Question: 11/3pt1 Required: Prepare the journal entry Stinson will make when the note is established. Prepare the journal entries Stinson will make to record the interest

Required:

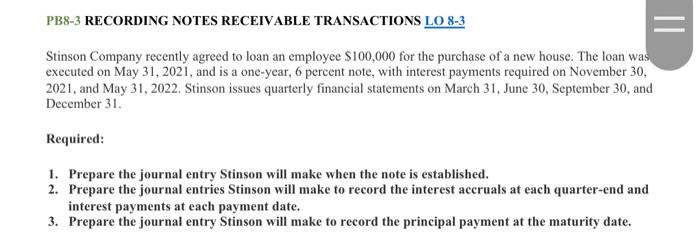

- Prepare the journal entry Stinson will make when the note is established.

- Prepare the journal entries Stinson will make to record the interest accruals at each quarter-end and interest payments at each payment date.

- Prepare the journal entry Stinson will make to record the principal payment at the maturity date.

|| PB8-3 RECORDING NOTES RECEIVABLE TRANSACTIONS LO 8-3 Stinson Company recently agreed to loan an employee $100,000 for the purchase of a new house. The loan was executed on May 31, 2021, and is a one-year, 6 percent note, with interest payments required on November 30, 2021, and May 31, 2022. Stinson issues quarterly financial statements on March 31, June 30, September 30, and December 31. Required: 1. Prepare the journal entry Stinson will make when the note is established. 2. Prepare the journal entries Stinson will make to record the interest accruals at each quarter-end and interest payments at each payment date. 3. Prepare the journal entry Stinson will make to record the principal payment at the maturity date.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts