $ 33.400 $ 1450 $ 34 850 ASSETS Accounts Receivable Reg Sales Accounts Receivables - Installment Sales Rook Tax $ 17,000 $ 21,200 $ 6,800 $ Book Tas $ 9.000 $ 14,300 $ 3,800 $ III 11:33 77% { K Chapter 16 - In class gr... ECON 302 - Ch. 16 In dass problem Fancy Inc provided the following information and financials for its first 2 years of its operations. In Fancy's first year of operations, the company used installment sales to promote its products. The company reported $7.800 in installment sales for the period and did not have any installment sales for the next 2 years. Fancy received cash of $800 and $3,000 for installment sales in Years 1 and 2 respectively Fancy uses the allowance method to recognize bad debt expense for book purposes and the direct write-off method for tax purposes. Under the allowance method, Fancy recognized $4.200 and $7.100 of bad debt expense in Years 1 and 2 respectively for bool purposes. It recognized 90 and $6,000 of bad debt expense in Years 1 and 2 respectively for tax purposes. . In each year, the Company received municipal interest of $1,450. Prepare a taxable income calculation. Provide the appropriate journal entries to record Tax expense each year. Descripton Sales Revenue Installment Sales Revenue Total Revenue Depreciation Expense Bad Debt Expense Other Operating Espense Total Operating Expense Operating Income Municipal Interest Revenge Income before Tax Year 1 Book $ 121,000 $ 2.000 $ 128,600 $ 4,000 $ 4,200 $ 38,000 $ 46,200 $ 82,400 $ 1.450 $ 83,850 Yew 2 Book $ 72.500 $ $ 7300 $ 4.000 $ 7.100 $ 20.000 $ 39.00 $ 33.400 $ 1450 $ 34 850 ASSETS Accounts Receivable Reg Sales Accounts Receivables - Installment Sales Rook Tax $ 17,000 $ 21,200 $ 6,800 $ Book Tas $ 9.000 $ 14,300 $ 3,800 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts