Question: 115 - A A A A E *, *' A--A-EEEEE L . . 1 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Em Font

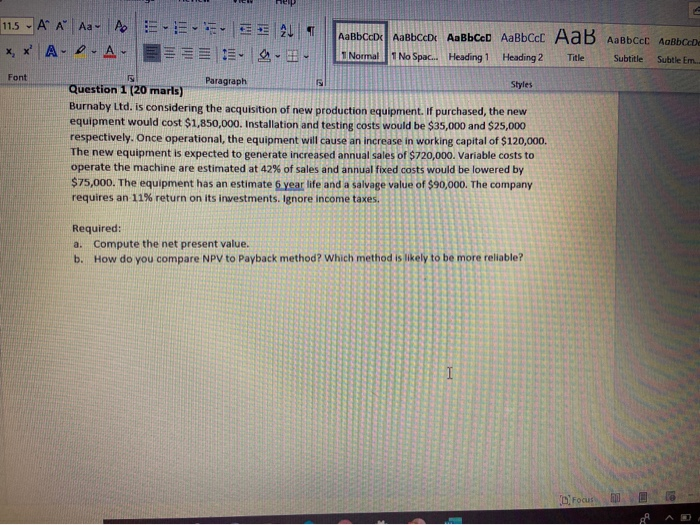

115 - A A A A E *, *' A--A-EEEEE L . . 1 No Spac... Heading 1 Heading 2 Title Subtitle Subtle Em Font Styles Paragraph Question 1 (20 marls) Burnaby Ltd. is considering the acquisition of new production equipment. If purchased, the new equipment would cost $1,850,000. Installation and testing costs would be $35,000 and $25,000 respectively. Once operational, the equipment will cause an increase in working capital of $120,000, The new equipment is expected to generate increased annual sales of $720,000. Variable costs to operate the machine are estimated at 42% of sales and annual fixed costs would be lowered by $75,000. The equipment has an estimate 6 year life and a salvage value of $90,000. The company requires an 11% return on its investments. Ignore income taxes. Required: a. Compute the net present value. b. How do you compare NPV to Payback method? Which method is likely to be more reliable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts